Alexander & Baldwin, Inc. Reports First Quarter 2018 Results

PR Newswire

HONOLULU, May 8, 2018

HONOLULU, May 8, 2018 /PRNewswire/ -- Alexander & Baldwin, Inc. (NYSE: ALEX) ("A&B" or "Company") today announced financial results for the first quarter of 2018.

"Our core segment—Commercial Real Estate—continued its strong financial and operating performance in the first quarter with 8.4% growth in operating profit, 2.8% growth in same-store net operating income1 and 10.2% re-leasing spreads. Strategically, we completed the successful migration of our mainland commercial real estate portfolio to Hawai`i with the acquisition of three premier Hawai`i neighborhood and community retail centers and the sale of our last six mainland properties. We also advanced our commercial development pipeline by turning over the first tenant spaces at our Lau Hala Shops project in Kailua and breaking ground on Ho`okele Shopping Center in March. The excellent financial, operational and strategic performance in Commercial Real Estate provided a positive start to 2018, and we expect to hit our earlier guidance for full-year same-store NOI growth," said Chris Benjamin, A&B president and chief executive officer.

"The Land Operations segment's financial results for the quarter were challenged by construction- and remediation-related costs within a builder joint venture. On the positive side, we sold a Kahala property, and several units at Kamalani, Keala o Wailea, Ka Milo and Kukui`ula, which resulted in sales proceeds and cash distributions from our partners of $28 million. Meanwhile, Grace Pacific had a particularly challenging quarter, even as it advanced important operating initiatives that should produce improving results as the year progresses."

Corporate Highlights

- Net income available to A&B shareholders for the first quarter of 2018 was $47.3 million or $0.66 per diluted share. The Company closed the sale of its last six mainland portfolio assets in the quarter, thus completing its mainland to Hawai`i migration. All of the Company's commercial real estate assets are now located in Hawai`i.

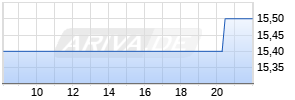

- In connection with its conversion to a REIT, the Company distributed $783.0 million (approximately $15.92 per share) to its shareholders (the "Special Distribution") on January 23, 2018, consisting of $156.6 million in cash and $626.4 million in shares. As of March 31, 2018, the Company had 72.0 million shares outstanding.

Commercial Real Estate ("CRE") Highlights

- CRE operating profit was $15.5 million in the first quarter of 2018, as compared to $14.3 million in the prior year first quarter, an increase of 8.4%.

- Same-store cash NOI1 increased 2.8% in the first quarter of 2018, as compared to the prior year first quarter. All same-store assets are located in Hawai`i as of the end of the quarter.

- Signed 61 leases covering 306,000 square feet of gross leasable area ("GLA") in the first quarter. Leasing spreads for signed leases when compared to previously escalated rents on the same spaces were 10.2% higher for the first quarter of 2018. Leasing spreads on Hawai`i retail spaces were 7.5% higher for the first quarter of 2018.

- Occupancy decreased by 190 basis points to 91.8% as of March 31, 2018, as compared to March 31, 2017, primarily due to the previously anticipated termination of one large tenant at Komohana Industrial Park. Occupancy in the Hawai`i retail portfolio was 93.1% at the end of the quarter, a decrease of 10 basis points.

- Major strategic lease transactions this year-to-date included:

- A ground lease with Wendy's on a 24,000-square-foot, vacant parcel in Kailua.

- Seven new leases at the recently acquired Honokohau Industrial property at an aggregate leasing spread of 22.5%.

- Year-to-date highlights in redevelopment and development for hold included:

- Groundbreaking and commencement of construction at the 94,000-square-foot Ho`okele Shopping Center adjacent to Maui Business Park in Kahului.

- Began turning spaces over to tenants at the 50,500-square-foot Lau Hala Shops center, which was 88% pre-leased as of March 31, 2018, and is scheduled to open in late 2018.

CRE Acquisition and Disposition Highlights

- In February 2018, the Company closed on the purchase of a 415,200-square-foot portfolio of three, newly constructed, premier retail centers located in Hawai`i ("TRC Asset Acquisition"), for $256.7 million (consideration of $254.1 million paid to the seller, and construction and acquisition-related costs of $2.6 million paid to third parties). The acquisition was financed with sources from property sales including the sale of six mainland properties for an aggregate sales price of $159.2 million, which closed in the first quarter 2018, and from proceeds from the sale of one mainland property, which closed in the fourth quarter 2017. In addition, the Company assumed mortgage debt in the acquisition.

- Sales of improved properties and a ground lease in the first quarter of 2018 amounted to $49.6 million, or $0.69 per diluted share.

Land Operations Highlights

- Land Operations operating loss was $5.4 million for the first quarter of 2018, as compared to a $2.4 million loss in the prior year first quarter. The first quarter 2018 operating loss principally resulted from $4.2 million of construction- and remediation-related costs at a builder joint venture project in which the Company is a passive investor.

- Sold a Kahala property, and several units at Kamalani, Keala o Wailea, Ka Milo and Kukui`ula that generated $28 million of cash proceeds and joint venture distributions.

- Advanced diversified agriculture lease discussions and plans for the sale and lease of lands for the expansion of the Kula Agricultural Park.

Materials & Construction Highlights

- Materials & Construction operating profit was $0.2 million for the first quarter of 2018, as compared to $5.6 million profit in the prior year first quarter. Adjusted EBITDA1 was $3.1 million for the three months ended March 31, 2018, as compared to $7.9 million for the prior year.

- Twenty-six percent of the available crew days in the first quarter were lost to weather, which reduced asphalt deliveries by 19.3% to 108.7 thousand tons during the three months ended March 31, 2018, as compared to the prior year. Crew days lost to weather more than doubled in the quarter, increasing from 51 days in the first quarter of 2017 to 109.5 days in the first quarter of 2018. Backlog2 for the Company's Materials & Construction segment was $198.4 million as of March 31, 2018, as compared to $213.2 million for the comparable prior year period.

Financing Highlights

- Recent financings in 2018 included the following:

- In February 2018, assumed a $62.0 million mortgage secured by Laulani Village, which was acquired as part of the TRC Asset Acquisition. The loan carries a fixed interest rate of 3.93% and matures in 2024.

- In February 2018, closed a $50 million, bank term loan facility maturing in 2023, which carries interest at LIBOR plus a margin that is determined using a leverage-based pricing grid.

- On April 18, 2018, refinanced the 3.9% fixed rate $62.5 million Prudential Series E loan that matured in 2024, with three new Prudential financings: $10 million at a fixed interest rate of 4.66% maturing in 2025; $34.5 million at a fixed interest rate of 4.81% maturing in 2027; and $18 million at a fixed interest rate of 4.89% maturing in 2028.

- At March 31, 2018, the Company's debt has a weighted-average maturity of 5.6 years with a weighted-average interest rate of 4.16%. Pro forma for the refinancing of Prudential Series E and Syndicated Term loan, the weighted-average maturity increased to 6.0 years. Seventy-two percent of debt was at a fixed rate.

| | |||||||

| | |||||||

| ALEXANDER & BALDWIN, INC. AND SUBSIDIARIES | |||||||

| SEGMENT DATA & OTHER FINANCIAL INFORMATION | |||||||

| (In millions, except per share amounts; unaudited) | |||||||

| | |||||||

| | Three Months Ended | ||||||

| | 2018 | | 2017 | ||||

| Operating Revenue: | | | | ||||

| Commercial Real Estate | $ | 35.2 | | | $ | 33.7 | |

| Land Operations | 29.3 | | | 11.0 | | ||

| Materials & Construction | 48.8 | | | 48.5 | | ||

| Total operating revenue | 113.3 | | | 93.2 | | ||

| Operating Profit (Loss): | | | | ||||

| Commercial Real Estate | 15.5 | | | 14.3 | | ||

| Land Operations | (5.4) | | | (2.4) | | ||

| Materials & Construction | 0.2 | | | 5.6 | | ||

| Total operating profit | 10.3 | | | 17.5 | | ||

| Interest expense | (8.4) | | | (6.2) | | ||

| General corporate expenses | (6.7) | | | (5.7) | | ||

| REIT evaluation/conversion costs | — | | | (4.8) | | ||

| Income (Loss) from Continuing Operations Before Income Taxes and Net Gain (Loss) on Sale of Improved Properties and Ground Leased Land | (4.8) | | | 0.8 | | ||

| Income tax benefit (expense) | 2.7 | | | 0.8 | | ||

| Income (Loss) from Continuing Operations Before Net Gain (Loss) on Sale of Improved Properties and Ground Leased Land | (2.1) | | | 1.6 | | ||

| Net gain (loss) on the sale of improved properties and ground leased land | 49.6 | | | 3.0 | | ||

| Income (Loss) from Continuing Operations | 47.5 | | | 4.6 | | ||

| Income (loss) from discontinued operations, net of income taxes | (0.1) | | | 2.4 | | ||

| Net Income (Loss) | 47.4 | | | 7.0 | | ||

| Income attributable to noncontrolling interest | (0.1) | | | (0.7) | | ||

| Net Income (Loss) Attributable to A&B Shareholders | $ | 47.3 | | | $ | 6.3 | |

| | | | | ||||

| Basic Earnings (Loss) Per Share of Common Stock: | | | | ||||

| Continuing operations available to A&B shareholders | $ | 0.71 | | | $ | 0.09 | |

| Discontinued operations available to A&B shareholders | — | | | 0.05 | | ||

| Net income (loss) available to A&B shareholders | $ | 0.71 | | | $ | 0.14 | |

| Diluted Earnings (Loss) Per Share of Common Stock: | | | | ||||

| Continuing operations available to A&B shareholders Werbung Mehr Nachrichten zur Alexander & Baldwin Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||