Clariant commences 2017 with strong sales growth and a significantly improved absolute EBITDA

Clariant AG / Clariant commences 2017 with strong sales growth and a significantly improved absolute EBITDA . Processed and transmitted by Nasdaq Corporate Solutions. The issuer is solely responsible for the content of this announcement.

| |

"Clariant achieved a very good start into the year with good volume growth and higher profitability", said CEO Hariolf Kottmann. "Our focus on local currency growth and profitability improvement is clearly reflected in these encouraging results. We are on a solid path towards achieving our sales expansion targets, a continued progression in absolute EBITDA and EBITDA margin before exceptional items as well as operating cash flow generation, in spite of what continues to be a challenging market environment in specific business areas."

Key Financial Data

| First Quarter | ||||||||

| in CHF million | 2017 | 2016 | % CHF | % LC | ||||

| Sales | 1 602 | 1 478 | 8 | 9 | ||||

| EBITDA before exceptional items | 250 | 229 | 9 | 10 | ||||

| - margin | 15.6 % | 15.5 % | ||||||

First quarter 2017 - Significantly higher sales and double-digit improvement in absolute EBITDA

Muttenz, April 27, 2017 - Clariant, a world leader in specialty chemicals, announced today first quarter 2017 sales of CHF 1.602 billion compared to CHF 1.478 billion in the first quarter of 2016. This corresponds to an increase of 9 % in local currency and 8 % in Swiss francs. The sales growth was driven by higher volumes across all Business Areas and increased by 3 % due to acquisitions.

In the first quarter, local currency sales growth was strong in Europe at 12 %, Asia at 11 % and the Middle East & Africa at 7 %, while North America grew by 11 % driven by acquisitions. The growth in Asia was supported by China and Southeast Asia. In Latin America, demand declined by 5 % in local currency against a strong comparable base and as a result of the weaker economic environment mainly in Brazil.

Care Chemicals and Plastics & Coatings continued their robust growth trends. Care Chemicals sales rose by 9 % in local currency to CHF 440 million supported by growth in both the Consumer Care and the Industrial Applications businesses. Sales in Plastics & Coatings increased by 6 % in local currency to CHF 673 million with a particularly strong regional development in Europe.

Natural Resources sales grew by 17 % in local currency and reached CHF 347 million, bolstered by acquisitions. In the difficult industry environment, the underlying Oil and Mining Services sales were slightly negative, but were helped by acquisitions. Functional Minerals continued its solid growth development. Sales in Catalysis were up by 2 % in local currency to CHF 142 million with a soft demand recovery in the Asian and European markets.

The EBITDA before exceptional items significantly increased by 10 % in local currency and reached CHF 250 million, compared to CHF 229 million in the previous year. This absolute profitability improvement was driven by all Business Areas.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Clariant | ||

|

MA3XET

| Ask: 4,41 | Hebel: 5,69 |

| mit moderatem Hebel |

Zum Produkt

| |

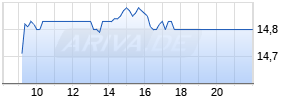

Kurse

|

As a result, the corresponding EBITDA margin before exceptional items increased to 15.6 % versus the previous year's level of 15.5 %. All Business Areas delivered EBITDA margins in-line with expectations. Most Business Areas matched a strong previous year despite the lower contribution from the seasonal Refinery and Aviation businesses due to the milder winter.

Outlook 2017 - Continued progression in profitability and operating cash flow generation

Clariant expects the uncertain environment, characterised by a high volatility in commodity prices, currencies as well as political uncertainties, to continue. In emerging markets, we anticipate the economic environment to remain challenging and volatile; we expect moderate growth in the United States, while growth in Europe is expected to remain stable.

For 2017, in spite of a continued challenging economic environment, Clariant is confident to be able to achieve growth in local currency, as well as progression in operating cash flow, absolute EBITDA and EBITDA margin before exceptional items.

Clariant confirms its mid-term target of reaching a position in the top tier of the specialty chemicals industry. This corresponds to an EBITDA margin before exceptional items in the range of 16 % to 19 % and a return on invested capital (ROIC) above the peer group average.

| Corporate Media Relations | Investor Relations |

| Jochen Dubiel Phone +41 61 469 63 63 jochen.dubiel@clariant.com | Anja Pomrehn Phone +41 61 469 67 45 anja.pomrehn@clariant.com |

| Thijs Bouwens Phone +41 61 469 63 63 thijs.bouwens@clariant.com | Maria Ivek Phone +41 61 469 62 92 maria.ivek@clariant.com |

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Clariant AG via Globenewswire

--- End of Message ---

Clariant AG

Rothausstrasse 61 Muttenz 1 Switzerland

ISIN: CH0012142631;

Mehr Nachrichten zur Clariant Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.