Wyndham Worldwide Reports Fourth Quarter and Full Year 2016 Results

PR Newswire

PARSIPPANY, N.J., Feb. 15, 2017

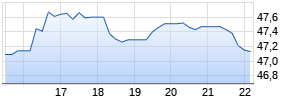

PARSIPPANY, N.J., Feb. 15, 2017 /PRNewswire/ -- Wyndham Worldwide Corporation (NYSE: WYN) today announced results for the three months and year ended December 31, 2016.

FOURTH QUARTER 2016 OPERATING RESULTS

Fourth quarter revenues were $1.3 billion, up 1% compared with the prior year period. Full reconciliations of GAAP results to non-GAAP measures for all reported periods appear in the tables to this press release.

Net income for the fourth quarter of 2016 was $164 million compared with $140 million for the fourth quarter of 2015. Diluted earnings per share (EPS) increased 26% to $1.53 per diluted share compared with $1.21 for the prior year period. Adjusted net income for the fourth quarter of 2016, which excludes charges and gains in both 2016 and 2015 as detailed in Table 7 of this press release, was $146 million compared with $113 million for the fourth quarter of 2015. Adjusted diluted EPS increased 38% to $1.35 from $0.98 per diluted share in the prior year period. Adjusted net income and EPS benefited from earnings growth across all of our businesses. EPS also benefited from the Company's share repurchase program.

Fourth quarter EBITDA was $322 million, compared with $275 million in the prior year period, an increase of 17%. Adjusted EBITDA, which excludes charges and gains in 2016 and charges in 2015 as detailed in Table 8 of this press release, was $318 million, compared with $273 million in the prior year period, an increase of 16%.

"In 2016, we delivered earnings growth and free cash flow that were both in line with our targets despite headwinds from a higher provision for loan losses and foreign exchange rates," said Stephen P. Holmes, chairman and CEO. "We achieved these results through consistent execution, careful expense management, and continued disciplined capital allocation."

FULL YEAR 2016 OPERATING RESULTS

Revenues for full year 2016 were $5.6 billion, an increase of 1% over the prior year.

Net income for full year 2016 was $611 million compared with $612 million for full year 2015. Diluted EPS increased 8% to $5.53 from $5.14 per diluted share in the prior year. Adjusted net income for full year 2016, which excludes charges and gains in both 2016 and 2015 as detailed in Table 7 of this press release, was $636 million compared with $608 million for full year 2015. Adjusted diluted EPS increased 13% to $5.75 from $5.11 in the prior year period. Adjusted net income and EPS benefited from earnings growth across all of our businesses. EPS also benefited from the Company's share repurchase program.

Full year 2016 EBITDA was $1,331 million, compared with $1,266 million in the prior year, an increase of 5%. Adjusted EBITDA, which excludes charges and gains in 2016 and charges in 2015 as detailed in Table 8 of this press release, was $1,373 million. This compares with $1,297 million in the prior year, an increase of 6%. On a currency-neutral basis and excluding acquisitions, adjusted EBITDA increased 7%.

For the twelve months ended December 31, 2016, net cash provided by operating activities was $973 million, compared with $991 million in the prior year period. The decrease reflects unfavorable currency movements of $48 million, including a $24 million devaluation of the Venezuelan bolivar in the first quarter of 2016.

Free cash flow was $782 million for the twelve months ended December 31, 2016, compared with $769 million for the same period in 2015, reflecting lower capital expenditures that were partially offset by the unfavorable currency movements referenced above. The Company defines free cash flow as net cash provided by operating activities less capital expenditures.

FOURTH QUARTER 2016 BUSINESS UNIT RESULTS

Hotel Group

Revenues were $316 million in the fourth quarter of 2016, compared with $314 million in the fourth quarter of 2015. Revenues reflected higher franchise fees and growth in the Company's Wyndham Rewards credit card program, partially offset by lower reimbursable property management revenues.

EBITDA was $99 million in the fourth quarter compared with $94 million in the prior year quarter. Adjusted EBITDA grew 6% to $99 million. In constant currency and excluding acquisitions, adjusted EBITDA increased 8%. This reflects the higher franchise fees and growth in the Company's Wyndham Rewards credit card program.

Fourth quarter domestic same store RevPAR increased 2.9%. Excluding oil markets, domestic same store RevPAR increased 3.7%. In constant currency, total systemwide same store RevPAR increased 2.7% compared with the fourth quarter of 2015, which reflects softness in domestic and Canadian oil markets.

As of December 31, 2016, the Company's hotel system consisted of over 8,000 properties and over 697,600 rooms, a 2.9% net room increase compared with year-end 2015. The development pipeline increased to more than 1,110 hotels and approximately 138,300 rooms, of which 60% were international and 67% were new construction.

Destination Network

Revenues were $317 million in the fourth quarter of 2016, compared with $310 million in the fourth quarter of 2015, an increase of 2%. In constant currency and excluding acquisitions, revenues increased 3%.

Vacation rental revenues were $151 million compared with $144 million in the prior year quarter. In constant currency and excluding the impact of acquisitions, vacation rental revenues were up 5%, reflecting a 5.3% increase in transaction volume, which benefited from enhanced yield management as well as capacity increases across our Denmark-based Novasol brand and our U.K. cottage and parks brands. Average net price per rental was flat.

Exchange revenues were $145 million compared with $146 million in the prior year quarter. In constant currency, exchange revenues grew 1% as exchange revenue per member increased 0.4% and the average number of members increased 0.2%.

EBITDA was $53 million in the fourth quarter, compared with $44 million in the prior year quarter. Adjusted EBITDA increased $9 million to $52 million for the fourth quarter of 2016, which reflects the revenue gains from continued strong vacation rental performance and lower costs.

Vacation Ownership

Revenues were $705 million in the fourth quarter of 2016, compared with $706 million in the fourth quarter of 2015.

Gross VOI sales in the fourth quarter of 2016 were flat, impacted by sales office closures from a restructuring and Hurricane Matthew. The number of new owners added during the quarter was up 8% from the prior year quarter. Volume per guest was up 0.4% and tour flow declined 1.5%, reflecting the closure of sales sites as noted above.

EBITDA was $182 million in the fourth quarter compared with $174 million in the prior year quarter. Adjusted EBITDA was $191 million for the fourth quarter of 2016, an increase of 10% compared with the prior year quarter, due to lower costs.

OTHER ITEMS

- The Company's Board of Directors authorized an increase in the quarterly cash dividend to $0.58 from $0.50 per share, beginning with the dividend that is expected to be declared in the first quarter of 2017.

- The Company repurchased 2.1 million shares of common stock for $150 million during the fourth quarter of 2016 at an average price of $70.34. From January 1 through February 14, 2017, the Company repurchased an additional 1.0 million shares for $75 million.

- Net interest expense in the fourth quarter of 2016 was $32 million, compared with $35 million in the fourth quarter of 2015. This reflects a larger proportion of lower cost variable debt partially offset by higher debt levels.

- Depreciation and amortization in the fourth quarter of 2016 was $65 million, compared with $61 million in the fourth quarter of 2015, reflecting new projects that were placed into service.

Balance Sheet Information as of December 31, 2016:

- Cash and cash equivalents of $185 million, compared with $171 million at December 31, 2015

- Vacation ownership contract receivables, net, of $2.8 billion, compared with $2.7 billion at December 31, 2015

- Vacation ownership and other inventory of $1.4 billion, compared with $1.3 billion at December 31, 2015

- Securitized vacation ownership debt of $2.1 billion, unchanged from December 31, 2015

- Long-term debt of $3.4 billion, compared with $3.1 billion at December 31, 2015. The remaining borrowing capacity on the revolving credit facility, net of commercial paper borrowings, was $1.1 billion as of December 31, 2016, compared with $1.4 billion at December 31, 2015.

A schedule of debt is included in Table 12 of this press release.

OUTLOOK

Note to Editors: The guidance excludes possible future share repurchases, while analysts' estimates often include share repurchases. This results in discrepancies between Company guidance and database consensus forecasts.

The Company provides the following guidance for the full year 2017:

- Revenues of approximately $5.80 billion to $5.95 billion

- Adjusted net income of approximately $637 million to $658 million

- Adjusted EBITDA of approximately $1.41 billion to $1.44 billion

- Adjusted diluted EPS of approximately $5.90 to $6.10 based on a diluted share count of 108 million

In determining adjusted EBITDA, adjusted net income and adjusted EPS, the Company excludes certain items which are otherwise included in determining the comparable GAAP financial measures. A description of the adjustments that have been applicable for the reported periods in determining adjusted net income, adjusted EBITDA and adjusted EPS are reflected in Tables 7 and 8 of this press release. The Company is providing an outlook for net income, EPS and EBITDA only on a non-GAAP basis because the Company is unable to predict with reasonable certainty the totality or ultimate outcome or occurrence of these adjustments for the outlook period, which can be dependent on future events that may not be reliably predicted. See Table 10 for certain non-GAAP information concerning the outlook period.

