Century Casinos, Inc. Completes Acquisition of Operations of Three Casinos from Eldorado Resorts

PR Newswire

COLORADO SPRINGS, Colorado, Dec. 6, 2019

COLORADO SPRINGS, Colorado, Dec. 6, 2019 /PRNewswire/ -- Century Casinos, Inc. (Nasdaq Capital Market®: CNTY) ("Century Casinos" or "the Company"), announced today that it completed the acquisition of the operations of Isle Casino Cape Girardeau ("Cape Girardeau"), Lady Luck Caruthersville ("Caruthersville") and Mountaineer Casino, Racetrack and Resort ("Mountaineer") from Eldorado Resorts, Inc. (Nasdaq Capital Market®: ERI) ("Eldorado Resorts") for approximately $107 million (the "Acquisition").

Simultaneous with the closing of the Acquisition, VICI Properties Inc. (NYSE: VICI) ("VICI") acquired the real estate assets of the three casino properties and the Company entered into a triple net lease agreement for such real estate with VICI. The lease has an initial annual rent of approximately $25 million and an initial term of 15 years, with four five-year renewal options.

The Company financed the Acquisition with a new credit facility that was issued by Macquarie Capital on the closing date. The credit facility also refinanced the Company's existing debt.

"We are very excited to be expanding into Missouri and West Virginia," Erwin Haitzmann and Peter Hoetzinger, Co-Chief Executive Officers of Century Casinos, remarked. "Cape Girardeau, Caruthersville and Mountaineer are great additions to our portfolio. We look forward to working with the staff and communities to continue the current success at these properties into the future," Haitzmann and Hoetzinger concluded.

Isle Casino Cape Girardeau is located in Cape Girardeau, Missouri, approximately 120 miles south of St. Louis, Missouri, overlooking the Mississippi river. The property opened in 2012 and consists of a dockside casino featuring 41,500 square feet of casino space, 863 gaming machines, 20 table games, three dining venues, a pavilion and an entertainment center. The property also includes a wide variety of non-gaming amenities, including an events center.

Lady Luck Caruthersville is a riverboat casino located along the Mississippi river in Caruthersville, Missouri. The property opened in 1995 and consists of a dockside casino featuring 21,000 square feet of casino space, 507 slot machines, nine table games, two dining venues, a 40,000 square foot pavilion and a 28-space RV park.

Mountaineer Casino, Racetrack and Resort is a hotel, casino, entertainment and live thoroughbred horse racing facility located in New Cumberland, West Virginia, one hour from downtown Pittsburgh, Pennsylvania. The property originally opened in 1951 with the casino opening in 1994 and features a 357-room hotel, approximately 1,486 slot machines, 36 table games, a poker room, a racetrack and five dining venues.

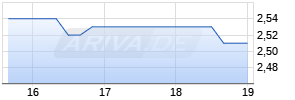

ARIVA.DE Börsen-Geflüster

Kurse

|

|

With this transaction, the Company's portfolio* increased to 18 casinos world-wide that include over 7,185 gaming machines, 285 table games and 3,400 employees. On a pro-forma basis giving effect to the Acquisition as if it occurred on October 1, 2018, the Company's last twelve months ("LTM") net operating revenue and Adjusted EBITDA with the acquired properties were $414.7 million and $56.6 million, respectively. See a reconciliation of the LTM results in Supplemental Information below. On a pro-forma basis using our debt as of September 30, 2019 and giving effect to the new credit facility, the Company's long-term debt and Net Debt after the Acquisition are $183.9 million and $133.0 million, respectively. See a reconciliation of the long-term debt and Net Debt in Supplemental Information below.

Stifel acted as exclusive financial advisor and Faegre Baker Daniels LLP acted as legal counsel to the Company in connection with the Acquisition.

Supplemental Information:

The Company defines Adjusted EBITDA as net earnings (loss) attributable to Century Casinos, Inc. shareholders before interest expense (income), net, income taxes (benefit), depreciation, amortization, non-controlling interest net earnings (loss) and transactions, pre-opening expenses, acquisition costs, non-cash stock-based compensation charges, asset impairment costs, (gain) loss on disposition of fixed assets, discontinued operations, (gain) loss on foreign currency transactions and other, gain on business combination and certain other one-time items, such as acquisition and disposition costs and gain or loss. Intercompany transactions consisting primarily of management and royalty fees and interest, along with their related tax effects, are excluded from the presentation of net earnings (loss) and Adjusted EBITDA. Not all of the aforementioned items occur in each reporting period, but have been included in the definition based on historical activity. These adjustments have no effect on the consolidated results as reported under the generally accepted accounting principles in the United States ("GAAP"). Adjusted EBITDA is not considered a measure of performance recognized under GAAP. Management believes that Adjusted EBITDA is a valuable measure of the relative performance of the Company and its properties. The gaming industry commonly uses Adjusted EBITDA as a method of arriving at the economic value of a casino operation. Management uses Adjusted EBITDA to compare the relative operating performance of separate operating units by eliminating the above-mentioned items associated with the varying levels of capital expenditures for infrastructure required to generate revenue and the often high cost of acquiring existing operations. Adjusted EBITDA is used by the Company's lending institution to gauge operating performance. The Company's computation of Adjusted EBITDA may be different from, and therefore may not be comparable to, similar measures used by other companies within the gaming industry.

