"Je pleiter, desto dreister."

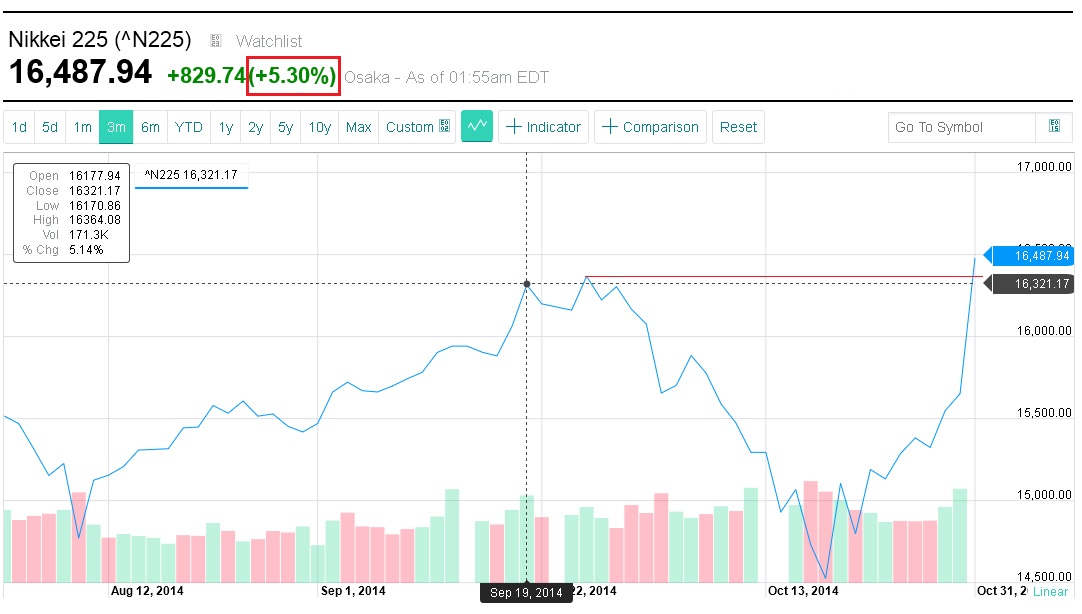

Der Nikkei stieg auf die frohe Bankerkunde hin um 5,5 % (Chart unten).

Ich hab wenig Zweifel daran, dass diese Aktion mit Wall Street abgesprochen war, um eine globale "Weihnachtsrally" zur Boni-Sicherung von Wall Street loszutreten.

Japans QE-Ausweitung um 37,5 % soll offenbar als Ausgleich für das ausgelaufene QE3 in USA dienen.

Japan will jetzt für umgerechnet 727 Millarden US-Dollar pro Jahr eigene Bonds (und fremde Aktien?) aufkaufen. Das Volumen entspricht 73 % dessen, was die Fed im Rahmen von QE3 aufgekauft hatte. Japans Wirtschaft hat aber nur ein BIP von 4,9 Billionen - weniger als 30 % des US-BIPs (16,7 Billionen)..

Japan betreibt somit aktuell QE in einem Volumen, das - umgerechnet auf das BIP - dem 2,5-fachen des QE3-Volumens in USA entspricht!Da Japan die wohl absturzgefährdetste große Industrienation ist, kann man sich ausrechnen, dass die Amis bei der nächsten Finanzkatastrophe (Risse im Fundament deuten sich bereits an) in ähnlich hemmungsloser Weise aus dem QE-Füllhorn schöpfen werden.

Bereits 2009/2010 taten einige US-Wirtschaftsgurus kund, dass die Bilanz der Fed zur Not langfristig bis auf die Höhe des US-BIP aufgeblasen werden soll. Aktuell hat die Fed für 4,5 Billionen Dollar US-Anleihen und ähnliches in ihren Büchern. Allein in USA bestünde daher noch Luft für weitere 12 Billionen! Hinzu kommt, was Draghi auf Wall-Street-Geheiß drucken wird, und was Japan jetzt (und künftig) liefert.

Das Ganze kann man nur noch als wild entschlossenes "Verhindern des globalen kapitalistischen Kollaps" mit der kollektiven Zentralbank-Brechstange werten..

www.marketwatch.com/story/...ocks-market-with-fresh-easing-2014-10-31

Japan central bank shocks market with fresh easing

In an unexpected move, the Bank of Japan’s policy board voted by a 5-to-4 margin to expand the pace of its quantitative easing, sending Tokyo stocks soaring and the Japanese yen falling sharply.

The central bank expanded the size of its Japanese Government Bond purchases to the equivalent of “about 80 trillion yen” ($727 billion) a year, an increase of ¥30 trillion [= 37,5 % mehr! A.L.] from the previous pace. It said it would also buy longer-dated JGBs, seeking an average remaining maturity of 7-10 years.

The central bank also said it would triple its purchases of exchange-traded funds and real-estate investment trusts.

Concerns about dwindling inflation appeared to drive the move, with the Bank of Japan saying that “on the price front, somewhat weak developments in demand following the [April 1] consumption-tax hike and a substantial decline in crude-oil prices have been exerting downward pressure recently.”

It said that “if the current downward pressure on prices remains ... there is a risk that conversion of deflationary mindset, which has so far been progressing steadily, might be delayed.”

It also added that the so-called “quantitative and qualitative easing” program would continue “as long as it is necessary.”

Earlier in the day, data showed that Japan’s inflation rate in September had hit its lowest level in almost a year.

Most economists had expected no action at the current meeting, and the surprise sent the U.S. dollar USDJPY, +1.46% jumping to ¥110.55 in less than half an hour, up from around ¥109.37 just ahead of the decision. It marked the dollar’s highest level against its Japanese counterpart since before the 2008 global financial crash.

Likewise, Japanese stocks surged, with the benchmark Nikkei Average NIK, +5.37% up 4.7%, compared to a 1.6% gain just prior to the announcement.

(Verkleinert auf 51%)