SouthState Corporation Reports Fourth Quarter 2023 Results, Declares Quarterly Cash Dividend

PR Newswire

WINTER HAVEN, Fla., Jan. 25, 2024

WINTER HAVEN, Fla., Jan. 25, 2024 /PRNewswire/ -- SouthState Corporation (NYSE: SSB) today released its unaudited results of operations and other financial information for the three-month and twelve-month periods ended December 31, 2023.

"We ended a year that demonstrated the resilience of the SouthState deposit franchise in the face of unprecedented change. In addition, loans grew 7% and we materially built our reserve", commented John C. Corbett, SouthState's Chief Executive Officer. "While we remain cautious of the lag effects of the recent rate increases, we see tremendous opportunity coming out of the cycle. Since the pandemic, Florida has grown by over one million people and SouthState benefits from operating in 4 of the 5 fastest growing states in the country. We are in a great position to deliver outsized results for our shareholders, and I want to thank our team for their hard work and service to our clients during 2023."

Highlights of the fourth quarter of 2023 include:

Returns

- Reported Diluted Earnings per Share ("EPS") of $1.39; Adjusted Diluted EPS (Non-GAAP) of $1.67

- Net Income of $106.8 million; Adjusted Net Income (Non-GAAP) of $128.3 million

- Return on Average Common Equity of 8.0%; Return on Average Tangible Common Equity (Non-GAAP) of 13.5% and Adjusted Return on Average Tangible Common Equity (Non-GAAP) of 16.1%*

- Return on Average Assets ("ROAA") of 0.94% and Adjusted ROAA (Non-GAAP) of 1.13%*

- Pre-Provision Net Revenue ("PPNR") per Weighted Average Diluted Share (Non-GAAP) of $2.27

- Book Value per Share of $72.78; Tangible Book Value ("TBV") per Share (Non-GAAP) of $46.32

∗ Annualized percentages

Performance

- Net Interest Income of $354 million; Core Net Interest Income (excluding loan accretion) (Non-GAAP) of $350 million

- Net Interest Margin ("NIM"), non-tax equivalent of 3.47% and tax equivalent (Non-GAAP) of 3.48%

- Net charge-offs of $7.3 million, or 0.09% annualized; $9.9 million Provision for Credit Losses ("PCL"), including release for unfunded commitments; total allowance for credit losses ("ACL") plus reserve for unfunded commitments of 1.58%; year-to-date net charge-offs of $24.9 million, or 0.08%

- Noninterest Income of $65 million, down $7 million compared to the prior quarter, primarily due to a decrease in correspondent banking and capital markets income; Noninterest Income represented 0.58% of average assets for the fourth quarter of 2023

- Recorded FDIC special assessment expense of $26 million

- Efficiency Ratio of 63% and Adjusted Efficiency Ratio (Non-GAAP) of 57%

Balance Sheet

- Loans increased $372 million, or 5% annualized, led by consumer real estate; ending loan to deposit ratio of 87%

- Deposits increased $114 million, or 1% annualized, despite a $339 million decline in brokered CDs; excluding brokered CDs, deposits increased $453 million, or 5% annualized, from prior quarter

- Total deposit cost of 1.60%, up 0.16% from prior quarter, resulting in a 30% cycle-to-date beta

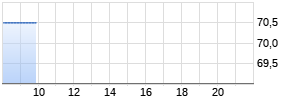

- Repurchased a total of 100,000 shares during 4Q 2023 at a weighted average price of $67.45

- Strong capital position with Tangible Common Equity, Total Risk-Based Capital, Tier 1 Leverage, and Tier 1 Common Equity ratios of 8.2%, 14.1%, 9.4%, and 11.8%, respectively†

† Preliminary

Subsequent Events

- The Board of Directors of the Company declared a quarterly cash dividend on its common stock of $0.52 per share, payable on February 16, 2024 to shareholders of record as of February 9, 2024

Financial Performance

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended | | |||||||||||||||||

| (Dollars in thousands, except per share data) | | Dec. 31, | | Sep. 30, | | Jun. 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, | | |||||||

| INCOME STATEMENT | | 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | | |||||||

| Interest Income | | | | | | | | | | | | | | | | | | | | | | |

| Loans, including fees (1) | | $ | 459,880 | | $ | 443,805 | | $ | 419,355 | | $ | 393,366 | | $ | 359,552 | | $ | 1,716,405 | | $ | 1,178,026 | |

| Investment securities, trading securities, federal funds sold and securities | | | | | | | | | | | | | | | | | | | | | | |

| purchased under agreements to resell | | | 55,555 | | | 56,704 | | | 58,698 | | | 57,043 | | | 64,337 | | | 228,001 | | | 218,999 | |

| Total interest income | | | 515,435 | | | 500,509 | | | 478,053 | | | 450,409 | | | 423,889 | | | 1,944,406 | | | 1,397,025 | |

| Interest Expense | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | 149,584 | | | 133,944 | | | 100,787 | | | 55,942 | | | 19,945 | | | 440,257 | | | 36,984 | |

| Federal funds purchased, securities sold under agreements | | | | | | | | | | | | | | | | | | | | | | |

| to repurchase, and other borrowings | | | 11,620 | | | 11,194 | | | 15,523 | | | 13,204 | | | 7,940 | | | 51,541 | | | 24,370 | |

| Total interest expense | | | 161,204 | | | 145,138 | | | 116,310 | | | 69,146 | | | 27,885 | | | 491,798 | | | 61,354 | |

| Net Interest Income | | | 354,231 | | | 355,371 | | | 361,743 | | | 381,263 | | | 396,004 | | | 1,452,608 | | | 1,335,671 | |

| Provision for credit losses | | | 9,893 Werbung Mehr Nachrichten zur South State Corp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||||||||||