ZF North America Capital Inc. / Key word(s): Offer 04.08.2016 07:17 Disclosure of an inside information according to Article 17 MAR, transmitted by EQS - a company of EQS Group AG. The issuer is solely responsible for the content of this announcement.

---------------------------------------------------------------------------

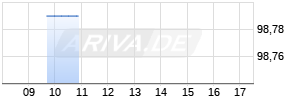

Ad hoc announcement - Publication of Inside Information according to Article 17 (1) of the Market Abuse Regulation This ad hoc announcement is not and must not, directly or indirectly, be distributed or made public in or into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. The offer is not being made to, nor will any tender of shares be accepted from, holders in such jurisdictions or elsewhere where their participation requires further documentation, filings or other measures in addition to those required by Swedish law. 4 August 2016 at 07:00 am CET ZF North America Capital Inc., a subsidiary of ZF Friedrichshafen AG, incorporated under the laws of the State of Delaware, United States, having its registered office at 1209 Orange Street, Wilmington 19801, United States (the "Issuer"). The Issuer has issued the following bonds: 4.00% USD 2020 with denomination USD 150,000, volume USD 1.0 bn and ISIN US98877DAA37 (144A) / USU98737AA47 (Reg S) 4.50% USD 2022 with denomination USD 150,000, volume USD 1.0 bn and ISIN US98877DAB10 (144A) / USU98737AB20 (Reg S) 4.75% USD 2025 with denomination USD 150,000, volume USD 1.5 bn and ISIN US98877DAC92 (144A) / USU98737AC03 (Reg S) 2.25% EUR 2019 with volume EUR 1.15 bn and ISIN DE000A14J7F8 2.75% EUR 2023 with denomination EUR 100,000 and volume EUR 1.1 bn and ISIN DE000A14J7G6 ZF announces a recommended public cash offer to the shareholders of Haldex ZF Friedrichshafen AG ("ZF Friedrichshafen", and together with its fully consolidated subsidiaries, "ZF Group"), through its wholly-owned subsidiary ZF International B.V. ("ZF"), announces a recommended public cash offer to the shareholders of Haldex Aktiebolag (publ) ("Haldex" and, together with its fully consolidated subsidiaries, "Haldex Group") to tender all their shares to ZF (the "Offer"). The shares in Haldex are listed on Nasdaq Stockholm, Mid Cap ("Nasdaq Stockholm"). ZF offers SEK 100.00 in cash per share in Haldex.(1) The total value of the Offer amounts to approximately SEK 4,411 million. The Offer exceeds the unsolicited offer announced by SAF-Holland GmbH on 14 July 2016 by SEK 5.58 per share. The Offer represents a premium of: - 34.4 percent per share compared to the volume-weighted average price for the Haldex share on Nasdaq Stockholm during the three months prior to the announcement of SAF-Holland GmbH's offer on 14 July 2016 (14.9 percent per share compared to the volume-weighted average price during the three months prior to 4 August 2016); - 43.7 percent per share compared to the volume-weighted average price for the Haldex share on Nasdaq Stockholm during the six months prior to the announcement of SAF-Holland GmbH's offer on 14 July 2016 (29.5 percent per share compared to the volume-weighted average price during the six months prior to 4 August 2016); and - 17.3 percent per share compared to the closing price of SEK 85.25 for the Haldex share on Nasdaq Stockholm on 13 July 2016, which was the last trading day prior to the announcement of SAF-Holland GmbH's offer (the Offer represents a 4.1 percent per share discount compared to the closing price (which, in ZF's opinion has been affected by the offer announcement of SAF-Holland GmbH) of SEK 104.25 for the Haldex share on Nasdaq Stockholm on 3 August 2016, which was the last trading day prior to the announcement of the Offer). The Offer is higher than the research analyst target price range of SEK 80.00 to 92.00 for the Haldex share stated on FactSet on 13 July 2016. The Board of Directors of Haldex has unanimously decided to recommend to the shareholders of Haldex to accept the Offer. ZF has obtained an undertaking to accept the Offer from Göran Carlson, the Chairman of the Board of Directors of Haldex, being the largest shareholder of Haldex, representing 2,506,356 shares corresponding to 5.7 percent of the total number of shares and votes in Haldex. More information on the undertaking is set out in the formal announcement of the transaction under Swedish law which is available on ZF's website under www.zf.com. ZF is of the opinion that a business combination of Haldex and ZF represents an outstanding opportunity for both companies to jointly expand their value to the customer in the supply for commercial vehicles in the field of drivetrain and chassis, including brake and air suspension solutions as well as for future megatrends in mobility as outlined in ZF Group's Strategy 2025. ZF believes that it will be able to continue to develop Haldex's market position and technological capabilities under ZF ownership due to ZF Group's technological leadership, global reach and customer access, combined with Haldex's technological competence, management and employees, and intends to invest significant funds and resources into Haldex. The complementary portfolio of Haldex constitutes a valuable enhancement to ZF Group's portfolio and will sustainably contribute to ZF Group's strategy. With Haldex's brake systems for commercial vehicles, ZF Group would be able to cover the whole functional chain of commercial vehicles in line with "See-Think-Act" (the aim of ZF Group's technology is to enable vehicles to see, think, and act autonomously) and transfer fuel efficiency, autonomous driving and safety systems technologies known from passenger cars to commercial vehicles. This will result in more safety for all traffic participants. ZF will finance the Offer through its existing cash resources and Intercompany Loans provided by ZF Friedrichshafen. ZF Friedrichshafen has irrevocably undertaken to provide ZF with the necessary funds to finance the Offer. ZF Friedrichshafen has sufficient cash resources and - if needed - available credit facilities in the amount of more than EUR 2.5 billion undrawn credit facilities. The conditions to drawdown under such credit facilities are customary for facilities of this type and are under the control of ZF. The Offer is conditional, among other things, upon being accepted by Haldex's shareholders to an extent that ZF becomes the owner of more than 90 percent of the outstanding shares in Haldex. The announced transaction is further subject to approval from competition authorities. ZF will file the transaction with relevant authorities shortly. Detailed terms and conditions of the Offer have been published in the formal announcement of the transaction under Swedish law which is available on ZF's website under www.zf.com. ZF will file the offer document required for the announced transaction with Finansinspektionen, Sweden's financial supervisory authority, and is expecting approval of the offer document shortly. Following approval, the offer document will be published on ZF's website. The acceptance period is expected to commence on or around 22 August 2016 and end on or around 30 September 2016. Citigroup Global Markets Deutschland AG ("Citi") is acting as financial advisor to ZF Friedrichshafen and Linklaters is acting as legal advisor to ZF and ZF Friedrichshafen in connection with the Offer.

------------------------------------------

(1)In the event that Haldex pays dividends or executes any other value transfer, pecuniary or in kind, to its shareholders, for which the record date occurs before settlement in the Offer, the cash consideration of the Offer will be reduced accordingly. Company Profile ZF Group is a global supplier focusing on driveline, chassis, electronics and safety technology for passenger cars and commercial vehicles as well as a range of industrial applications with a wide product portfolio and global reach. As of 31 December 2015, ZF Group's workforce worldwide comprised approximately 138,000 employees in 40 countries. ZF Group reported sales of EUR 29.2 billion in 2015. For further information on ZF Group, please refer to its website (www.zf.com). For additional information please contact: ZF Friedrichshafen contact for media and investors Thomas Wenzel Graf-von-Soden-Platz 1 88046 Friedrichshafen GERMANY Phone: +49 7541 772543 Mobile: +49 151 167 164 45 Email: thomas.wenzel@zf.com www.zf.com Contact for Swedish media and investors Fogel & Partners Anders Fogel Mobile: +46 722 044 750 Email: anders.fogel@fogelpartners.se Contact for German Media and additional contact for investors CNC - Communications & Network Consulting Knut Engelmann Mobile: +49 174 234 2808 Email: knut.engelmann@cnc-communications.com Roland Klein Mobile: +44 7776 162 997 Email: roland.klein@cnc-communications.com This press release was submitted for publication on 4 August 2016 at 07:00 am CET. IMPORTANT INFORMATION Forward-looking statements Statements in this ad hoc announcement relating to future status or circumstances, including statements regarding future performance, growth and other trend projections as well as benefits of the Offer, are forward- looking statements. Forward-looking statements may generally, but not always, be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as "may," "will," "expects," "believes," "anticipates," "plans," "intends," "estimates," "projects," "targets," "forecasts," "seeks," "could," or the negative of such terms, and other variations on such terms or comparable terminology. Forward-looking statements include, but are not limited to, statements about the expected future business of Haldex resulting from and following the Offer. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to many factors, many of which are outside the control of ZF and Haldex, including but not limited to the effect of changes in general economic conditions, the level of interest rates, fluctuations in product demand, competition, technological change, employee relations, planning and property regulations, natural disasters and the potential need for increased capital expenditure (such as resulting from increased demand, new business opportunities and deployment of new technologies). Any such forward-looking statements speak only as of the date on which they are made and neither ZF nor Haldex has (or undertakes) any obligation to update or revise any of them, whether as a result of new information, future events or otherwise, except for in accordance with applicable laws and regulations. Offer Restrictions The Offer is not being made to persons whose participation in the Offer requires that any additional offer document is prepared or registration effected or that any other measures are taken in addition to those required under Swedish law. This ad hoc announcement and any documentation relating to the Offer are not being published in or distributed to or into and must not be mailed or otherwise distributed or sent in or into any country in which the distribution or offering would require any such additional measures to be taken or would be in conflict with any law or regulation in such country. Persons who receive this communication (including, without limitation, nominees, trustees and custodians) and are subject to the law of any such jurisdiction will need to inform themselves about, and observe, any applicable restrictions or requirements. Any failure to do so may constitute a violation of the securities laws of any such jurisdiction. ZF, to the fullest extent permitted by applicable law, disclaims any responsibility or liability for the violations of any such restrictions by any person. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions may be disregarded. The Offer is not being made, and will not be made, and this ad hoc announcement is not being distributed and will not be distributed, directly or indirectly, in or into, Australia, Canada, Hong Kong, Japan, New Zealand or South Africa by use of mail or any other means or instrumentality of interstate or foreign commerce, or of any facilities of a national securities exchange, of Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. This includes, but is not limited to facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic transmission. The Offer cannot be accepted and shares may not be tendered in the Offer by any such use, means, instrumentality or facility of, or from within, Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or by persons located or resident in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Accordingly, this ad hoc announcement and any related Offer documentation are not being and should not be mailed or otherwise transmitted, distributed, forwarded or sent in or into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or to any Australian, Canadian, Hong Kong, Japanese, New Zealand or South African persons or any persons located or resident in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. ZF will not deliver any consideration from the Offer into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions will be invalid and any purported acceptance by a person located in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or any agent, fiduciary or other intermediate acting on a non-discretionary basis for a principal giving instructions from within Australia, Canada, Hong Kong, Japan, New Zealand or South Africa will be invalid and will not be accepted. Each holder of shares participating in the Offer will represent that it is not an Australian, Canadian, Hong Kong, Japanese, New Zealand or South African person, is not located in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa and is not participating in such Offer from Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or that it is acting on a non- discretionary basis for a principal that is not an Australian, Canadian, Hong Kong, Japanese, New Zealand or South African person, that is located outside Australia, Canada, Hong Kong, Japan, New Zealand or South Africa and that is not giving an order to participate in such Offer from Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. This ad hoc announcement is not being, and must not be, sent to shareholders with registered addresses in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Banks, brokers, dealers and other nominees holding shares for persons in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa must not forward this ad hoc announcement or any other document received in connection with the Offer to such persons. Notwithstanding the foregoing, ZF reserves the right to permit the Offer to be accepted by persons not resident in Sweden if, in its sole discretion, ZF is satisfied that such transaction can be undertaken in compliance with applicable laws and regulations. Citi is acting as financial adviser to ZF Friedrichshafen, and no one else, in connection with the Offer. Citi will not be responsible to anyone other than ZF Friedrichshafen for providing advice in relation to the Offer. The information has been provided by ZF Friedrichshafen and, with respect to Haldex, by Haldex and taken from Haldex's publicly available information. Citi has not assumed any obligation to independently verify, and disclaims any liability with respect to, the information herein. Neither Citi nor any of its affiliates owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Citi in connection with this announcement, any statement contained herein, the Offer or otherwise. The figures reported in this ad hoc announcement have been rounded off as appropriate. 04.08.2016 The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.dgap.de

---------------------------------------------------------------------------

Language: English Company: ZF North America Capital Inc. 15811 Centennial Drive MI 48168 Northville United States Phone: Fax: E-mail: investor.relations@zf.com Internet: ISIN: DE000A14J7F8, DE000A14J7G6 WKN: A14J7F, A14J7G Listed: Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange; Open Market in Frankfurt; Luxemburg End of Announcement EQS News-Service

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Ad hoc announcement - Publication of Inside Information according to Article 17 (1) of the Market Abuse Regulation This ad hoc announcement is not and must not, directly or indirectly, be distributed or made public in or into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. The offer is not being made to, nor will any tender of shares be accepted from, holders in such jurisdictions or elsewhere where their participation requires further documentation, filings or other measures in addition to those required by Swedish law. 4 August 2016 at 07:00 am CET ZF North America Capital Inc., a subsidiary of ZF Friedrichshafen AG, incorporated under the laws of the State of Delaware, United States, having its registered office at 1209 Orange Street, Wilmington 19801, United States (the "Issuer"). The Issuer has issued the following bonds: 4.00% USD 2020 with denomination USD 150,000, volume USD 1.0 bn and ISIN US98877DAA37 (144A) / USU98737AA47 (Reg S) 4.50% USD 2022 with denomination USD 150,000, volume USD 1.0 bn and ISIN US98877DAB10 (144A) / USU98737AB20 (Reg S) 4.75% USD 2025 with denomination USD 150,000, volume USD 1.5 bn and ISIN US98877DAC92 (144A) / USU98737AC03 (Reg S) 2.25% EUR 2019 with volume EUR 1.15 bn and ISIN DE000A14J7F8 2.75% EUR 2023 with denomination EUR 100,000 and volume EUR 1.1 bn and ISIN DE000A14J7G6 ZF announces a recommended public cash offer to the shareholders of Haldex ZF Friedrichshafen AG ("ZF Friedrichshafen", and together with its fully consolidated subsidiaries, "ZF Group"), through its wholly-owned subsidiary ZF International B.V. ("ZF"), announces a recommended public cash offer to the shareholders of Haldex Aktiebolag (publ) ("Haldex" and, together with its fully consolidated subsidiaries, "Haldex Group") to tender all their shares to ZF (the "Offer"). The shares in Haldex are listed on Nasdaq Stockholm, Mid Cap ("Nasdaq Stockholm"). ZF offers SEK 100.00 in cash per share in Haldex.(1) The total value of the Offer amounts to approximately SEK 4,411 million. The Offer exceeds the unsolicited offer announced by SAF-Holland GmbH on 14 July 2016 by SEK 5.58 per share. The Offer represents a premium of: - 34.4 percent per share compared to the volume-weighted average price for the Haldex share on Nasdaq Stockholm during the three months prior to the announcement of SAF-Holland GmbH's offer on 14 July 2016 (14.9 percent per share compared to the volume-weighted average price during the three months prior to 4 August 2016); - 43.7 percent per share compared to the volume-weighted average price for the Haldex share on Nasdaq Stockholm during the six months prior to the announcement of SAF-Holland GmbH's offer on 14 July 2016 (29.5 percent per share compared to the volume-weighted average price during the six months prior to 4 August 2016); and - 17.3 percent per share compared to the closing price of SEK 85.25 for the Haldex share on Nasdaq Stockholm on 13 July 2016, which was the last trading day prior to the announcement of SAF-Holland GmbH's offer (the Offer represents a 4.1 percent per share discount compared to the closing price (which, in ZF's opinion has been affected by the offer announcement of SAF-Holland GmbH) of SEK 104.25 for the Haldex share on Nasdaq Stockholm on 3 August 2016, which was the last trading day prior to the announcement of the Offer). The Offer is higher than the research analyst target price range of SEK 80.00 to 92.00 for the Haldex share stated on FactSet on 13 July 2016. The Board of Directors of Haldex has unanimously decided to recommend to the shareholders of Haldex to accept the Offer. ZF has obtained an undertaking to accept the Offer from Göran Carlson, the Chairman of the Board of Directors of Haldex, being the largest shareholder of Haldex, representing 2,506,356 shares corresponding to 5.7 percent of the total number of shares and votes in Haldex. More information on the undertaking is set out in the formal announcement of the transaction under Swedish law which is available on ZF's website under www.zf.com. ZF is of the opinion that a business combination of Haldex and ZF represents an outstanding opportunity for both companies to jointly expand their value to the customer in the supply for commercial vehicles in the field of drivetrain and chassis, including brake and air suspension solutions as well as for future megatrends in mobility as outlined in ZF Group's Strategy 2025. ZF believes that it will be able to continue to develop Haldex's market position and technological capabilities under ZF ownership due to ZF Group's technological leadership, global reach and customer access, combined with Haldex's technological competence, management and employees, and intends to invest significant funds and resources into Haldex. The complementary portfolio of Haldex constitutes a valuable enhancement to ZF Group's portfolio and will sustainably contribute to ZF Group's strategy. With Haldex's brake systems for commercial vehicles, ZF Group would be able to cover the whole functional chain of commercial vehicles in line with "See-Think-Act" (the aim of ZF Group's technology is to enable vehicles to see, think, and act autonomously) and transfer fuel efficiency, autonomous driving and safety systems technologies known from passenger cars to commercial vehicles. This will result in more safety for all traffic participants. ZF will finance the Offer through its existing cash resources and Intercompany Loans provided by ZF Friedrichshafen. ZF Friedrichshafen has irrevocably undertaken to provide ZF with the necessary funds to finance the Offer. ZF Friedrichshafen has sufficient cash resources and - if needed - available credit facilities in the amount of more than EUR 2.5 billion undrawn credit facilities. The conditions to drawdown under such credit facilities are customary for facilities of this type and are under the control of ZF. The Offer is conditional, among other things, upon being accepted by Haldex's shareholders to an extent that ZF becomes the owner of more than 90 percent of the outstanding shares in Haldex. The announced transaction is further subject to approval from competition authorities. ZF will file the transaction with relevant authorities shortly. Detailed terms and conditions of the Offer have been published in the formal announcement of the transaction under Swedish law which is available on ZF's website under www.zf.com. ZF will file the offer document required for the announced transaction with Finansinspektionen, Sweden's financial supervisory authority, and is expecting approval of the offer document shortly. Following approval, the offer document will be published on ZF's website. The acceptance period is expected to commence on or around 22 August 2016 and end on or around 30 September 2016. Citigroup Global Markets Deutschland AG ("Citi") is acting as financial advisor to ZF Friedrichshafen and Linklaters is acting as legal advisor to ZF and ZF Friedrichshafen in connection with the Offer.

------------------------------------------

(1)In the event that Haldex pays dividends or executes any other value transfer, pecuniary or in kind, to its shareholders, for which the record date occurs before settlement in the Offer, the cash consideration of the Offer will be reduced accordingly. Company Profile ZF Group is a global supplier focusing on driveline, chassis, electronics and safety technology for passenger cars and commercial vehicles as well as a range of industrial applications with a wide product portfolio and global reach. As of 31 December 2015, ZF Group's workforce worldwide comprised approximately 138,000 employees in 40 countries. ZF Group reported sales of EUR 29.2 billion in 2015. For further information on ZF Group, please refer to its website (www.zf.com). For additional information please contact: ZF Friedrichshafen contact for media and investors Thomas Wenzel Graf-von-Soden-Platz 1 88046 Friedrichshafen GERMANY Phone: +49 7541 772543 Mobile: +49 151 167 164 45 Email: thomas.wenzel@zf.com www.zf.com Contact for Swedish media and investors Fogel & Partners Anders Fogel Mobile: +46 722 044 750 Email: anders.fogel@fogelpartners.se Contact for German Media and additional contact for investors CNC - Communications & Network Consulting Knut Engelmann Mobile: +49 174 234 2808 Email: knut.engelmann@cnc-communications.com Roland Klein Mobile: +44 7776 162 997 Email: roland.klein@cnc-communications.com This press release was submitted for publication on 4 August 2016 at 07:00 am CET. IMPORTANT INFORMATION Forward-looking statements Statements in this ad hoc announcement relating to future status or circumstances, including statements regarding future performance, growth and other trend projections as well as benefits of the Offer, are forward- looking statements. Forward-looking statements may generally, but not always, be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as "may," "will," "expects," "believes," "anticipates," "plans," "intends," "estimates," "projects," "targets," "forecasts," "seeks," "could," or the negative of such terms, and other variations on such terms or comparable terminology. Forward-looking statements include, but are not limited to, statements about the expected future business of Haldex resulting from and following the Offer. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to many factors, many of which are outside the control of ZF and Haldex, including but not limited to the effect of changes in general economic conditions, the level of interest rates, fluctuations in product demand, competition, technological change, employee relations, planning and property regulations, natural disasters and the potential need for increased capital expenditure (such as resulting from increased demand, new business opportunities and deployment of new technologies). Any such forward-looking statements speak only as of the date on which they are made and neither ZF nor Haldex has (or undertakes) any obligation to update or revise any of them, whether as a result of new information, future events or otherwise, except for in accordance with applicable laws and regulations. Offer Restrictions The Offer is not being made to persons whose participation in the Offer requires that any additional offer document is prepared or registration effected or that any other measures are taken in addition to those required under Swedish law. This ad hoc announcement and any documentation relating to the Offer are not being published in or distributed to or into and must not be mailed or otherwise distributed or sent in or into any country in which the distribution or offering would require any such additional measures to be taken or would be in conflict with any law or regulation in such country. Persons who receive this communication (including, without limitation, nominees, trustees and custodians) and are subject to the law of any such jurisdiction will need to inform themselves about, and observe, any applicable restrictions or requirements. Any failure to do so may constitute a violation of the securities laws of any such jurisdiction. ZF, to the fullest extent permitted by applicable law, disclaims any responsibility or liability for the violations of any such restrictions by any person. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions may be disregarded. The Offer is not being made, and will not be made, and this ad hoc announcement is not being distributed and will not be distributed, directly or indirectly, in or into, Australia, Canada, Hong Kong, Japan, New Zealand or South Africa by use of mail or any other means or instrumentality of interstate or foreign commerce, or of any facilities of a national securities exchange, of Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. This includes, but is not limited to facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic transmission. The Offer cannot be accepted and shares may not be tendered in the Offer by any such use, means, instrumentality or facility of, or from within, Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or by persons located or resident in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Accordingly, this ad hoc announcement and any related Offer documentation are not being and should not be mailed or otherwise transmitted, distributed, forwarded or sent in or into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or to any Australian, Canadian, Hong Kong, Japanese, New Zealand or South African persons or any persons located or resident in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. ZF will not deliver any consideration from the Offer into Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions will be invalid and any purported acceptance by a person located in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or any agent, fiduciary or other intermediate acting on a non-discretionary basis for a principal giving instructions from within Australia, Canada, Hong Kong, Japan, New Zealand or South Africa will be invalid and will not be accepted. Each holder of shares participating in the Offer will represent that it is not an Australian, Canadian, Hong Kong, Japanese, New Zealand or South African person, is not located in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa and is not participating in such Offer from Australia, Canada, Hong Kong, Japan, New Zealand or South Africa or that it is acting on a non- discretionary basis for a principal that is not an Australian, Canadian, Hong Kong, Japanese, New Zealand or South African person, that is located outside Australia, Canada, Hong Kong, Japan, New Zealand or South Africa and that is not giving an order to participate in such Offer from Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. This ad hoc announcement is not being, and must not be, sent to shareholders with registered addresses in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa. Banks, brokers, dealers and other nominees holding shares for persons in Australia, Canada, Hong Kong, Japan, New Zealand or South Africa must not forward this ad hoc announcement or any other document received in connection with the Offer to such persons. Notwithstanding the foregoing, ZF reserves the right to permit the Offer to be accepted by persons not resident in Sweden if, in its sole discretion, ZF is satisfied that such transaction can be undertaken in compliance with applicable laws and regulations. Citi is acting as financial adviser to ZF Friedrichshafen, and no one else, in connection with the Offer. Citi will not be responsible to anyone other than ZF Friedrichshafen for providing advice in relation to the Offer. The information has been provided by ZF Friedrichshafen and, with respect to Haldex, by Haldex and taken from Haldex's publicly available information. Citi has not assumed any obligation to independently verify, and disclaims any liability with respect to, the information herein. Neither Citi nor any of its affiliates owes or accepts any duty, liability or responsibility whatsoever (whether direct or indirect, whether in contract, in tort, under statute or otherwise) to any person who is not a client of Citi in connection with this announcement, any statement contained herein, the Offer or otherwise. The figures reported in this ad hoc announcement have been rounded off as appropriate. 04.08.2016 The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.dgap.de

---------------------------------------------------------------------------

Language: English Company: ZF North America Capital Inc. 15811 Centennial Drive MI 48168 Northville United States Phone: Fax: E-mail: investor.relations@zf.com Internet: ISIN: DE000A14J7F8, DE000A14J7G6 WKN: A14J7F, A14J7G Listed: Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Hanover, Munich, Stuttgart, Tradegate Exchange; Open Market in Frankfurt; Luxemburg End of Announcement EQS News-Service

---------------------------------------------------------------------------