SSH COMMUNICATIONS SECURITY CORP STOCK EXCHANGE RELEASE, October 22,

2008, at 9:00 a.m.

- Net sales for January-September totaled EUR 6.3 million, down by

47.4 % percent year on year (EUR 11.9 million in Q1-Q3/2007).

- Third-quarter net sales came to EUR 2.0 million, down by 75.0

percent on a year earlier (EUR 7.8 million in Q3/2007). The third

quarter of the previous year contained the company's largest order so

far.

- Operating loss for January-September amounted to EUR -1.1 million

(an operating profit of 3.2 million in Q1-Q3/2007), loss EUR -0.4

million (3.9 million). Third-quarter operating profit was EUR -0.3

million and net profit was EUR -0.1 million. In spite of the loss the

company's financial position remained healthy, with equity ratio

92.5% (93.4%)and liquid assets at the end of the period EUR 16.1

million (EUR 20.9 million).

- The company signed four significant license agreements during the

period. The largest order, value about EUR 0.6 million, came from a

US public sector contractor.

KEY FIGURES

7-9/ 7-9/ 1-9/ 1-9/ 1-12/

2008 2007 2008 2007 2007

Net sales (MEUR) 2.0 7.8 6.3 11.9 14.2

Net sales, change % -75.0 342.6 -47.4 94.8 58.1

Operating profit/loss

(MEUR) -0.3 4.4 -1.4 3.2 2.2

% of net sales -16.9 55.9 -22.7 27.2 15.7

Operating profit/loss,

change % -107.6 996.5 -143.9 327.6 262.8

Profit/loss before taxes

(MEUR) -0.1 4.6 -0.9 3.9 3.1

% of net sales -7.6 59.2 -13.9 32.4 21.9

Number of employees

at period end 75 84 75 84 83

Earnings per share (EUR) -0.04 0.14 0.11

Shareholders' equity per

share (EUR) 0.53 0.75 0.72

SSH Communications Security is a world-leading provider of enterprise

security solutions and end-to-end communications security, and the

original developer of the Secure Shell protocol. The company's SSH

Tectia solution addresses the most critical needs of large

enterprises, financial institutions and government agencies.

NET SALES

Consolidated net sales for January-September totaled EUR 6.3 million

(EUR 11.9 million), down by -47.4 % percent, year on year. Net sales

for the third quarter totaled EUR 2.0 million, a decrease of 75.0 %

compared to the corresponding quarter for year 2007.

The majority of SSH's invoicing is based on the U.S. dollar. During

the report period, the U.S. dollar's average exchange rate to euro

weakened approximately 13 percent compared to the same period a year

ago. At constant currency, net sales would have decreased -43 percent

compared to the January-September period and -74 percent compared to

the third quarter of year 2007.

RESULTS AND EXPENSES

Operating loss for January-September amounted to EUR -1.4 million

(Q1-Q3/2007: an operating profit of EUR 3.2 million), with net loss

totaling EUR -1.1 million (a profit of EUR 3.9 million). Operating

loss for the third quarter totaled EUR -0.3 million (a profit of EUR

4.4 million), with net loss amounting to EUR -0.4 million (a profit

of EUR 4.6 million).

Research and development expenses for the report period totaled EUR

2.9 million (EUR 2.6 million), while sales and marketing expenses

amounted EUR 3.6 million (EUR 5.0 million) and administrative

expenses EUR 1.2 million (EUR 1.2 million).

The result of the reporting period is influenced by a EUR 0.2 million

writeoff of a deferred tax asset.

During the reporting period, SSH Communications Security KK, fully

owned subsidiary of SSH, was liquidated. The procedure incurred no

material expenses as the charges were covered by a restructuring cost

recorded in the previous financial year.

BALANCE SHEET AND FINANCIAL POSITION

The financial position of SSH remained at a healthy level during the

report period, which also included a distribution of EUR 4.3 million

to the shareholders. The consolidated balance sheet total on

September 30, 2008 stood at EUR 19.0 million (EUR 25.2 million), of

which liquid assets accounted for EUR 16.1 million (EUR 20.9

million), or 84.7 percent of the balance sheet total. The company's

interest bearing liabilities, EUR 0.2 million, comprised lease

finance commitments. On September 30, 2008, gearing, or the ratio of

net liabilities to shareholders' equity, was -106.1 percent (-98.6)

and the equity ratio stood at 92.5 percent (93.4).

In August, permission was obtained to implement the decrease of the

company's share premium fund, decided by the Annual Shareholders

Meeting on March 27, 2008. Share premium fund was decreased by

transferring all assets from the fund to unrestricted equity fund.

The reported gross capital expenditure for the period totaled EUR 0.1

million (EUR 0.1 million), plus lease financed commitments EUR 0.2

million (0.0). The reported financial income consisted mainly of

interest on fixed-term deposits. Financial income and expenses

totalled EUR 0.6 million (EUR 0.6 million).

During January-September, SSH reported a negative cash flow of EUR

-2.1 million from business operations, and investments showed a

positive cash flow of EUR +6.8 million. Cash flow from financing

totaled EUR -4.3 million. Cash flow from operations, investments and

financing resulted in the company showing a positive total cash flow

of EUR 0.4 million during the period.

CHANGE IN ACCOUNTING PRACTISE FOR RECORDING PROFITS FROM SALES (IAS8)

The accounting practice for recording of maintenance sales revenue

was restated in September 2008, with all maintenance sales revenue

being now periodised. Earlier, only significant sales items

(exceeding EUR 5 000) were periodised over the lifetime of the

maintenance period. The new practice is in accordance with IAS 8.

The change did not have material impact on net sales in

January-September 2008 or in other periods. The change, however,

reduces share capital and increases short-term liabilities. For

consistency, comparison data has been restated as well. The impact of

the restate is as follows:

RESTATE IMPACT

(MEUR) 1-3/ 1-6/ 1-9/ 1-9/ 1-12/

2008 2008 2008 2007 2007

Net sales 0.0 -0.1 0.0 0.0 0.1

Operating profit/loss 0.0 -0.1 0.0 0.0 0.1

Profit/loss before taxes 0.0 -0.1 0.0 0.0 0.1

Earnings per share (EUR) 0.0 0.0 0.0 0.0 0.0

Shareholders' equity -0.4 -0.4 -0.4 -0.4 -0.4

Long-term liabilities 0.0 0.0 0.0 0.0 0.0

Short-term liabilities 0.4 0.4 0.4 0.4 0.4

Total liabilities and

shareholders' equity 0.0 0.0 0.0 0.0 0.0

Quarterly values of original and restated financials are presented at

the end of this interim report.

MARKET DEVELOPMENTS

The most significant users of the company's products are large

enterprises and public sector organizations. The most important

market area is the USA. During the current year macro economic

factors have affected the demand, and many customers have been forced

to postpone their projects.

Large enterprise, financial, and public sector organizations have a

growing need for improved data security in several ways. SSH is

confident that legislative reforms in developed countries, global

data security standards, as well as many industry and company level

data security development programs will continue to drive demand

favorably for SSH Tectia. We believe as the macro-level outlook

starts stabilizing, the demand in the important market segments will

normalize.

SALES PERFORMANCE

SSH'S NET SALES

EUR million 7-9/ 4-6/ 1-3/ 10-12/ 7-9/ 1-12/

2008 2008 2008 2007 2007 2007

BY SEGMENT

AMER 1.2 1.8 1.3 1.5 7.3 11.7

APAC 0.2 0.2 0.3 0.2 0.2 0.8

EROW 0.5 0.7 0.5 0.6 0.3 1.8

SSH Group total 2.0 2.5 1.8 2.3 7.8 14.2

BY OPERATION

License sales 0.8 1.5 0.7 1.1 6.8 10.1

Maintenance 1.1 1.0 1.1 1.1 1.1 4.1

Total 2.0 2.5 1.8 2.3 7.8 14.2

The Americas, the Asia Pacific region, and the 'Europe and Rest of

the World' market area accounted for 61.4 percent (85.2 percent),

11.2 percent (5.0 percent) and 27.4 percent (9.8 percent) of reported

net sales, respectively.

During the report period, SSH concluded five new license agreements

that were worth more than EUR 100,000. The ten largest customers

accounted for 40 percent of reported net sales, with the largest

single customer accounting for approximately 9 percent.

PRODUCTS AND MARKETING

During the report period, SSH focused its sales and marketing efforts

on large enterprises, financial institutions, and government agencies

in the USA, Europe, and Asia, in line with its long-term strategy.

The company continued also developing its partner network in the same

focus markets.

The marketing focus was on the company's new Tectia security

solutions of IBM mainframe environment and SSH Tectia's enhanced file

transfer applications for large internal enterprise networks. The

company continued the development of the new third generation

architecture-based products. The company also made further

development of the productisation to provide higher value, new

features and expanded uses, as well as enabling easier purchasing for

the customers.

New applications, support of all essential enterprise OS platforms

including IBM mainframes, versatile integration capabilities, and

centralized management have made SSH Tectia the most extensive

integrated end-to-end communications security solution in the market.

RESEARCH AND DEVELOPMENT

Research and development expenses for January-September totaled EUR

2.9 million (EUR 2.6 million), the equivalent of 46.7 percent of net

sales (22.0 percent). During the report period SSH didn't capitalize

any research and development expenses.

HUMAN RESOURCES AND ORGANIZATION

At the end of September, the Group had 75 employees on its payroll,

down by 9 from the previous year, an decrease of 10.7 percent.

At the end of the period, 53.3 percent of the employees worked in

R&D, 36.0 percent in sales and marketing, and 10.7 percent in

corporate administration.

BOARD AND AUDITORS

The Annual General Meeting (AGM) on March 27, 2008 re-elected Tomi

Laamanen, Timo Ritakallio and Tatu Ylönen to SSH Communications

Security Corp.'s Board of Directors. New board members, Pyry Lautsuo

and Juha Mikkonen were elected to the board. Tomi Laamanen continues

as chairman.

The AGM again elected to have PricewaterhouseCoopers Oy, authorized

public accountants, as the company's auditor, with Henrik Sormunen,

authorized public accountant, acting as the principal auditor.

SHARES, SHAREHOLDING AND CHANGES IN GROUP STRUCTURE

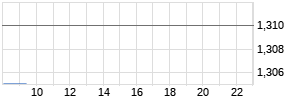

The reported trading volume of SSH Communications Security Corp.

shares totaled 2,798,440 (valued at EUR 3,914,988). The highest

quotation was EUR 1.69 and the lowest EUR 0.99. The trade-weighted

average share price for the period was EUR 1.41, and the share closed

at EUR 1.05 (September 28, 2008).

During the report period, the ownership structure of the company did

not change essentially. Tatu Ylönen holds, directly and through his

company, Tatu Ylönen Oy, 52.9 percent of the company's shares,

Assetman Oy holds 14.7 % and Tero Kivinen holds 5.2 percent. More

information about the shareholding can be obtained from the company's

web site.

During the report period, the Group decided to have the Japanese

subsidiary SSH Communications Security K.K go into voluntary

liquidation. This is a fully owned subsidiary of SSH. This

arrangement is a part of the re-structuring of company's Asian sales

organization, with a goal to sharpen the geographical sales focus, to

increase the role of resellers and to decrease costs.

SHARE CAPITAL AND BOARD AUTHORIZATIONS

The company's registered share capital on September 30, 2008 was EUR

856,508.25, consisting of 28,550,275 shares. During the report

period, SSH increased its share capital twice, based on subscription

to the new shares under SSH's stock-option plan. In total, 750 new

SSH shares were subscribed under the I/1999 stock option plan, 1,913

shares under the I/2003 stock option plan and 11,500 shares under the

II/2003 stock option plan respectively. With these subscriptions the

company's share capital was increased by EUR 424.89.

The Annual General Meeting 27 March 2008 decided, in accordance with

the proposal made by the Board of Directors, to authorize the Board

of Directors to decide on issuing the maximum of 5,500,000 shares in

one or more new share issues or on issuing special rights to share

subscription as defined in the Finnish Companies Act Chapter 10,

section 1, with or without subscription rights to shareholders. This

authorization is effective until the next Annual General Meeting, but

will expire 30 June 2009, at the latest. The Board has not exercised

this authorization.

