The Sherwin-Williams Company Reports 2022 Year-End and Fourth Quarter Financial Results

PR Newswire

CLEVELAND, Jan. 26, 2023

CLEVELAND, Jan. 26, 2023 /PRNewswire/ -- The Sherwin-Williams Company (NYSE: SHW) announced its financial results for the year and fourth quarter ended December 31, 2022. All comparisons are to the full year and fourth quarter of the prior year, unless otherwise noted.

- Consolidated net sales increased 11.1% in the year to a record $22.15 billion

- Net sales from stores in U.S. and Canada open more than twelve calendar months increased 11.7% in the year

- Diluted net income per share increased to $7.72 per share in the year compared to $6.98 per share in the full year 2021

- Adjusted diluted net income per share increased to $8.73 per share in the year compared to $8.15 per share in the full year 2021

- Fourth quarter consolidated net sales increased 9.8%; diluted net income per share was $1.48 per share and adjusted diluted net income per share increased 41% in the quarter to $1.89 per share

- Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) increased 10.4% in the year to $3.61 billion or 16.3% of consolidated net sales

- Full year 2023 diluted net income per share guidance in the range of $6.79 to $7.59 per share, including acquisition-related amortization expense of $0.81 per share and restructuring expense of $0.25 to $0.35 per share

CEO REMARKS

"Sherwin-Williams delivered strong fourth quarter results compared to the same period a year ago, including high single-digit percentage sales growth, significant year-over-year gross margin improvement, expanded adjusted operating margins in all three segments, strong double-digit adjusted diluted net income per share growth and strong EBITDA growth," said Chairman and Chief Executive Officer, John G. Morikis. "Our strong fourth quarter performance led to record full year sales, which increased 11.1% to $22.1 billion. Full year adjusted diluted net income per share also increased to a record level. Additionally, we generated strong net operating cash in the year, which enabled us to invest $883 million in share repurchases, pay $619 million in dividends and deploy $1 billion to complete five acquisitions that will add to our solutions and capabilities.

"Our more than 61,000 employees delivered these results in another year of difficult operating conditions, including relentless cost inflation, less than optimal raw material availability, slowing economies, a war in Europe and COVID lockdowns in China. We refused to be deterred by these challenges and continued to do what we do best – serve our customers.

"Looking at our reportable segment performance in 2022, The Americas Group delivered double-digit sales growth in all customer segments, including the seventh consecutive year of double-digit growth in residential repaint. Consumer Brands Group faced extremely difficult conditions in Europe and Asia that impacted sales but continued to take actions that will drive enhanced future profitability. In Performance Coatings Group, sales increased in nearly all business units, and adjusted segment margin improved 250 basis points year-over-year."

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Sherwin-Williams Company | ||

|

VD04P2

| Ask: 7,89 | Hebel: 6,32 |

| mit moderatem Hebel |

Zum Produkt

| |

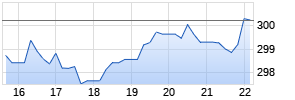

Kurse

|

FOURTH QUARTER CONSOLIDATED RESULTS

| | Three Months Ended December 31, | ||||||

| | 2022 | | 2021 | | $ Change | | % Change |

| Net sales | $ 5,230.5 | | $ 4,762.1 | | $ 468.4 | | 9.8 % |

| Income before income taxes | $ 494.9 | | $ 308.9 | | $ 186.0 | | 60.2 % |

| As a % of sales | 9.5 % | | 6.5 % | | | | |

| Net income per share - diluted | $ 1.48 | | $ 1.15 | | $ 0.33 | | 28.7 % |

| Adjusted net income per share - diluted | $ 1.89 | | $ 1.34 | | $ 0.55 | | 41.0 % |

Consolidated net sales increased primarily due to selling price increases in all segments and higher architectural sales volume in The Americas Group, partially offset by lower sales volumes outside of North America in the Consumer Brands and Performance Coatings Groups. Acquisitions increased consolidated net sales by approximately 1.5%, while currency translation rate changes decreased consolidated net sales by 2.0%.

Income before income taxes increased primarily due to selling price increases in all segments and higher sales volume in The Americas Group. These factors were partially offset by higher raw material costs across all three segments, increased SG&A spending in The Americas Group and Performance Coatings Group, costs associated with our previously announced targeted restructuring actions including non-cash trademark impairment charges and higher interest expense.

Diluted net income per share included a charge of $0.21 per share for acquisition-related amortization expense and charges totaling $0.20 per share related to restructuring actions including non-cash trademark impairments.

FOURTH QUARTER SEGMENT RESULTS

The Americas Group ("TAG")

| | Three Months Ended December 31, | ||||||

| | 2022 | | 2021 | | $ Change | | % Change |

| Net sales | $ 3,071.1 | | $ 2,653.5 | | $ 417.6 | | 15.7 % |

| Same-store sales (1) | 15.5 % | | 1.0 % | | | | |

| Segment profit | $ 526.7 | | $ 400.3 | | $ 126.4 | | 31.6 % |

| Reported segment margin | 17.2 % | | 15.1 % | | | | |

| |

| (1) Same-store sales represents net sales from stores in U.S. and Canada open more than twelve calendar months. |

Net sales in TAG increased due primarily to selling price increases and higher architectural sales volume in most end markets. TAG segment profit increased due primarily to higher paint sales volume and selling price increases, partially offset by increased raw material costs and higher SG&A costs related to continued investments in long-term growth strategies.

Consumer Brands Group ("CBG")

| | Three Months Ended December 31, | ||||||

| | 2022 | | 2021 | | $ Change | | % Change |

| Net sales | $ 551.5 | | $ 565.3 | | $ (13.8) | | (2.4) % |

| Segment profit | $ 2.4 | | $ 16.1 | | $ (13.7) | | (85.1) % |

| Reported segment margin | 0.4 % | | 2.8 % | | | | |

| Adjusted segment profit (1) | $ 62.3 | | $ 35.4 | | $ 26.9 | | 76.0 % |

| Adjusted segment margin | 11.3 % | | 6.3 % | | | | |

| | |

| (1) | Adjusted segment profit excludes the impact of restructuring costs (including non-cash trademark impairments) and acquisition-related amortization expense. In CBG, restructuring costs were $41.1 million in the fourth quarter of 2022 and acquisition-related amortization expense was $18.8 million and $19.3 million in the fourth quarter of 2022 and 2021, respectively. |

Net sales in CBG decreased primarily due to lower sales volume, partially offset by selling price increases in all regions. Currency translation rate changes decreased net sales by 1.7%. CBG segment profit decreased primarily due to the lower sales volume, increased raw material costs and supply chain inefficiencies, and the costs associated with targeted restructuring actions including non-cash trademark impairments. These factors were partially offset by selling price increases and good cost control. Restructuring costs reduced segment profit as a percent of net external sales by 750 basis points, and acquisition-related amortization expense reduced segment profit as a percent of net external sales by 340 basis points compared to 350 basis points in the fourth quarter of 2021.

Performance Coatings Group ("PCG")

Mehr Nachrichten zur Sherwin-Williams Company Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.