V2X (Formerly Vectrus) Reports Strong Second Quarter 2022 Results

PR Newswire

MCLEAN, Va., Aug. 9, 2022

Important Note: On July 5, 2022, Vectrus, Inc. closed on the merger with The Vertex Company ("the Transaction") and in connection with the closing was renamed V2X, Inc. "Reported results" reflect the contributions of Vectrus, Inc. based on results prior to the close of the Transaction, unless otherwise noted.

Vectrus Second Quarter Highlights:

- Second quarter revenues of $498 million, up +6% Y/Y

- Operating income (inclusive of V2X transaction expenses) of $15.0 million with a margin of 3.0%

- Adjusted EBITDA1 of $24.7 million with a margin of 5.0%

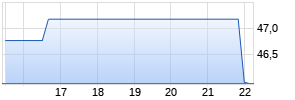

- Second quarter fully diluted EPS of $0.88; Adjusted diluted EPS1 of $1.41

- Strong second quarter operating cash flow of $46 million

Guidance:

- The V2X merger closed on July 5, 2022, creating a more diversified company generating approximately $3.6 billion in combined pro forma annual revenue

- Establishing second-half 2022 guidance for V2X that reflects the contributions of both Vectrus and Vertex with a total revenue range of $1.90 to $1.94 billion, an Adjusted EBITDA1 range of $140 to $150 million, and an operating cash flow range of $130 to $150 million

MCLEAN, Va., Aug. 9, 2022 /PRNewswire/ -- V2X, Inc. (NYSE:VVX) announced second quarter 2022 financial results. The second quarter 2022 results are based on Vectrus' stand-alone financial metrics for the period ended July 1, 2022, and do not include contribution from The Vertex Company.

"We're excited to announce the successful combination of Vectrus and The Vertex Company, creating a larger, higher margin and more diversified, V2X," said Chuck Prow, Chief Executive Officer of V2X. "With 14,000 employees, $3.6 billion in pro forma annual revenue, and $290 million of Adjusted EBITDA, V2X is a leader in the operational segment of the federal services market providing converged solutions throughout the mission lifecycle of our clients most critical and enduring global missions."

Prow continued, "V2X has a strong financial profile with significant free cash flow and long-term revenue visibility through several notable contract wins that are in the early stages of their lifecycle. These wins are reflected in the company's trailing twelve-month awards of approximately $6 billion, which include two recent significant awards at Vertex, the Naval Test Wing Atlantic, a seven-year program valued at $850 million, and the Air Force Global Strike Command five-year contract valued at $130 million. This also includes $600 million of awards booked at Vectrus during the quarter that were driven by expansion and increased scope on existing programs as well as follow-on contracts. The strong velocity of awards has resulted in a significant backlog of approximately $12 billion that provides solid visibility over the next several years."

"In summary, the financial and strategic attributes of V2X are compelling," added Prow. "Our integration activities are well underway and the commitment to our clients, the missions we are privileged to support, and delivering results remains our focus."

Vectrus Second Quarter Results

"Second quarter results for stand-alone Vectrus were strong, propelled by top-line performance and favorable operating cash flow," said Prow. "During the quarter, revenue grew 6% year-over-year and 9% sequentially to $498 million. Revenue growth was driven by building on the momentum of programs in INDOPACOM and Europe, along with successful phase-in of new contracts, including the Logistics Readiness Center at Fort Benning," said Prow. "Each day, our global team of dedicated employees execute on our core programs while also bringing innovation and technology-oriented solutions to complex challenges throughout the mission lifecycle."

"With a high-level readiness to meet the needs of our clients, the team continued its support of several important missions during the quarter, including providing the DoD with urgent and compelling services for the European Deterrence Initiative," said Prow. "We leveraged our rapid response capability and over 40-year history of operating in Europe to provide the DoD with unique services in support of this complex and ongoing mission. Additionally, achieving full operational capability on LOGCAP V Kwajalein, approximately a month and a half ahead of schedule, has helped to expand our footprint in the INDOPACOM region. Activity in the region remains robust and our position continues to expand. For example, we recently expanded our scope of responsibilities at Subic Bay in the Philippines. This program is expected to run over the next eight years and provides strategic logistics services to the DoD. Work content in the INDOPACOM region now represents 9% of total revenue, up 3% from last year, and positions us well to support the DoD in a full range of operations over the next ten years."

"Adjusted EBITDA for the quarter was strong at $24.7 million or 5.0% margin. Adjusted EBITDA increased sequentially $6.5 million and was driven by higher revenue volume and success on operational excellence initiatives. We remain focused on margin improvement, and this quarter's results reflect our ability to expand earnings even as we execute on several programs in the early phases of period of performance. As we have noted in the past, LOGCAP V is generating higher revenue volume with a greater amount of material and pass-through content that has a different margin complexion. However, our teams are focused on driving program efficiencies and improving margin rates through contract add-on work while working with clients to convert certain components of work to more advantageous contract structures."

Prow concluded, "Our second quarter results demonstrate the Company's success in achieving top-line growth through increased work scope on existing programs, expansion of capabilities, broadening our geographic footprint, and adding new clients. As we embark on the Company's new chapter as V2X, I am excited about the greater scale, market leadership, and enhanced portfolio of offerings with the Vectrus/Vertex combination."

Second quarter 2022 revenue of $498.1 million was up $27.2 million year on year. "Revenue grew 6% year-over-year, driven by our transition to full operational capability on LOGCAP V programs in Iraq and Kuwait late last year, and INDOPACOM this year. In addition, revenue benefitted from transitioning Fort Benning and volume associated with rapid response and contingency efforts," said Susan Lynch, Senior Vice President and Chief Financial Officer. "This revenue growth demonstrates achievement of our enterprise goal of growing the business through contract expansion and portfolio diversity despite the headwinds associated with the withdrawal of the US military from Afghanistan," added Lynch.

Operating income was $15.0 million or 3.0% margin. This includes M&A and integration related expenses of $5.9 million and amortization of acquired intangible assets of $2.1 million which were incurred in the quarter. Adjusted operating income1 was $23.0 million or 4.6% margin, increasing sequentially by $6.4 million and 100 basis points. Adjusted EBITDA1 was $24.7 million or 5.0% margin, increasing sequentially by $6.5 million and 100 basis points. Adjusted EBITDA margin compares to $26.6 million or 5.6% in the prior year period. "The year-on-year margin change was influenced by the significant amount of revenue and contracts that are in the early stages of their lifecycle. In aggregate, on average and over time, we expect to see improvement in the margin profile as we drive operational efficiencies and diversify into higher margin scopes of work," said Lynch.

Fully diluted EPS for the second quarter of 2022 was $0.88 as compared to $1.35 in the prior year. Fully diluted EPS in the quarter included the aforementioned M&A and integration related costs. Adjusted diluted EPS1 was $1.41 in the quarter as compared to $1.52 in the prior year. The year-on-year change in Adjusted diluted EPS1 was primarily due to the above-mentioned change in Adjusted EBITDA1.

Cash generated from operating activities for the quarter was $46.0 million. Through July 1, 2022, net cash from operating activities was $19.6 million, compared to net cash from operating activities of $14.0 million through the second quarter of 2021. Cash from operating activities through the first half of 2022 was negatively impacted by an approximately $8.0 million repayment of CARES Act tax deferrals and $5.8 million of merger-related payments.

Net debt on July 1, 2022, was $58.4 million, compared to $105.2 million on July 2, 2021. Total debt on July 1, 2022, was $90.2 million, down $84.8 million from $175.0 million on July 2, 2021. Cash at quarter-end was $35.1 million. Total consolidated indebtedness to consolidated EBITDA1 (total leverage ratio) was 1.09x compared to 1.76x at the same time last year.

Total backlog as of July 1, 2022, was $4.6 billion. Funded backlog was $1.3 billion.

V2X Guidance

Lynch continued, "We are establishing second half 2022 guidance ranges for V2X, which includes the contribution from both Vectrus and The Vertex Company."

V2X guidance for the second half (2H) 2022 is as follows:

| $ millions, except for EBITDA margins and per share amounts | V2X 2H 2022 Guidance | | ||

| Revenue | $1,900 | to | $1,940 | |

| Adjusted EBITDA1 | $140 | to | $150 | |

| Adjusted Diluted Earnings Per Share1 | $1.94 | to | $2.19 | |

| Net Cash Provided by Operating Activities | $130 | to | $150 | |

Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below.

Second Quarter 2022 Conference Call

Management will conduct a conference call with analysts and investors at 4:30 p.m. ET on Tuesday, August 9, 2022. U.S.-based participants may dial in to the conference call at 877-242-2259, while international participants may dial 416-981-9017. A live webcast of the conference call as well as an accompanying slide presentation will be available on the Vectrus Investor Relations website at https://app.webinar.net/P4Qe37VDnop.

A replay of the conference call will be posted on the V2X website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through August 23, 2022, at 844-512-2921 (domestic) or 412-317-6671 (international) with passcode 22020062.

Footnotes:

1 See "Key Performance Indicators and Non-GAAP Financial Measures" for descriptions and reconciliations.

About V2X

V2X is a leading provider of critical mission solutions and support to defense clients globally, formed by the 2022 merger of Vectrus and The Vertex Company to build on more than 120 combined years of successful mission support. The Company delivers a comprehensive suite of integrated solutions across the operations and logistics, aerospace, training and technology markets to national security, defense, civilian and international clients. Our global team of approximately 14,000 employees brings innovation to every point in the mission lifecycle, from preparation, to operations, to sustainment, as it tackles the most complex challenges with agility, grit, and dedication.

Safe Harbor Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the "Act"): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all the statements and items listed in the table in "2022 Guidance" above and other assumptions contained therein for purposes of such guidance, other statements about our 2021 performance outlook, five-year growth plan, revenue, DSO, contract opportunities, the potential impact of COVID-19, and any discussion of future operating or financial performance.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "believe," "could," "potential," "continue" or similar terminology. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management.

These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside our management's control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company's historical experience and our present expectations or projections. For a discussion of some of the risks and important factors that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission.

We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| V2X, INC. | ||||||||

| | ||||||||

| | | Three Months Ended | | Six Months Ended | ||||

| | | July 1, | | July 2, | | July 1, | | July 2, |

| (In thousands, except per share data) | | 2022 | | 2021 | | 2022 | | 2021 |

| Revenue | | $ 498,066 | | $ 470,845 | | $ 954,537 | | $ 904,849 |

| Cost of revenue | | 453,305 | | 422,660 | | 872,581 | | 816,308 |

| Selling, general, and administrative expenses | | 29,740 | | 25,605 | | 61,699 | | 49,427 |

| Operating income | | 15,021 | | 22,580 | | 20,257 | | 39,114 |

| Interest expense, net | | (1,963) | | (2,253) | | (3,643) | | (4,186) |

| Income from operations before income taxes | | 13,058 | | 20,327 | | 16,614 | | 34,928 |

| Income tax expense | | 2,586 Werbung Mehr Nachrichten zur V2X Inc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||