Ambev Reports 2017 Second Quarter Results Under IFRS

PR Newswire

SÃO PAULO, July 27, 2017

SÃO PAULO, July 27, 2017 /PRNewswire/ – Ambev S.A. [BOVESPA: ABEV3; NYSE: ABEV] announces today its results for the 2017 second quarter. The following operating and financial information, unless otherwise indicated, is presented in nominal Reais and prepared according to International Financial Reporting Standards (IFRS), and should be read together with our quarterly financial information for the six-month period ended June 30th, 2017 filed with the CVM and submitted to the SEC.

Operating and Financial Highlights

Top line performance: Top line was up 4.8% in 2Q17, driven by growth in all our international operations: Latin America South (LAS) (+36.2%), Central America and the Caribbean (CAC) (+6.9%) and Canada (+1.4%), partially impacted by Brazil (-4.1%). In Brazil, volumes declined by 4.7%, while NR/hl was up 0.7%. In CAC, organic volumes were up 1.6%, with a NR/hl growth of 4.2%, while reported volumes increased by 26.2% as a result of the swap of assets carried out with ABI and our operations in Panama. In LAS, volumes grew by a solid 12.2% and NR/hl was up 21.4%. In Canada, volumes were slightly down (-0.4%), while NR/hl grew by 1.8%.

Cost of Goods Sold (COGS): Our COGS increased by 10.6% in the quarter and, on a per hectoliter basis, by 11.6%. Cash COGS (excluding depreciation and amortization) grew by 11.2% while, on a per hectoliter basis, by 12.2%, mainly due to inflationary pressures and unfavorable FX in Brazil and LAS.

Selling, General & Administrative (SG&A) expenses: SG&A was up 1.3% in 2Q17 while cash SG&A (excluding depreciation and amortization) up 1.7%, below our weighted average inflation (around 5.1%), due to efficiency gains in sales & marketing and cost savings in administrative expenses.

EBITDA, Gross margin and EBITDA margin: Normalized EBITDA reached R$ 3,943.3 million (-0.7%) in 2Q17, with gross margin of 60.6% (-200bps) and EBITDA margin of 38.4% (-210bps).

Normalized Net Profit and EPS: Normalized Net Profit was R$ 2,141.5 million in 2Q17, 2.4% lower than in 2Q16, as the EBITDA organic decline and the negative impact of currency translation due to the appreciation of the Brazilian Real were partially offset by the reduction of net financial expenses. Normalized EPS in the quarter was R$ 0.13.

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Ambev ADR | ||

|

MD3K3C

| Ask: 0,23 | Hebel: 4,45 |

| mit moderatem Hebel |

Zum Produkt

| |

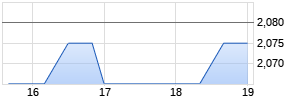

Kurse

|

Cash Generation and CAPEX: Cash generated from operating activities in 2Q17 was 2,424.6 (+16.5%) while CAPEX reached 751 million (-34.8%). Year to date, cash generated from operating activities totaled R$ 4,409.1 million, compared to a negative balance of R$ 132.9 million in the same period of 2016. CAPEX year to date is R$ 1.3 billion (-29.5%).

Pay-out and Financial discipline: Year to date, we have paid/announced R$ 3.6 billion in dividends. As of June 30th, 2017, our net cash position was R$ 3,821.4 million.

| Financial highlights - Ambev consolidated | | | % As | % | | | % As | % |

| R$ million | 2Q16 | 2Q17 | Reported | Organic | YTD16 | YTD17 | Reported | Organic |

| Total volumes | 35.667,8 | 35.660,3 | 0,0% | -1,1% | 75.625,1 | 76.965,4 | 1,8% | 0,8% |

| Net sales | 10.377,2 | 10.268,0 | -1,1% | 4,8% | 21.942,3 | 21.509,8 | -2,0% | 6,5% |

| Gross profit | 6.482,6 | 6.219,8 | -4,1% | 1,4% | 14.087,4 | 12.938,4 | -8,2% | -0,2% |

| Gross margin | 62,5% | 60,6% | -190 bps | -200 bps | 64,2% | 60,2% | -400 bps | -410 bps |

| Normalized EBITDA | 4.204,6 | 3.943,3 | -6,2% | -0,7% | 9.469,0 | 8.299,5 | -12,4% | -4,6% |

| Normalized EBITDA margin | 40,5% | 38,4% | -210 bps | -210 bps | 43,2% | 38,6% | -460 bps | -450 bps |

| Profit | 2.172,5 | 2.124,8 | -2,2% | | 5.066,5 | 4.414,7 | -12,9% | |

| Normalized Profit | 2.194,7 | 2.141,5 | -2,4% | | 5.095,0 | 4.457,5 | -12,5% | |

| EPS (R$/shares) | 0,13 | 0,13 | -1,7% | | 0,31 | 0,27 | -12,5% Werbung Mehr Nachrichten zur Ambev ADR Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. |