Home Values Rise at Fastest Pace in 12 Years

PR Newswire

SEATTLE, May 24, 2018

SEATTLE, May 24, 2018 /PRNewswire/ -- National median home values are rising at their fastest pace in 12 years, according to the April Zillow® Real Estate Market Reporti. Over the past year, home values across the country rose 8.7 percent to a median value of $215,600.

Home values have not appreciated this quickly since June 2006, right before the housing bubble bust, when they were appreciating 9 percent annually. U.S. home values are now higher than they have ever been, and home values in 21 of the 35 largest housing markets have surpassed peak value hit during the height of the housing boom over a decade ago.

"Home values are rising faster than we've seen in a very long time: The spring home shopping season has been a perfect storm of strong demand and tight supply," said Zillow senior economist Aaron Terrazas. "Sluggish new construction has exacerbated the supply situation and homes that are hitting the market, are moving very quickly once they do. Americans are also in a spending mood, boosted by recent tax cuts and rising wages. Millennials who long delayed becoming homeowners, are out in force – a shift we're also seeing in softer rent appreciation."

Home values are appreciating the fastest in San Jose, Las Vegas, and Seattle. In San Jose, home values rose 26 percent to a median of $1,263,900. In Las Vegas and Seattle, home values rose 16.5 percent and 13.6 percent, respectively.

Median rent across the nation rose 2.5 percent over the past year to a median payment of $1,449 per month. Sacramento, Calif., Riverside, Calif., and Las Vegas reported the greatest year-over-year rent appreciation among the 35 largest U.S. metros. In Sacramento and Riverside, median rent rose 7 percent and in Las Vegas, median rent rose 4.5 percent.

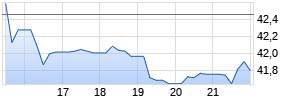

April ended with mortgage rates on Zillowii at 4.35 percent, after starting the month at 4.20 percent. April mortgage rates peaked toward the end of the monthiii at 4.42 percent, the highest rate since the beginning of 2013iv, and hit a month low in the first few weeks of the monthv when rates were at 4.19 percent. Zillow's real-time mortgage rates are based on thousands of custom mortgage quotes submitted daily to anonymous borrowers on the Zillow Mortgages site and reflect the most recent changes in the market.

| Metropolitan | Zillow Home Value | ZHVI Year- | Percent Fall | Zillow Rent | ZRI Year- |

| United States | $ 215,600 | 8.7% | 0.0% | $ 1,449 | 2.5% |

| New York, NY | $ 424,800 | 7.3% | -6.2% | $ 2,401 | 0.8% |

| Los Angeles- | $ 644,600 | 8.4% | 0.0% | $ 2,759 | 3.9% |

| Chicago, IL | $ 218,000 | 5.5% | -14.2% | $ 1,653 | 1.7% |

| Dallas-Fort | $ 225,100 | 11.2% | 0.0% | $ 1,605 | 1.9% |

| Philadelphia, | $ 225,300 | 5.8% | -5.1% | $ 1,581 | 1.1% |

| Houston, TX | $ 195,500 | 4.7% | 0.0% | $ 1,561 | 1.2% |

| Washington, | $ 398,900 | 4.5% | -8.4% | $ 2,149 | 1.5% |

| Miami-Fort | $ 269,100 | 7.5% | -13.6% | $ 1,867 | 1.2% |

| Atlanta, GA | $ 200,600 | 10.6% | 0.0% | $ 1,399 | 4.3% |

| Boston, MA | $ 449,000 | 6.5% | 0.0% | $ 2,385 | 1.3% |

| San Francisco, | $ 947,500 | 11.4% | 0.0% | $ 3,425 | 2.1% |

| Detroit, MI | $ 151,600 | 8.9% | -4.8% | $ 1,209 | 3.4% |

| Riverside, CA | $ 355,700 | 9.2% | -13.2% | $ 1,894 | 7.0% |

| Phoenix, AZ | $ 253,100 Werbung Mehr Nachrichten zur Zillow Group A Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |