Calamos Investments Closed-End Funds (NASDAQ: CHI, CHY, CSQ, CGO, CHW, CCD and CPZ) Announce Monthly Distributions and Required Notifications of Sources of Distribution

PR Newswire

METRO CHICAGO, Ill., Oct. 3, 2022

METRO CHICAGO, Ill., Oct. 3, 2022 /PRNewswire/ -- Calamos Investments®* has announced monthly distributions and sources of distributions paid in October 2022 to shareholders of its seven closed-end funds (the Funds) pursuant to the Funds' respective distribution plans.

| Fund | Distribution | Payable date | Record date | Ex-dividend date |

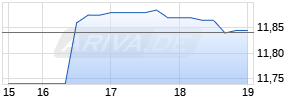

| CHI (inception 06/26/2002) ARIVA.DE Börsen-GeflüsterCalamos Convertible Opportunities and Income Fund | $0.0950 | 10/20/22 | 10/14/22 | 10/13/22 |

| CHY (inception 05/28/2003) Calamos Convertible and High Income Fund | $0.1000 | 10/20/22 | 10/14/22 | 10/13/22 |

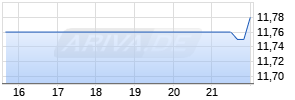

| CSQ (inception 03/26/2004) Calamos Strategic Total Return Fund | $0.1025 | 10/20/22 | 10/14/22 | 10/13/22 |

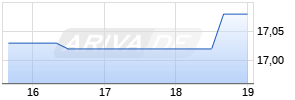

| CGO (inception 10/27/2005) Calamos Global Total Return Fund | $0.0800 | 10/20/22 | 10/14/22 | 10/13/22 |

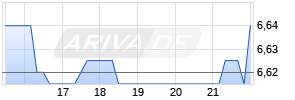

| CHW (inception 06/27/2007) Calamos Global Dynamic Income Fund | $0.0500 | 10/20/22 | 10/14/22 | 10/13/22 |

| CCD (inception 03/27/2015) Calamos Dynamic Convertible and Income Fund | $0.1950 | 10/20/22 | 10/14/22 | 10/13/22 |

| CPZ (inception 11/29/2019) Calamos Long/Short Equity & Dynamic Income Trust | $0.1400 | 10/20/22 | 10/14/22 | 10/13/22 |

Effective September 30, 2022, Calamos Global Total Return Fund 's monthly distribution was reduced by $0.0200 per share and Calamos Global Dynamic Income Fund's monthly distribution was reduced by $0.0200 per share. These changes in the distribution rates for CGO and CHW take into account multiple factors, including but not limited to, each Fund's current and expected earnings, the overall market environment and our investment team's current economic and market outlook.

The following table provides estimates of Calamos Global Total Return Fund's and Calamos Global Dynamic Income Fund's distribution sources, reflecting YTD cumulative experience. The Funds attribute these estimates equally to each regular distribution throughout the year.

| Distribution Components for October 2022's Payable Date | CGO | CHW |

| Ordinary Income | $0.0000 | $0.0000 |

| Short-Term Capital Gains | $0.0000 | $0.0000 |

| Long-Term Capital Gains | $0.0000 | $0.0000 |

| Return of Capital | $0.0800 | $0.0500 |

| Total Distribution (Level Rate) | $0.0800 | $0.0500 |

| | | |

| 2022 Fiscal YTD Data | CGO | CHW |

| Ordinary Income | $0.0081 | $0.0700 |

| Short-Term Capital Gains | $0.5919 | $0.3051 |

| Long-Term Capital Gains | $0.0000 | $0.0528 |

| Return of Capital | $0.5800 | $0.3921 |

| Total Fiscal YTD Distribution (Level Rate) | $1.1800 | $0.8200 |

Regarding Calamos' remaining five closed-end funds, which operate under a managed distribution policy: The information below is required by an exemptive order granted to the Funds by the US Securities and Exchange Commission and includes the information sent to shareholders regarding the sources of the Funds' distributions.

The following table sets forth the estimated amount of the sources of distribution for purposes of Section 19 of the Investment Company Act of 1940, as amended, and the related rules adopted thereunder. The Funds estimate the following percentages, of their respective total distribution amount per common share, attributable to (i) current and prior fiscal year net investment income, (ii) net realized short-term capital gain, (iii) net realized long-term capital gain and (iv) return of capital or other capital source as a percentage of the total distribution amount. These percentages are disclosed for the current distribution as well as the fiscal YTD cumulative distribution amount per common share for the Funds. The following table provides estimates of each Fund's distribution sources, reflecting YTD cumulative experience. The Funds attribute these estimates equally to each regular distribution throughout the year.

| | | | | Estimated Per Share Sources of Distribution | | Estimated Percentage of Distribution | ||||||

| Fund | | Per Share | | Net | Short-Term | Long-Term | Return of Werbung Mehr Nachrichten zum Fonds kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |||||