The Annual General Meeting also authorized the Board of Directors to

decide on dividend distribution and/or on distribution of assets from

the invested unrestricted equity fund. By virtue of the

authorization, the distributed assets can be a maximum of 0.15 euro

per share and EUR 4,350,000 in total. The authorization is valid

until 31 December 2008. Further, the Board of Directors was

authorized to lower the subscription price of shares that can be

subscribed on the grounds of the stock option plans released by the

Company between years 2000 and 2003, at an amount which equates the

distribution of assets. On 2 April 2008, after the end of the report

period, the Board of Directors decided to distribute 0.15 euro per

share from the invested unrestricted equity fund to the shareholders,

and to lower the subscription price of the 2000 - 2003 stock option

plans by the same amount. The date of payment was 15 April, 2008.

CORPORATE GOVERNANCE

The company complies with the corporate governance recommendations

for listed companies issued by the NASDAQ OMX Helsinki, the Central

Chamber of Commerce of Finland, and the Confederation of Finnish

Industry and Employers. More information on corporate governance is

available on the company's Web site (www.ssh.com).

PROSPECTS

The outlook of the world economy has weakened fast. The company

estimates its results to remain at loss for the year 2008.

The company's actual sales so far and estimations for the rest of the

year have been impacted especially by the slow-down of IT investments

of banks and other financial sector enterprises, as well as the

development of sales to other large customers in the USA. The company

continues arrangements to cut operating expenses and return to

profitability.

INCOME STATEMENT

EUR million 7-9/ 7-9/ 1-9/ 1-9/ 1-12/

2008 2007 2008 2007 2007

Net sales 2.0 7.8 6.3 11.9 14.2

Purchasing and production

costs 0.0 0.0 0.0 0.0 0.0

Gross profit 2.0 7.8 6.3 11.9 14.2

Other operating income 0.0 0.0 0.1 0.1 0.1

Expenses

Product development -0.9 -0.8 -2.9 -2.6 -3.7

Sales and

marketing -1.0 -2.3 -3.6 -5.0 -6.5

Administration -0.4 -0.3 -1.2 -1.2 -1.7

Operating profit/loss -0.3 4.4 -1.4 3.2 2.2

Financial income and

expenses 0.2 0.3 0.6 0.6 0.9

Profit/loss before taxes -0.1 4.6 -0.9 3.9 3.1

Taxes -0.2 0.0 -0.2 0.0 0.0

Net profit/loss for the

period -0.4 4.6 -1.1 3.9 3.1

EARNINGS PER SHARE 1-9/ 1-9/ 1-12/

2008 2007 2007

Earnings per share (EUR) -0.04 0.14 0.11

Earnings per share, diluted

(EUR) -0.04 0.13 0.11

BALANCE SHEET

EUR million 9/30/ 9/30/ 12/31/

2008 2007 2007

ASSETS

Fixed and other non-current assets

Tangible assets 0.4 0.1 0.1

Intangible assets 0.0 0.1 0.1

Deferred tax assets 0.0 0.2 0.2

Total fixed and other

non-current assets 0.4 0.5 0.5

Inventories and current assets

Short-term receivables 2.5 3.7 3.0

Short-term investments 14.0 15.5 20.3

Cash and cash equivalents 2.1 5.4 1.7

Total inventories and current assets 18.6 24.7 25.1

Total assets 19.0 25.2 25.5

LIABILITIES AND SHAREHOLDERS' EQUITY

Shareholders' equity 15.1 21.2 20.4

Long-term liabilities

Provisions 0.0 0.0 0.2

Long-term financial

liabilities 0.1 0.0 0.0

Total long-term liabilities 0.1 0.0 0.2

Short-term liabilities 3.8 4.0 4.9

Total liabilities and shareholders' equity 19.0 25.2 25.5

CASH FLOW STATEMENT

EUR million 1-9/ 1-9/ 1-12/

2008 2007 2007

Cash flow from business operations -2.1 3.9 5.1

Cash flow from investments 6.8 -0.2 -5.0

Cash flow from financing -4.3 0.0 0.0

Increase(+) / decrease (-) in liquid assets 0.4 3.7 0.1

Liquid assets at period start 1.7 1.7 1.7

Adjustment for translation difference 0.0 -0.1 -0.1

Liquid assets at period end 2.1 5.4 1.7

STATEMENT ON CHANGES IN SHAREHOLDERS'

EQUITY

EUR million Share Share Fair Trans- Unrest- Total

Capi Premi value lation ricted

tal -um reser diff. equity

-ves funds and

retained

earnings

Shareholders'

equity

Jan. 1, 2007 0.9 11.5 0.1 -0.8 6.3 18.0

Change 0.0 0.0 0.0 -0.2 -2.1

Shareholders' equity

Sep. 30, 2007 0.9 11.5 0.1 -1.0 4.2 21.6

Change 0.0 0.0 0.0 -0.1 5.2

Shareholders'

equity

Dec. 31, 2007 0.9 11.5 0.1 -1.1 9.4 20.8

Change 0.0 -11.5 0.0 0.1 7.3

Net profit -0.9

Shareholders'

equity

Sep. 30, 2008 0.9 0.0 0.1 -1.4 15.5 15.1

NET SALES BY SEGMENT

EUR million 7-9/ 7-9/ 1-9/ 1-9/ 1-12/

2008 2007 2008 2007 2007

AMER 1.2 7.3 4.2 10.2 11.7

APAC 0.2 0.2 0.7 0.6 0.8

EROW 0.5 0.3 1.4 1.2 1.8

SSH Group total 2.0 7.8 6.3 11.9 14.2

OPERATING PROFIT/LOSS BY SEGMENT

EUR million 7-9/ 7-9/ 1-9/ 1-9/ 1-12/

2008 2007 2008 2007 2007

AMER 0.5 5.6 1.9 7.0 7.6

APAC 0.2 0.0 0.2 0.3 0.3

EROW 0.3 0.0 0.8 -0.1 -0.1

Common Group expenses* -1.3 -1.3 -4.3 -3.9 -5.5

SSH Group total -0.3 4.4 -1.4 3.2 2.2

* Common Group expenses include Group administration expenses (e.g.,

management and finance) and product management and R&D expenses for

corporate headquarters.

KEY FIGURES AND RATIOS

1-9/ 1-9/ 1-12/

2008 2007 2007

Net sales (MEUR) 6.3 11.9 14.2

Operating profit/loss (MEUR) -1.4 3.2 2.2

Operating profit/loss, as % of

net sales -22.7 27.2 15.7

Profit/loss before extraordinary

items and taxes (MEUR) -0.9 3.9 3.1

Profit/loss before extraordinary

items and taxes, as % of net

sales -13.9 32.4 21.9

Profit/loss before taxes (MEUR) -0.9 3.9 3.1

Profit/loss before taxes, as

% of net sales -13.9 32.4 21.9

Return on investment (%) -3.3 15.3 17.1

Return on equity (%) -4.7 15.0 16.3

Interest-bearing net liabilities

(MEUR) -16.0 -20.9 -22.0

Equity ratio (%) 92.5 93.4 91.3

Gearing (%) -106.1 -98.6 -107.8

Gross capital expenditure (MEUR) 0.0 0.1 0.1

% of net sales 0.0 0.7 0.7

R&D expenses (MEUR) 2.9 2.6 3.7

% of net sales 46.7 22.0 25.9

Personnel, period average 78 81 81

Personnel, period end 75 84 83

PER-SHARE DATA

1-9/ 1-9/ 1-12/

2008 2007 2007

Earnings per share, undiluted

(EUR) -0.04 0.14 0.11

Earnings per share, diluted

(EUR) -0.04 0.13 0.11

Equity per share (EUR) 0.53 0.74 0.72

No. of shares at period end

(thousands) 28 550 28 507 28 536

Share performance (EUR)

Average price 1.41 1.51 1.63

Low 0.99 1.12 1.12

High 1.69 2.00 2.39

Share price, period end 1.05 1.92 1.61

Market capitalization, period

end (MEUR) 30.0 54.7 45.9

Volume of shares traded

(in millions) 2.8 11.8 15.0

Volume of shares traded, as

% of total 9.8 41.4 52.6

Value of shares traded, in

millions of euros 3.9 18.0 24.5

Price-to-earnings ratio (P/E) 14.8

CONTINGENT LIABILITIES

EUR million 9/30 9/30 12/31

2008 2007 2007

Rental liabilities 0.0 0.0 0.1

Leasing commitments outside

the balance sheet

Maturing within 1 year 0.7 0.6 0.7

Maturing between 1 and 5

years 0.7 0.8 1.1

Currency derivatives (not

included in hedge accounting)

Fair value 0.0 0.0 0.0

Nominal value 0.0 1.8 0.0

This interim report has been compiled observing IAS 34 (Interim

Financial Reporting) accounting standard. The same accounting

principles have been used in the financial statements for 2007. These

data are based on unaudited figures.

IMPACT OF THE CHANGE IN ACCOUNTING PRACTISE FOR RECORDING PROFITS

FROM SALES (IAS8)TO GROUP'S FINANCIALS PER QUARTER

1-3/ 2007 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 2.6 2.6 0.0

Operating profit/loss 0.0 0.0 0.0

Profit/loss before taxes 0.2 0.1 0.0

Earnings per share (EUR) 0.0 0.0 0.0

Shareholders' equity 17.6 18.1 0.4

Long-term liabilities 0.0 0.0 0.0

Short-term liabilities 3.2 2.8 -0.4

Total liabilities and

shareholders' equity 20.9 20.9 0.0

1-6/ 2007 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 4.1 4.1 0.0

Operating profit/loss -1.1 -1.1 0.0

Profit/loss before taxes -0.8 -0.8 0.0

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 16.7 17.1 0.5

Long-term liabilities 0.0 0.0 0.0

Short-term liabilities 2.9 2.5 -0.5

Total liabilities and

shareholders' equity 19.6 19.6 0.0

1-9/ 2007 (MEUR) ORIGINAL RESTATED DIFFERENCE

VALUE VALUE

Net sales (MEUR) 11.9 11.9 0.0

Operating profit/loss 3.2 3.2 0.0

Profit/loss before taxes 3.9 3.8 0.0

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 21.2 21.6 0.4

Long-term liabilities 0.0 0.0 0.0

Short-term liabilities 4.0 3.6 -0.4

Total liabilities and

shareholders' equity 25.2 25.2 0.0

1-12/ 2007 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 14.2 14.1 -0.1

Operating profit/loss 2.2 2.2 -0.1

Profit/loss before taxes 3.1 3.0 -0.1

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 20.4 20.8 0.4

Long-term liabilities 0.2 0.2 0.0

Short-term liabilities 4.9 4.5 -0.4

Total liabilities and

shareholders' equity 25.5 25.5 0.0

1-3/ 2008 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 1.8 1.9 0.0

Operating profit/loss -0.9 -0.8 0.0

Profit/loss before taxes -0.7 -0.6 0.0

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 19.8 20.2 0.4

Long-term liabilities 0.2 0.2 0.0

Short-term liabilities 3.7 3.3 -0.4

Total liabilities and

shareholders' equity 23.7 23.7 0.0

1-6/ 2008 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 4.3 4.4 0.1

Operating profit/loss -1.1 -1.0 0.1

Profit/loss before taxes -0.7 -0.6 0.1

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 15.4 15.9 0.4

Long-term liabilities 0.4 0.4 0.0

Short-term liabilities 3.5 3.0 -0.4

Total liabilities and

shareholders' equity 19.3 19.3 0.0

1-9/ 2008 ORIGINAL RESTATED DIFFERENCE

(MEUR) VALUE VALUE

Net sales (MEUR) 6.3 6.3 0.0

Operating profit/loss -1.4 -1.4 0.0

Profit/loss before taxes -0.9 -0.9 0.0

Earnings per share (EUR) 0.0 0.0 0.0

0.0

Shareholders' equity 15.1 15.5 0.4

Long-term liabilities 0.1 0.1 0.0

Short-term liabilities 3.8 3.4 -0.4

Total liabilities and

shareholders' equity 19.0 19.0 0.0

STATEMENT ON CHANGES IN

SHAREHOLDERS' EQUITY

EUR million Share Share Fair Trans- Unrest- Total

Capital Premium value lation ricted

reserves differ-rence equity

funds

and

retained

earnings

Shareholders'

equity

1.1.2007 0.9 11.5 0.1 -0.8 6.3 18.0

Shareholders'

equity ,

restated

1.1.2007 0.9 11.5 0.1 -0.8 5.9 17.5

Shareholders'

equity

30.3.2007 0.9 11.5 0.1 -0.9 6.4 18.1

Shareholders'

equity ,

restated

30.3.2007 0.9 11.5 0.1 -0.9 6.0 17.6

Shareholders'

equity

30.6.2007 0.9 11.5 0.1 -0.9 5.6 17.1

Shareholders'

equity ,

restated

30.6.2007 0.9 11.5 0.1 -0.9 5.1 16.7

Shareholders'

equity

30.9.2007 0.9 11.5 0.1 -1.0 10.1 21.6

Shareholders'

equity ,

restated

30.9.2007 0.9 11.5 0.1 -1.0 9.7 21.2

Shareholders'

equity

31.12.2007 0.9 11.5 0.1 -1.1 9.4 20.8

Shareholders'

equity ,

restated

31.12.2007 0.9 11.5 0.1 -1.1 8.9 20.4

Shareholders'

equity

30.3.2008 0.9 11.5 0.1 -1.0 8.7 20.2

Shareholders'

equity ,

restated

30.3.2008 0.9 11.5 0.1 -1.0 8.3 19.8

Shareholders'

equity

30.6.2008 0.9 11.5 0.1 -1.1 4.5 15.9

Shareholders'

equity ,

restated

30.6.2008 0.9 11.5 0.1 -1.0 3.9 15.4

Shareholders'

equity ,

restated

30.9.2007 0.9 0.0 0.1 -1.4 15.5 15.1

DISCLAIMER

The content in this report is provided by SSH Communications Security

Corp ("SSH") and its third party content providers for your personal

information only, and does not constitute an offer or invitation to

purchase any securities. Nor does it provide any form of advice

(investment, tax, legal) amounting to investment advice, or make any

recommendations regarding particular investments or products. SSH

does not provide investment advice or recommendations to buy or sell

its shares or the shares of others. If you are interested in

investing in SSH, please contact your financial adviser for further

details and information. Past performance of SSH shares is not

indicative of future results. EXCEPT AS PROVIDED BY APPLICABLE

COMPULSORY LAW SSH EXPRESSLY DISCLAIMS ALL WARRANTIES, EXPRESSED OR

IMPLIED, AS TO THE AVAILABILITY, ACCURACY OR RELIABILITY OF ANY OF

THE CONTENT PROVIDED, OR AS TO THE FITNESS OF THE INFORMATION FOR ANY

PURPOSE.

FINANCIAL REPORTING

The company will hold a briefing on its interim report for equity

analysts and the media in Hotel Scandic Marski, Filip 1-cabinet, 2nd

floor, address Mannerheimintie 10, 00100 Helsinki on Wednesday,

October 22nd 2008, starting at 11:00 a.m.

SSH Communications Security Corp will release its next interim report

and financial statements for January 1-December 31, 2008 in February

2009. Further information will be available on the company's website

in due course.

Helsinki, on October 22, 2008

SSH COMMUNICATIONS SECURITY CORP

Board of Directors

Arto Vainio

CEO

For further information, please contact:

Arto Vainio, CEO tel. +358 (0)20 500 7400

Mika Peuranen, CFO tel. +358 (0)20 500 7419

Distribution:

NASDAQ OMX Helsinki Ltd.

Major media

www.ssh.com

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

Top-News

SSH INTERIM REPORT FOR JANUARY 1 - SEPTEMBER 30, 2008

Mittwoch, 22.10.2008 08:05 von Hugin - Aufrufe: 367

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

-1

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.