*As of September 30, 2019, giving effect to the Acquisition but, excluding properties with management contracts.

Supplemental Information:

Pro forma net operating revenue, pro forma Adjusted EBITDA and pro forma combined EBITDAR are non-GAAP financial measures. The unaudited pro forma financial information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the Acquisition occurred at the beginning of the period presented, nor the impact of the possible business model changes. The unaudited pro forma financial information, while helpful in illustrating the financial characteristics of the combined company under one set of assumptions, does not reflect the realization of potential cost savings, revenue synergies, changes in market conditions and asset dispositions, among other factors, and, accordingly, does not attempt to predict or suggest future results. The Company expects to incur costs associated with the Acquisition and the integration of the businesses and operations of the Company and those of Cape Girardeau, Caruthersville and Mountaineer. However, the unaudited pro forma financial information does not include these estimated Acquisition and integration costs.

We define Net Debt as total long-term debt (including current portion) plus deferred financing costs minus cash and cash equivalents. Net Debt is not considered a liquidity measure recognized under US GAAP. Management believes that Net Debt is a valuable measure of our overall financial situation. Net Debt provides investors with an indication of our ability to pay off all of our long-term debt if it became due simultaneously.

Supplemental Information:

Reconciliation of LTM results for the Company and the acquired properties.

| | Net Operating Revenue | ||||||||

| Amounts in millions | | | Century | | | Acquired | | | Pro Forma |

| For the three months ended: | | | | | | | | | |

| December 31, 2018 | | $ | 45.1 | | | | | | |

| March 31, 2019 | | | 45.6 | | | | | | |

| June 30, 2019 | | | 52.4 | | | | | | |

| September 30, 2019 | | | 52.9 | | | | | | |

| LTM Results | | $ | 196.1 | | $ | 218.6 | | $ | 414.7 |

| | | | | | | | | | |

| (1) | Based on the unaudited LTM results for the period ended September 30, 2019 as provided by Eldorado Resorts. |

| (2) | The unaudited pro forma financial information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the Acquisition occurred at the beginning of the period presented, nor the impact of possible business model changes. The unaudited pro forma financial information, while helpful in illustrating the financial characteristics of the combined company under one set of assumptions, does not reflect the realization of potential cost savings, revenue synergies, changes in market conditions and asset dispositions, among other factors, and, accordingly, does not attempt to predict or suggest future results. The Company expects to incur costs associated with the Acquisition and the integration of the businesses and operations of the Company and those of Cape Girardeau, Caruthersville and Mountaineer. However, unaudited pro forma financial information does not include these estimated Acquisition and integration costs. |

Supplemental Information:

Reconciliation of LTM results for the Company and the acquired properties.

| | Adjusted EBITDA | ||||||||||||||

| Amounts in thousands | | | Century | | | Acquired | | | Pro Forma | | | VICI | | | Pro Forma |

| For the three months ended: | | | | | | | | | | | | | |||

| December 31, 2018 | | $ | 5.8 | | | | | | | | | | | | |

| March 31, 2019 | | | 6.7 | | | | | | | | | | | | |

| June 30, 2019 | | | 6.7 | | | | | | | | | | | | |

| September 30, 2019 | | | 7.1 | | | | | | | | | | | | |

| LTM Results | | $ | 26.3 | | $ | 55.3 | | $ | 81.6 | | $ | (25.0) | | $ | 56.6 |

| | | | | | | | | | | | | | | | |

| (1) | Based on the unaudited LTM results for the period ended September 30, 2019 as provided by Eldorado Resorts. |

| (2) | The unaudited pro forma financial information is presented for illustrative purposes only and does not indicate the financial results of the combined company had the Acquisition occurred at the beginning of the period presented, nor the impact of possible business model changes. The unaudited pro forma financial information, while helpful in illustrating the financial characteristics of the combined company under one set of assumptions, does not reflect the realization of potential cost savings, revenue synergies, changes in market conditions and asset dispositions, among other factors, and, accordingly, does not attempt to predict or suggest future results. The Company expects to incur costs associated with the Acquisition and the integration of the businesses and operations of the Company and those of Cape Girardeau, Caruthersville and Mountaineer. However, unaudited pro forma financial information does not include these estimated Acquisition and integration costs. |

| (3) | EBITDAR is a non-GAAP financial measure. Pro forma combined EBITDAR excludes $25.0 million of annual rental expense associated with the triple net lease agreement with VICI for the acquired properties. |

Supplemental Information:

Reconciliation of long-term debt and Net Debt for the Company and the acquired properties.

| | | | As Reported | | | | | | Pro Forma |

| Amounts in thousands | | | September 30, | | | Adjusted | | | September 30, |

| Credit agreement - Bank of Montreal | | $ | 52,412 | | $ | (52,412) | | $ | — |

| Credit agreement - Macquarie | | | — | | | 170,000 | | | 170,000 |

| Credit agreements - CPL | | | 2,076 | | | — Werbung Mehr Nachrichten zur Century Casinos Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |