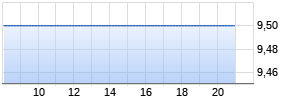

SunCoke Energy, Inc. Announces Strongest Quarterly Operating Performance In Three Years With Third Quarter 2017 Results

PR Newswire

LISLE, Ill., Oct. 26, 2017

LISLE, Ill., Oct. 26, 2017 /PRNewswire/ -- SunCoke Energy, Inc. (NYSE: SXC) today reported results for the third quarter 2017, which reflect strong operating results across the Company's coke and logistics businesses. The third quarter also benefited from the timing of scheduled outages at our cokemaking facilities.

"Our third quarter operating performance was the best we have had in three years after adjusting for the timing impact related to Convent's deferred revenue in the fourth quarter of each year," said Fritz Henderson, Chairman, President and Chief Executive Officer of SunCoke Energy, Inc. "This outstanding quarter, coupled with our solid performance in the first half of the year, has positioned us to deliver full-year results at the top end of our 2017 guidance range."

The Company also continued to execute its Indiana Harbor oven rebuild initiative during the third quarter in line with expectations. To-date, we have completed 47 of the 58 oven rebuilds within the 2017 campaign, with the remaining 11 rebuilds expected to be completed by the end of November. Henderson commented, "We are encouraged with IHO's progress to-date on this multi-year turnaround effort. The plant is on track to report full-year results in line with our 2017 expectations, and we believe that it is well positioned to deliver improved performance in 2018 and beyond."

During the quarter, SunCoke's Convent Marine Terminal received its first shipment of crushed stone (aggregates) under a multi-year contract with firm use commitments. In addition, the terminal also successfully handled its first trial shipments of rail-borne petcoke for two refinery customers in early-October.

Henderson continued, "Our team has aggressively pursued new opportunities for diversifying our product and customer mix since acquiring Convent in mid-2015, and we are pleased with the progress we have made over the last few quarters. Going forward, we believe that we can leverage the terminal's capabilities to enter new vertical markets, expand existing products and grow Adjusted EBITDA by $5 million to $10 million over the next two years."

SXC continued executing against its capital allocation strategy to purchase SXCP units in the open market and repurchased approximately 520 thousand units during the quarter. Year-to-date the Company has repurchased approximately 2.1 million total units, which are expected to generate more than $5 million in additional cash flow annually under SXCP's existing distribution policy.

Henderson concluded, "In addition to maximizing the performance of our cokemaking and logistics assets, we remain focused on allocating capital in the most efficient manner for SXC shareholders. We continue to be pleased with the value created with our SXCP unit purchases through the third quarter."

THIRD QUARTER CONSOLIDATED RESULTS

| | Three Months Ended September 30, | ||||||||||

| (Dollars in millions) | 2017 | | 2016 | | Increase/( | ||||||

| Revenues | $ | 339.0 | | | $ | 293.9 | | | $ | 45.1 | |

| Adjusted EBITDA(1) | $ | 62.1 | | | $ | 49.4 | | | $ | 12.7 | |

| Net income attributable to SXC | $ | 11.6 | | | $ | 6.1 | | | $ | 5.5 | |

| | |

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

Revenues during the third quarter 2017 increased $45.1 million compared to the same prior year period, reflecting the pass-through of higher coal prices in our Domestic Coke segment as well as higher sales volumes in our Coal Logistics segment.

Adjusted EBITDA during the third quarter 2017 increased $12.7 million to $62.1 million, primarily due to higher sales volumes in our Coal Logistics segment, improved Domestic Coke performance, lower corporate spending and higher technology and licensing fees earned in our Brazil Coke segment.

Net income attributable to SXC was $11.6 million, or $0.18 per share, for the third quarter 2017, which is $5.5 million favorable to third quarter 2016 income of $6.1 million, or $0.10 per share, driven primarily by the improved operating results described above. This improvement was partially offset by a $4.3 million unfavorable impact of higher interest expense and the absence of extinguishment gains in the current year period associated with our debt activities in both years as well as higher depreciation expense, primarily as a result of the change in expected useful lives of the Indiana Harbor ovens.

THIRD QUARTER SEGMENT RESULTS

Domestic Coke

Domestic Coke consists of cokemaking facilities and heat recovery operations at our Jewell, Indiana Harbor, Haverhill, Granite City and Middletown plants.

| | Three Months Ended September 30, | ||||||||||

| (Dollars in millions, except per ton amounts) | 2017 | | 2016 | | Increase/( | ||||||

| Revenues | $ | 309.7 | | | $ | 273.2 | | | $ | 36.5 | |

| Adjusted EBITDA(1) | $ | 55.6 | | | $ | 52.1 | | | $ | 3.5 | |

| Sales volumes (thousands of tons) | 975 | | | 1,000 | | | (25) | | |||

| Adjusted EBITDA per ton(2) | $ | 57.03 | | | $ | 52.10 | | | $ | 4.93 | |

| | |

| (1) | See definition of Adjusted EBITDA and reconciliation elsewhere in this release. |

| (2) | Reflects Domestic Coke Adjusted EBITDA divided by Domestic Coke sales volumes. |

- Revenues increased $36.5 million, primarily reflecting the pass-through of higher coal prices.

- Adjusted EBITDA increased $3.5 million, reflecting an improvement in operating performance, excluding Indiana Harbor, driven by favorable coal-to-coke yields, which increased Adjusted EBITDA $2.5 million, the favorable benefit of a portion of our 2017 outage costs falling outside of the third quarter and a lower allocation of central costs.

Coal Logistics

Coal Logistics consists of the coal handling and mixing services operated by SXCP at Convent Marine Terminal ("CMT") located on the Mississippi river in Louisiana, Lake Terminal in East Chicago, Indiana and Kanawha River Terminals, LLC ("KRT"), which has terminals along the Ohio and Kanawha rivers in West Virginia. Additionally, Dismal River Terminal ("DRT"), located in Virginia adjacent to our Jewell Cokemaking facility, is operated by SXC.

| | Three Months Ended September 30, | ||||||||||

| (Dollars in millions) | 2017 | | 2016 | | Increase/( | ||||||

| Revenues | $ | 18.4 | | | $ | 12.2 | | | $ | 6.2 | |

| Intersegment sales | $ | 4.8 | | | $ | 4.9 | | | $ Werbung Mehr Nachrichten zur SunCoke Energy Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | ||