United Bancorp, Inc. Reports an 11% Increase in Diluted Earnings per Share, a Forward Dividend Yield of 3.3% and Market Value Appreciation of 41% for the Year Ended December 31, 2016

PR Newswire

MARTINS FERRY, Ohio, Jan. 25, 2017

MARTINS FERRY, Ohio, Jan. 25, 2017 /PRNewswire/ -- United Bancorp, Inc. (NASDAQ: UBCP), headquartered in Martins Ferry, Ohio, reported diluted earnings per share of $0.71 for the year ended December 31, 2016, as compared to $0.64 for the year ended December 31, 2015, an increase of 11%. This growth in earnings can be attributed to several factors that are explained below in detail. The Company's diluted earnings per share for the three months ended December 31, 2016, was $0.18, compared to $0.17 for the same period last year, an increase of 6%.

Randall M. Greenwood, Senior Vice President, CFO and Treasurer remarked, "We are very happy to report on the earnings improvement of our Company for the year-ended December 31, 2016. During 2016, the Company's net interest margin increased to a level of 3.83%, as compared to 3.64% for the same period in 2015. This increase in the net interest margin is primarily attributed to the Company experiencing positive organic growth in its loan portfolio, which produced higher levels of interest income, and the continued lowering of its interest expense levels. As of December 31, 2016, the Company had gross loans of $356.7 million, which is an increase of $27.1 million, or 8.2%, over December 31, 2015. This is a direct result of the Company's enhanced loan origination platform started in the late second quarter of 2015. Having a higher level of funding invested in quality loans helped drive the increase in the margin. This occurred even though the loan portfolio continued to reprice downward over the course of the past year as the long-end of the yield curve remained at historic low levels through most of the year. Considering that longer-term Treasury rates (which have a correlation to how the Company's loans reprice) have been priced at relatively the same levels for the past several years, the overall yield in the Company's loan portfolio stabilized during the second half of 2016. The combination of both loan growth and the stabilization of the yield in the Company's loan portfolio should lead to higher levels of interest income being generated in the coming year. With stronger loan growth, the Company's funds management policy changed during 2016. In prior years, the majority of surplus funding was invested in very liquid, lower-yielding excess reserves at the Federal Reserve. During the first quarter of 2016, these excess reserves previously invested in lower-yielding investment alternatives were fully depleted and the Company, for the first time in several years, switched to a borrowed position to fund its loan growth by utilizing wholesale funding alternatives. While securities and other restricted stock balances increased year-over-year, going forward, it is anticipated that the Company's securities portfolio will be maintained at this present level to support its pledge requirement for public depository accounts until investment yields get to more normalized levels. The Company's credit quality has not changed significantly and has remained strong on a year-over-year basis, as nonaccrual loans marginally increased by $317,000 to a level of $1.4 million, which is 0.38% of total loans. Also on a year-over-year basis, loans past due thirty plus days decreased $410,000 to a level of $1.7 million. Net loans charged off for the year ended December 31, 2016 were $281,000, or 0.08% of average loans, as compared to $380,000, or 0.12% of average loans, for the year ended December 31, 2015. The Company continued to see a decrease in its other real estate and repossessions ("OREO,") as balances decreased by $23,000, or 6.3%, to a level of $335,000. Lastly, the overall total allowance for loan losses to total loans was 0.66%, resulting in a total allowance for loan losses to nonperforming loans of 172.0% at December 31, 2016, as compared to 0.74% and 233.5% respectively at December 31, 2015.

"On the liability-side of the balance sheet, the Company continued to see a positive return on its strategy of attracting lower-cost funding accounts, while allowing higher-cost funding to run off. Year-over-year, lower-cost funding, consisting of demand and savings deposits, increased by $19.5 million and comprised 84.3% of total deposits as of December 31, 2016, as compared to 82.2% of total deposits the year prior. This was one factor that helped the Company reduce its total interest expense by $499,000, or 21.9%, on a year-over-year basis. The other factors that helped the Company reduce its total interest expense levels during 2016 were the previously announced repricing of the Company's $4.1 million subordinated debenture on January 1, 2016, from a fixed rate of 6.25% to an average variable rate of approximately 2.35% (which is based on three-month LIBOR plus a margin of 1.35%) and a $6.0 million Federal Home Loan Bank advance that matured in May at a rate of 3.28%, which was replaced with a short-term borrowing with a current rate tied to the federal funds rate at approximately 76 basis points. Both of these events should save the Company approximately $311,000 in interest expense on an annualized basis. Lastly, noninterest expense levels increased by $581,000, or 4.7%, during this past year. Part of this increase is attributed to the increase in lending personnel that are driving our Company's solid loan growth. Another large portion of the increase in noninterest expense levels was a result of the previously reported debit card-related fraud losses that primarily occurred during the second and third quarters of 2016. During the third quarter, the Company implemented newer fraud prevention technology relating to its debit cards that included a chip-enabled debit card and a smart phone app, 'My Mobile Money,' that significantly curtailed the fraud losses that it realized the remainder of the year." Greenwood concluded, "Over the next 12 months, it is projected that our Company's interest expense will be positively impacted by the repricing of $20 million in fixed-rate advances with the Federal Home Loan Bank ("FHLB") that are set to mature. The average cost of these advances is 3.91% and, given the current interest rate environment, the company should save an estimated $354,000 in interest expense in the coming year. By continuing to grow our loan portfolio and reducing our overall levels of interest expense, we believe that we will see continued growth in the level of the net interest income that our Company generates. It is projected that this will lead to a higher level of earnings and profitability for our Company in 2017."

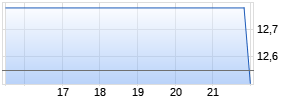

Scott A. Everson, President and CEO stated, "We are extremely pleased with the double-digit earnings growth results that our Company experienced on a year-over-year basis as of December 31, 2016. This past year, we saw the positive results of the efforts expended in recent years within our Company to gain efficiencies through process improvement, while building and leveraging our loan origination platforms to generate higher levels of revenue. We are pleased with the results that we are seeing and will continue looking for additional opportunities that will help our organization become more operationally efficient, generate higher levels of revenue and produce higher levels of quality earnings. As we previously announced, our Company has embarked upon a new period, whereby our exclusive focus is to grow our assets in a profitable fashion that will produce consistent and increasing earnings. This vision, which is called Mission 2020, sets the course for our Company to grow its assets to a level of $1.0 billion, or greater, by the end of 2020. In order to achieve this ambitious growth plan, we will need to continue focusing on being operationally efficient, while taking on higher levels of non-interest expense to support a loan origination platform that will drive the organic growth of our Company. It is projected that this enhanced platform, which began being implemented in the late second quarter of last year, will continue to lead to the origination of higher levels of quality loans as seen during the course of 2016. This will help our Company generate higher levels of interest income, which, in turn, should produce an increase in the all-important revenue line… net interest income. During the mid-part of this year, our Company further added to its commercial loan origination platform by hiring supplementary origination personnel in addition to opening a Loan Production Office (LPO) in Wheeling, West Virginia. Having a LPO in this highly desirable, local market will create value for our Company and help us achieve our strategy of expanding our markets. As previously announced, the Company also envisions expanding its geographic footprint by acquiring other community-minded banking organizations within the tri-state area of Ohio, West Virginia and Pennsylvania, to help it attain the lofty level of growth envisioned under Mission 2020. Being a very well capitalized and profitable Company in today's environment will help us achieve the goals that are defined under this vision within our current strategic plan. With the aforementioned change in our funds management policy during the first half of 2016, our Company is now positioned to attract higher levels of funding, both retail and wholesale, which will allow us to leverage our capital at a more optimal level and produce higher earnings and returns. As of December 31, 2016, our Company has equity to assets of 9.7%, which is considered to be well-capitalized by regulatory standards. At this level of capitalization, our Company will be able to begin the growth trajectory that we envision, which should benefit all of our valued shareholders. In 2016, we paid a regular cash dividend of $0.42 and a special dividend of $0.05. This total cash dividend payout of $0.47 this past year was an increase of $0.05, or 12%, over the previous year. With our Company's present regular cash dividend of $0.11, which began being paid in the third quarter of 2016, our forward yield as of year-end is 3.3%. At this level, our Company's cash dividend yield is significantly higher than that of the average bank in our country. With our present focus of increasing our operating leverage by driving the revenue of our Company while containing expenses, we firmly believe that we will continue to reward our shareholders by paying higher dividends and seeing appreciation in our market value. On a year-over-year basis, the market value of our Company's stock increased by $3.91, or 41%, to a level of $13.50." Everson concluded, "Our number one focus continues to be growing our shareholders' investment in our Company through profitable operations and strategic growth. In addition to driving the market value appreciation of our shareholders' ownership, we will continue striving to reward our owners by paying a solid cash dividend. Overall, we are very pleased with the performance of our Company in 2016 and the direction that we are going. We are extremely optimistic about our future potential and look forward to carrying the earnings momentum that we saw this past year well into the foreseeable future!"

United Bancorp, Inc. is headquartered in Martins Ferry, Ohio and has total assets of $438.0 million and total shareholder's equity of $42.6 million as of December 31, 2016. Through its single bank charter, The Citizens Savings Bank, the Company has eighteen banking offices that serve the Ohio Counties of Athens and Fairfield through its Community Bank Division and Belmont, Carroll, Harrison, Jefferson and Tuscarawas through its Citizens Bank Division. United Bancorp, Inc. is a part of the Russell Microcap Index and trades on the NASDAQ Capital Market tier of the NASDAQ Stock Market under the symbol UBCP, Cusip #909911109.

Certain statements contained herein are not based on historical facts and are "forward-looking statements" within the meaning of Section 21A of the Securities Exchange Act of 1934. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company's control), may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of these terms. Actual results could differ materially from those set forth in forward-looking statements, due to a variety of factors, including, but not limited to, those related to the economic environment, particularly in the market areas in which the company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset/liability management, changes in the financial and securities markets, including changes with respect to the market value of our financial assets, and the availability of and costs associated with sources of liquidity. The Company undertakes no obligation to update or carry forward-looking statements, whether as a result of new information, future events or otherwise.

| United Bancorp, Inc, | |||||

| "UBCP" | |||||

| | For the Three Months Ended | | % | ||

| | December 31, | | December 31, | | |

| | 2016 | | 2015 | | Change |

| Earnings | | | | | |

| Interest income on loans | $ 3,917,550 | | $ 3,682,427 | | 6.39% |

| Loan fees | 170,060 | | 220,818 | | -22.99% |

| Interest income on securities | 156,276 | | 162,004 | | -3.54% |

| Total interest income | 4,243,886 | | 4,065,249 | | 4.39% |

| Total interest expense | 440,688 | | 542,401 | | -18.75% |

| Net interest income | 3,803,198 | | 3,522,848 | | 7.96% |

| (Credit) provision for loan losses | (6,417) | | 165,749 | | -103.87% |

| Net interest income after provision for loan losses | 3,809,615 | | 3,357,099 | | 13.48% |

| Service charges on deposit accounts | 625,204 | | 735,085 | | -14.95% |

| Net realized gains on sale of loans | 29,209 | | 2,118 | | 1279.08% |

| Net realized gain on sale of other | | | | | |

| real estate and repossessions (OREO) | - | | - | | N/A |

| Net recovery on previously written down OREO | - | | - | | N/A |

| Other noninterest income | 201,442 | | 200,804 | | 0.32% |

| Total noninterest income | 855,855 | | 938,007 | | -8.76% |

| Provision for losses on impairment of foreclosed real estate | - | | 4,940 | | N/A |

| Other noninterest expense | 3,331,765 | | 3,057,060 | | 8.99% |

| (Excluding provision for losses on impairment | | | | | |

| of foreclosed real estate) | | | | | |

| Total noninterest expense | 3,331,765 | | 3,062,000 | | 8.81% |

| Income tax expense | 432,470 | | 366,974 | | 17.85% |

| Net income | $ 901,235 | | $ 866,132 | | 4.05% |

| Per share | | | | | |

| Earnings per common share - Basic Werbung Mehr Nachrichten zur United Bancorp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||