Shareholder Class Action Filed Against Fifth Street Asset Management, Inc. - FSAM

PR Newswire

RADNOR, Pa., Jan. 14, 2016

RADNOR, Pa., Jan. 14, 2016 /PRNewswire/ -- The law firm of Kessler Topaz Meltzer & Check, LLP announces that a shareholder class action lawsuit has been filed against Fifth Street Asset Management, Inc. (Nasdaq: FSAM) ("FSAM" or the "Company") on behalf of purchasers of the Company's securities in connection with and following FSAM's Initial Public Offering ("IPO") on or around October 30, 2014.

FSAM shareholders who wish to discuss this action and their legal options are encouraged to contact Kessler Topaz Meltzer & Check, LLP (Darren J. Check, Esq., D. Seamus Kaskela, Esq. or Adrienne O. Bell, Esq.) at (888) 299-7706 or at info@ktmc.com.

For additional information about this lawsuit, or to request information about this action online, please visit https://www.ktmc.com/new-cases/fifth-street-asset-management-inc.

FSAM is the asset manager and investment advisor for two publicly traded asset portfolio companies – Fifth Street Finance Corp. (Nasdaq: FSC) ("FSC") and Fifth Street Senior Floating Rate Corp. (Nasdaq: FSFR) ("FSFR"). FSC and FSFR (the "Funds") lend to and invest in small and mid-sized companies in connection with investments by private equity sponsors. FSAM generates revenue from the Funds for providing investment advisory and administrative services.

According to the shareholder class action complaint, the Offering Documents filed in connection with FSAM's IPO contained materially false and misleading statements of fact and failed to disclose facts necessary to make the statements made therein not misleading, including, among other statements, that: (i) FSAM had $4.2 billion assets under management from FSC as of June 30, 2014, when in fact a substantial portion of FSC's portfolio had been impaired on a cost basis prior to the IPO; (ii) FSAM had increased its management fee revenues by a compound annual growth rate of nearly 50% year-over-year during the six months ended June 30, 2014 due to FSAM's "outstanding performance," when in fact the growth in fee revenue was largely due to the overstatement of FSC's assets and dilutive stock offerings detrimental to the Funds' shareholders; and (iii) FSAM had "high-quality and predictable earnings," when in fact FSAM's revenues were unsustainable and the result of conduct that placed FSAM's most important asset – its management contract with FSC – at risk.

As further detailed in the complaint, since the time of Company's IPO in October 2014, the price of FSAM shares has plummeted because, among other reasons: (i) FSC disclosed that a substantial portion of its debt portfolio had entered non-accrual (including about 4% of FSC's portfolio prior to the IPO); (ii) Fitch Ratings Inc. downgraded FSC to BB+ from BBB- on a negative outlook due largely to FSAM's poor management of FSC and its credibility problems with investors; and (iii) FSC has had to restate its financials for three consecutive quarters, including the quarter in which the IPO was conducted, due to material weakness in its controls over financial reporting.

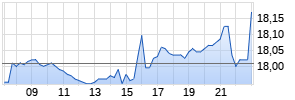

On December 9, 2015, FSAM stock closed at $4.03 per share, more than 76% below the price of the shares at the time of the IPO.

ARIVA.DE Börsen-Geflüster

Kurse

|

|

FSAM shareholders who purchased their securities during the Class Period may, no later than March 7, 2016, petition the Court to be appointed as a lead plaintiff of the class.

A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. Members of the purported class may petition the Court to be appointed as a lead plaintiff through Kessler Topaz Meltzer & Check or other counsel, or may choose to do nothing and remain an absent class member. In order to be appointed as a lead plaintiff, the Court must determine that the class member's claim is typical of the claims of other class members, and that the class member will adequately represent the class in the action. Your ability to share in any recovery is not affected by the decision of whether or not to serve as a lead plaintiff.

Kessler Topaz Meltzer & Check prosecutes class actions in state and federal courts throughout the country. Kessler Topaz Meltzer & Check is a driving force behind corporate governance reform, and has recovered billions of dollars on behalf of institutional and individual investors from the United States and around the world. The firm represents investors, consumers and whistleblowers (private citizens who report fraudulent practices against the government and share in the recovery of government dollars). The complaint in this action was not filed by Kessler Topaz Meltzer & Check. For more information about Kessler Topaz Meltzer & Check, or for additional information about participating in this action, please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Darren J. Check, Esq.

D. Seamus Kaskela, Esq.

Adrienne O. Bell, Esq.

280 King of Prussia Road

Radnor, PA 19087

(888) 299-7706

(610) 667-7706

info@ktmc.com

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/shareholder-class-action-filed-against-fifth-street-asset-management-inc---fsam-300204205.html

SOURCE Kessler Topaz Meltzer & Check, LLP

Mehr Nachrichten zur Oaktree Specialty Lending Corp. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.