The Company will post full guidance information on its website following the conference call.

CONFERENCE CALL INFORMATION

Wyndham Worldwide Corporation will hold a conference call with investors to discuss the Company's results, outlook and guidance on Wednesday, February 15, 2017 at 8:30 a.m. ET. Listeners can access the webcast live through the Company's website at http://www.wyndhamworldwide.com/investors/. The conference call may also be accessed by dialing 888-632-3384 and providing the pass code "WYNDHAM." Listeners are urged to call at least 10 minutes prior to the scheduled start time. An archive of this webcast will be available on the website for approximately 90 days beginning at 12:00 p.m. ET on February 15, 2017. A telephone replay will be available for approximately 10 days beginning at 12:00 p.m. ET on February 15, 2017 at 800-839-0866.

PRESENTATION OF FINANCIAL INFORMATION

Financial information discussed in this press release includes non-GAAP measures, which include or exclude certain items. These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing the Company's ongoing operating performance. Exclusion of items in the Company's non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring. Full reconciliations of GAAP results to the comparable non-GAAP measures for the reported periods appear in the financial tables section of the press release.

ABOUT WYNDHAM WORLDWIDE

Wyndham Worldwide (NYSE: WYN) is one of the largest global hospitality companies, providing travelers with access to a collection of trusted hospitality brands in hotels, vacation ownership, and unique accommodations including vacation exchange, holiday parks, and managed home rentals. With a collective inventory of nearly 130,000 places to stay across more than 110 countries on six continents, Wyndham Worldwide and its 38,000 associates welcomes people to experience travel the way they want. This is enhanced by Wyndham Rewards®, the Company's re-imagined guest loyalty program across its businesses, which is making it simpler for members to earn more rewards and redeem their points faster. For more information, please visit www.wyndhamworldwide.com.

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, conveying management's expectations as to the future based on plans, estimates and projections at the time the Company makes the statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements contained in this press release include statements related to the Company's revenues, earnings, cash flow, dividends, and related financial and operating measures.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Factors that could cause actual results to differ materially from those in the forward-looking statements include general economic conditions, the performance of the financial and credit markets, the economic environment for the hospitality industry, the impact of war, terrorist activity or political strife, operating risks associated with the hotel, vacation exchange and rentals and vacation ownership businesses, as well as those described in the Company's Annual Report on Form 10-K, filed with the SEC on February 12, 2016. Except for the Company's ongoing obligations to disclose material information under the federal securities laws, it undertakes no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events.

| Wyndham Worldwide Corporation | |

| Earnings Release Schedules | |

| Quarter Four - December 31, 2016 | |

| Table of Contents | |

| | |

| | Table No. |

| | |

| Consolidated Statements of Income (Unaudited) | 1 |

| | |

| Operating Results of Reportable Segments | 2 |

| | |

| Operating Statistics | 3 |

| | |

| Condensed Consolidated Statements of Cash Flows and Reconciliation of Free Cash Flows (Unaudited) | 4 |

| | |

| Revenue Detail by Reportable Segment | 5 |

| | |

| Brand System Details | 6 |

| | |

| Non-GAAP Reconciliation of Adjusted Net Income and EPS | 7 |

| | |

| Non-GAAP Reconciliation of Adjusted EBITDA by Reportable Segment | 8 |

| | |

| Non-GAAP Reconciliation of Gross VOI Sales | 9 |

| | |

| Non-GAAP Reconciliation of 2017 Outlook | 10 |

| | |

| Non-GAAP Reconciliation - Constant Currency and Currency Neutral | 11 |

| | |

| Schedule of Debt | 12 |

| | | | | | | | | | | | | | | Table 1 |

| Wyndham Worldwide Corporation | ||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | ||||||||||||||

| (In millions, except per share data) | ||||||||||||||

| (Unaudited) | ||||||||||||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | Three Months Ended | | Twelve Months Ended | ||||||||

| | | | | December 31, | | December 31, | ||||||||

| | | | | 2016 | | 2015 | | 2016 | | 2015 | ||||

| Net revenues | | | | | | | | | | | | | ||

| | Service and membership fees | | $ | 550 | | $ | 562 | | $ | 2,552 | | $ | 2,519 | |

| | Vacation ownership interest sales | | | 415 | | | 403 | | | 1,606 | | | 1,604 | |

| | Franchise fees | | | 164 Werbung Mehr Nachrichten zur Travel + Leisure Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||||