Federated Hermes, Inc. expands distribution in Latin America through agreement with PICTON, S.A., a leading third-party marketing firm

PR Newswire

PITTSBURGH and SANTIAGO, Chile, Aug. 25, 2020

PITTSBURGH and SANTIAGO, Chile, Aug. 25, 2020 /PRNewswire/ -- Federated Hermes, Inc. (NYSE: FHI), a global leader in active, responsible investing, and PICTON S.A., a leading third-party fund distributor in Latin America, today announced an agreement that allows PICTON to market certain Federated Hermes funds to institutional clients in Latin America. The agreement focuses PICTON's efforts on strategically positioning Federated Hermes' investment capabilities and services in the Latin American pension funds industry and with institutional participants across the region on a private-offering basis.

"With their experience and strong local knowledge of markets in Chile, Colombia and Peru, we are pleased to work with PICTON to market Federated Hermes' products in the region. As a global leader in responsible investing, it was important for us to be diligent in our search process and find a firm that is client-focused and has a track record of success. We found that in the PICTON team," said Bryan Burke, head of global accounts and Latin America at Federated Hermes.

"PICTON is proud to enter into this arrangement with Federated Hermes, a firm with outstanding history and a leader in responsible investing," said Matias Eguiguren, founding partner at PICTON. "We look forward to a strong relationship driven by Federated Hermes' investment capabilities and our broad and deep knowledge of institutional clients," said Patricio Mebus, head of mutual funds distribution at PICTON.

PICTON will provide due diligence, product information and analysis to institutional clients and serve as a liaison point between them and Federated Hermes' teams.

PICTON is an independent investment firm serving high-net-worth individuals and institutional investors throughout Latin America. PICTON distributes best-in-class investment products to Latin American institutional investors, while providing the highest service standard, being one of the leading third-party fund distributors in the region with local offices in Chile, Colombia and Peru and strategic alliances in Mexico and Brazil. For more information, visit picton.cl.

Federated Hermes, Inc. is a leading global investment manager with $628.8 billion in assets under management as of June 30, 2020. Guided by our conviction that responsible investing is the best way to create wealth over the long term, our investment solutions span 162 equity, fixed-income, alternative/private markets, multi-asset and liquidity management strategies and a range of separately managed account strategies. Providing world-class active investment management and engagement services to more than 11,000 institutions and intermediaries, our clients include corporations, government entities, insurance companies, foundations and endowments, banks and broker/dealers. Headquartered in Pittsburgh, Federated Hermes' more than 1,900 employees include those in London, New York, Boston and several other offices worldwide. For more information, visit FederatedHermes.com.

Certain statements in this press release, such as those related to marketing efforts and distribution relationships, constitute or may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the company, or industry results, to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Other risks and uncertainties include the ability of the company to predict the level of fee waivers and expenses in future quarters, predict whether performance fees or carried interest will be earned and retained, sustain product demand, asset flows and mix, which could vary significantly depending on various factors, such as market conditions, investment performance and investor behavior. Other risks and uncertainties include the risk factors discussed in the company's annual and quarterly reports as filed with the SEC. As a result, no assurance can be given as to future results, levels of activity, performance or achievements, and neither the company nor any other person assumes responsibility for the accuracy and completeness of such statements in the future.

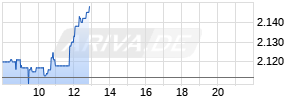

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Hermes | ||

|

HS4VYS

| Ask: 1,69 | Hebel: 20,89 |

| mit starkem Hebel |

Zum Produkt

| |

|

HS4HCV

| Ask: 4,67 | Hebel: 5,17 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

![]() View original content:http://www.prnewswire.com/news-releases/federated-hermes-inc-expands-distribution-in-latin-america-through-agreement-with-picton-sa-a-leading-third-party-marketing-firm-301118230.html

View original content:http://www.prnewswire.com/news-releases/federated-hermes-inc-expands-distribution-in-latin-america-through-agreement-with-picton-sa-a-leading-third-party-marketing-firm-301118230.html

SOURCE Federated Hermes, Inc.

Mehr Nachrichten zur Hermes Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.