Exar Corporation Announces Fiscal 2017 Fourth Quarter and Year-End Financial Results

PR Newswire

FREMONT, Calif., May 9, 2017

FREMONT, Calif., May 9, 2017 /PRNewswire/ -- Exar Corporation (NYSE: EXAR) a leading supplier of analog mixed-signal application specific technology solutions serving the Industrial, Infrastructure, Automotive, and Audio/Video markets, today announced financial results for the Company's fiscal year 2017 fourth quarter and year-end, which ended on April 2, 2017. Unless otherwise indicated, all non-GAAP financial results exclude the financial results of the iML Display business, which the Company has divested, and are presented in the GAAP results as discontinued operations.

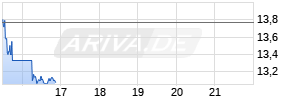

On March 29, 2017, Exar and MaxLinear, Inc. (NYSE: MXL) jointly announced that they had entered into a definitive agreement under which MaxLinear has agreed to acquire Exar for $13.00 per share in cash, via a tender offer. Subsequently, MaxLinear, Inc. filed a tender offer Schedule TO (amended on April 24, 2017 and May 5, 2017) and Exar filed a Schedule 14D-9 (amended on April 24, 2017 and May 3, 2017). Exar stockholders, banks and brokers who have questions, require assistance, or who desire to tender shares are referred to the Offer's Information Agent, Georgeson, toll-free at (866) 767-8986 prior to 12:00 p.m. midnight May 11, 2017.

Fiscal 2017 Fourth Quarter Highlights from Continuing Operations

- Net sales of $27.8 million, up 2% sequentially and 10% year-over-year

- GAAP gross margin of 54.2% (Non-GAAP gross margin of 56.7%)

- GAAP operating loss of $0.1 million (Non-GAAP operating income of $4.2 million)

- GAAP EPS of $0.03 (Non-GAAP EPS of $0.09)

- Cash and equivalents, and short-term marketable securities of $236 million

Fiscal 2017 Full Year Highlights from Continuing Operations

- Net sales of $109.8 million, up 8% year-over-year

- GAAP gross margin of 50.2% (Non-GAAP gross margin of 53.5%)

- GAAP operating income of $7.2 million (Non-GAAP operating income of $15.4 million)

- GAAP EPS of $0.18 (Non-GAAP EPS of $0.31)

About Exar

For more information, visit http://www.exar.com.

Discussion of Non-GAAP Financial Measures

The Company's non-GAAP measures exclude charges related to stock-based compensation, amortization of acquired intangible assets, impairment charges, gain upon closing sale-leaseback of our corporate headquarters, gain on sale of long-term investments, restructuring charges and exit costs which include costs for personnel whose positions have been eliminated as part of a restructuring or are in the process of being eliminated as part of the discontinuation of a product line, severance costs associated with the former CEO, the financial results of the iML Display business as well as the gain recognized from the sale of the iML business, accruals for and proceeds received from dispute resolutions and patent litigation, merger and acquisition and related integration costs, certain income tax benefits and credits, and related income tax effects on certain excluded items. The Company excludes these items primarily because they are significant special expense and gain estimates, which management separates for consideration when evaluating and managing business operations. The Company's management uses non-GAAP net income and non-GAAP earnings per share to evaluate its current operating results and financial results and to compare them against historical financial results. Management believes these non-GAAP measures are useful to investors because they are frequently used by securities analysts, investors and other interested parties in evaluating the Company and provide further clarity on its profitability.

Unless otherwise indicated, all non-GAAP financial results exclude the financial results of the iML Display business, which the Company has divested, and are presented in the GAAP results as discontinued operations.

In addition, the Company believes that providing investors with these non-GAAP measurements enhances their ability to compare the Company's business against that of its competitors who employ and disclose similar non-GAAP measures. However, the manner in which we calculate these non-GAAP financial measures may be different from non-GAAP methods of accounting and reporting used by the Company's competitors to the extent their non-GAAP measures include or exclude other items. The material limitation associated with the use of the non-GAAP financial measures is that the non-GAAP measures may not reflect the full economic impact of Exar's activities. Accordingly, investors are cautioned not to place undue reliance on non-GAAP information. The presentation of this additional information should not be considered a substitute for net income or net income per diluted share or other measures prepared in accordance with GAAP.

Investors should refer to the reconciliation of Non-GAAP Results to GAAP Results, which is contained in this press release.

Additional Information and Where to Find It

Neither this communication nor the information incorporated herein by reference is an offer to purchase or a solicitation of an offer to sell any shares or any other securities of Exar. On April 13, 2017, MaxLinear and its subsidiary commenced the tender offer and filed a Tender Offer Statement on Schedule TO with the SEC, and Exar filed a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC. EXAR STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL, AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, INCLUDING ALL AMENDMENTS TO THOSE MATERIALS. SUCH DOCUMENTS CONTAIN IMPORTANT INFORMATION, WHICH SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. The Tender Offer Statement and the Solicitation/Recommendation Statement are available without charge at the SEC's website at www.sec.gov. Free copies of these materials and certain other offering documents were sent to Exar's stockholders by the information agent for the Tender Offer. These documents may also be obtained for free by contacting MaxLinear Investor Relations at http://investors.maxlinear.com/, at IR@MaxLinear.com or by telephone at (760) 517-1112 or by contacting Exar Investor Relations at investorrelations@exar.com or by telephone at (510) 668-7201. The contents of the websites referenced above are not deemed to be incorporated by reference into the Offer documents.

For more information, visit http://www.exar.com

For Press Inquiries Contact: press@exar.com

| For Investor Relations Contact: | ||

| | Keith Tainsky, CFO | Laura Guerrant-Oiye, Investor Relations |

| | Phone: (510) 668-7201 | Phone: (510) 668-7201 |

| | Email: investorrelations@exar.com | Email: laura.guerrant@exar.com |

-Tables follow-

| EXAR CORPORATION AND SUBSIDIARIES | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||

| (In thousands, except per share amounts) | |||||||||||

| (Unaudited) | |||||||||||

| | | | | | | | | | | | |

| | | THREE MONTHS ENDED | | TWELVE MONTHS ENDED | | ||||||

| | | APRIL 2, | | JANUARY 1, | | MARCH 27, | | APRIL 2, | | MARCH 27, | |

| | | 2017 | | 2017 | | 2016 | | 2017 | | 2016 | |

| | | | | | | | | | | | |

| Net sales | | $ 19,796 | | $ 18,845 | | $ 18,060 | | $ 78,677 | | $ 65,799 | |

| Net sales, related party | | 8,018 | | 8,377 | | 7,283 | | 31,096 | | 35,791 | |

| Total net sales | | 27,814 | | 27,222 | | 25,343 | | 109,773 | | 101,590 | |

| | | | | | | | | | | | |

| Cost of sales: | | | | | | | | | | | |

| Cost of sales (1) | | 9,394 | | 10,054 | | 9,694 | | 40,867 | | 39,615 | |

| Cost of sales, related party | | 2,739 | | 3,118 | | 3,082 | | 11,207 | | 15,929 | |

| Restructuring charges and exit costs | | - | | - | | - | | 225 | | 739 | |

| Proceeds from legal settlement | | - | | - | | - | | - | | (1,500) | |

| Amortization of purchased intangible assets | | 594 | | 594 | | 594 | | 2,376 | | 2,427 | |

| Total cost of sales | | 12,727 | | 13,766 | | 13,370 | | 54,675 | | 57,210 | |

| Gross profit | | 15,087 | | 13,456 | | 11,973 Werbung Mehr Nachrichten zur Exar Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||