Vince Holding Corp. Reports First Quarter Fiscal 2014 Results

PR Newswire

NEW YORK, June 5, 2014

NEW YORK, June 5, 2014 /PRNewswire/ -- Vince Holding Corp. (NYSE: VNCE), a leading contemporary fashion brand, today reported unaudited results for the first quarter ended May 3, 2014.

Vince Holding Corp. ("Vince" or the "Company") completed an initial public offering ("IPO") of its common stock on November 27, 2013. Prior to the IPO and the related restructuring transactions, Vince Holding Corp., formerly known as Apparel Holding Corp. and Kellwood Holding Corp., was a diversified apparel company operating a broad portfolio of fashion brands, which included Vince. As a result of the IPO and the related restructuring transactions, the non-Vince businesses were separated from the Vince business on November 27, 2013, and the Vince business became the sole operating business of Vince Holding Corp.

In this press release, the Company is presenting its financial results in conformity with U.S. generally accepted accounting principles ("GAAP"), and the first quarter fiscal 2013 financial results reflect the non-Vince businesses as discontinued operations. The Company is also presenting results relating to the first quarter of fiscal 2013 on an "adjusted" basis in order to exclude the impact of results of the non-Vince businesses, certain public company transition costs and other adjustments. Adjusted results presented in this press release are non-GAAP financial measures. See "Non-GAAP Financial Measures" below for more information about the Company's use of non-GAAP financial measures and Exhibit (3) to this press release for a reconciliation of actual GAAP results to such adjusted results.

Jill Granoff, Chairman and Chief Executive Officer of Vince, commented, "It was another terrific quarter for the Vince brand as we again delivered double-digit growth across all distribution channels. In our wholesale segment, sales increased nearly 29% driven by strong performance in both women's ready-to-wear and men's sportswear. In our direct-to-consumer segment, sales increased over 41% driven by 11.1% comparable store sales growth, six net new stores and continued strong momentum in our ecommerce business which benefited from our website re-launch in February. These results demonstrate that our everyday luxury essentials continue to resonate with our broad customer following."

For the first quarter ended May 3, 2014:

- Net sales for the first quarter of fiscal 2014 were $53.5 million, up 32.4% over the $40.4 million achieved during the first quarter of fiscal 2013. Comparable store sales for the first quarter of fiscal 2014 increased 11.1% over the first quarter of fiscal 2013.

- Gross profit in the first quarter of fiscal 2014 increased 50.8% to $26.4 million from $17.5 million in the first quarter of fiscal 2013. Gross profit as a percentage of net sales increased to 49.4% from 43.4% in fiscal 2013. This increase was driven primarily by the year-over-year cycling on the additional inventory reserves taken in the first quarter of fiscal 2013 which contributed 370 basis points of the 600 basis point improvement in gross margin in the first quarter fiscal 2014.

- Selling, general, and administrative expenses in the first quarter of fiscal 2014 were $21.2 million or 39.7% of sales compared to $15.6 million or 38.7% of sales in the first quarter of fiscal 2013 including public company transition costs. Excluding these costs, selling, general and administrative expenses as a percent of sales were 35.5% in the first quarter of fiscal 2013.

- Operating income for the first quarter of fiscal 2014 increased 174% to $5.2 million compared to $1.9 million for the first quarter of fiscal 2013. Excluding public company transition costs from operating income for the first quarter of fiscal 2013, operating income for the first quarter of fiscal 2014 increased 64.1% compared to the same period in fiscal 2013 and, as a percent of sales, was 9.7% for the first quarter of fiscal 2014 compared to 7.9% for the same period in fiscal 2013.

- Net income for the first quarter of fiscal 2014 was $1.4 million compared to a net loss of ($15.1) million for the first quarter of fiscal 2013, which includes the impact of public company transition costs and results of the non-Vince businesses that were separated on November 27, 2013. On an adjusted basis, net income was $0.1 million in the first quarter of fiscal 2013.

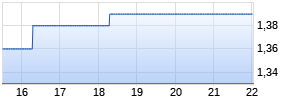

- Diluted earnings per share for the first quarter of fiscal 2014 was $0.04 compared to a net loss per share for the first quarter of fiscal 2013 of ($0.58). On an adjusted basis, first quarter diluted earnings per share was $0.00 in the first quarter of fiscal 2013.

Balance Sheet

The Company's cash balance at the end of the first quarter was $21.8 million. The Company paid down $20.0 million of debt during the first quarter of fiscal 2014, resulting in total debt outstanding of $150.0 million as of May 3, 2014.

Inventory at the end of the first quarter of fiscal 2014 was $31.9 million versus $34.0 million as of February 1, 2014 and $20.1 million at the end of the first quarter of fiscal 2013.

Capital expenditures during the first quarter of fiscal 2014 totaled $1.3 million, $1.0 million of which was attributable to real estate activities, such as new and remodeled stores and shop-in-shop build-outs.

2014 Outlook

Ms. Granoff continued, "We are proud of our strong first quarter 2014 performance and we are even more excited about the continued progress we are making in our evolution to becoming a global, dual-gender lifestyle brand. Our apparel business remains solid, our licensed women's footwear business is gaining momentum and next month we will launch children's wear and men's footwear, both new licensed categories. We are also making progress on several operational improvement initiatives that we expect will drive additional gross margin rate expansion during the remainder of fiscal 2014. Given these activities, along with our strong first quarter performance, we have increased our expectation for fiscal 2014 diluted earnings per share to $0.88 - $0.92 from $0.85 to $0.90 per share."

For fiscal 2014, the Company now expects to:

- Achieve total net sales of $325 million to $340 million, including revenues from 7 to 8 new retail stores and comparable store sales growth in the high single-digit to low double-digit range

- Expand gross margin 150 to 250 basis points

- Increase selling, general, and administrative expenses as a percent of sales 150 to 250 basis points over adjusted fiscal 2013 rate of 25.6%

- Generate diluted earnings per share of $0.88 to $0.92

- Spend approximately $17 million to $22 million in capital expenditures

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with GAAP, the Company has provided, with respect to financial results relating to the first quarter of fiscal 2013, adjusted selling, general and administrative expenses, adjusted operating income, adjusted interest expense, adjusted provision for taxes, adjusted net loss from discontinued operations, adjusted net income and adjusted earnings per share and related shares outstanding, which are non-GAAP financial measures, in order to eliminate the effect on operating results of certain public company transition costs and the results of the non-Vince businesses that were separated on November 27, 2013, as well as present interest expense and income taxes during all periods on a basis that is consistent with our current debt structure and anticipated effective tax rates. The Company believes that the presentation of adjusted results facilitates an understanding of the Company's continuing operations without the non-recurring impact associated with the IPO and related restructuring transactions. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. A reconciliation of GAAP to non-GAAP results has been provided in Exhibit (3) to this press release.

2014 First Quarter Earnings Conference Call

The Company plans to release its first quarter fiscal 2014 results and its updated outlook for fiscal 2014 on Thursday, June 5, 2014. A conference call will be held at 9:00 a.m. ET on that date, hosted by Vince Holding Corp. Chairman and Chief Executive Officer, Jill Granoff, and Chief Financial Officer, Lisa Klinger. During the conference call, the Company may answer questions concerning business and financial developments, trends and other business or financial matters. The Company's responses to these questions, as well as other matters discussed during the conference call, may contain or constitute information that has not been previously disclosed.

Those who wish to participate in the call may do so by dialing 877-201-0168, conference ID 50325722. Any interested party will also have the opportunity to access the call via the Internet at http://investors.vince.com/. To listen to the live call, please go to the website at least 15 minutes early to register and download any necessary audio software. For those who cannot listen to the live broadcast, a recording will be available for 30 days after the date of the event. Recordings may be accessed at http://investors.vince.com/.

ABOUT VINCE

Founded in 2002, Vince is a leading contemporary fashion brand known for its modern effortless style and everyday luxury essentials. The company offers a broad range of women's and men's ready-to-wear including its signature cashmere sweaters, leather jackets, luxe leggings, dresses, silk and woven tops, denim and footwear. Vince is carried in 2,350 stores across 47 countries and as of June 5, 2014 operates 24 full-price retail locations, 6 outlet stores and its e-commerce site, vince.com.

Forward Looking Statements: This document, and any statements incorporated by reference herein, contains forward-looking statements under the Private Securities Litigation Reform Act of 1995. Such statements often include words such as "may," "will," "should," "believe," "expect," "seek," "anticipate," "intend," "estimate," "plan," "target," "project," "forecast," "envision" and other similar phrases. Although we believe the assumptions and expectations reflected in these forward-looking statements are reasonable, these assumptions and expectations may not prove to be correct and we may not achieve the financial results or benefits anticipated. These forward-looking statements are not guarantees of actual results. Our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including, without limitation: our ability to remain competitive in the areas of merchandise quality, price, breadth of selection, and customer service; our ability to anticipate and/or react to changes in customer demand and attract new customers; changes in consumer confidence and spending; our ability to maintain projected profit margins; unusual, unpredictable and/or severe weather conditions; the execution and management of our retail store growth, including the availability and cost of acceptable real estate locations for new store openings; the execution and management of our international expansion, including our ability to promote our brand and merchandise outside the U.S. and find suitable partners in certain geographies, our ability to expand our product offerings into new product categories including the ability find suitable licensing partners; our ability to successfully implement our marketing initiatives, our ability to protect our trademarks in the U.S. and internationally, our ability to maintain the security of electronic and other confidential information; serious disruptions and catastrophic events; changes in global economies and credit and financial markets; competition; our ability to attract and retain key personnel; commodity, raw material and other cost increases; compliance with laws, regulations and orders; changes in laws and regulations; outcomes of litigation and proceedings and the availability of insurance, indemnification and other third-party coverage of any losses suffered in connection therewith; tax matters and other factors as set forth from time to time in our Securities and Exchange Commission filings, including under the heading "Risk Factors." We intend these forward-looking statements to speak only as of the time of this release and do not undertake to update or revise them as more information becomes available.

This press release is also available on the Vince Holding Corp. website (http://investors.vince.com/).

Lisa K. Klinger

Chief Financial Officer

(212) 515-2655

| Vince Holding Corp. and Subsidiaries | | ||||||

| Condensed Consolidated Statements of Operations | Exhibit (1) | ||||||

| (Unaudited, amounts in thousands | | ||||||

| Except percentages and share and per share data) | | ||||||

| | |||||||

| | | | | | |||

| | | Three Months Ended | | ||||

| | | May 3, 2014 | | | May 4, 2013 | | |

| | | | | | | | |

| Net Sales | | $ 53,452 | | | $ 40,363 | | |

| Cost of products sold | | 27,041 | | | 22,850 | | |

| Gross profit | | 26,411 | | | 17,513 | | |

| as a % of net sales | | 49.4% | | | 43.4% | | |

| Selling, general and administrative expenses | | 21,204 | | | 15,613 | | |

| as a % of net sales | | 39.7% | | | 38.7% | | |

| Income from operations | | 5,207 | | | 1,900 | | |

| as a % of net sales | | 9.7% | | | 4.7% | | |

| Interest expense, net | | 2,850 | | | 10,624 | | |

| Other expense, net | | 50 | | | 125 | | |

| Income (loss) before taxes | | 2,307 | | | (8,849) | | |

| Income Taxes | | 923 | | | 930 | | |

| Net Income (loss) from continuing operations | 1,384 | | | (9,779) | | ||

| Net loss from discontinued operations, net of tax | | - | | | (5,330) | | |

| Net income (loss) | | $ 1,384 | | | $ (15,109) | | |

| | | | | | | | |

| Net income (loss) per share - basic: | | ||||||

| | | | | | | | |

| Net income (loss) from continuing operations | | $ 0.04 | | | $ (0.37) | | |

| Net loss from discontinued operations | | - | | | (0.21) | | |

| Net income (loss) | | $ 0.04 | | | $ (0.58) | | |

| | | ||||||

| Net income (loss) per share - diluted: | | ||||||

| | | | | | | | |

| Net income (loss) from continuing operations | | $ 0.04 | | | $ (0.37) | | |

| Net loss from discontinued operations | | - | | | (0.21) | | |

| Net income (loss) | | $ 0.04 Werbung Mehr Nachrichten zur Vince Holdings Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||