SECURED PROPERTY DEVELOPMENTS PLC - Final Results

PR Newswire

London, May 21

REGISTERED NUMBER: 02055395 (England and Wales)

Group Strategic Report, Report of the Directors and

Consolidated Financial Statements for the Year Ended 31st December 2019

for

Secured Properties Developments Plc

Secured Properties Developments Plc

Contents of the Consolidated Financial Statements

for the Year Ended 31st December 2019

| Page | |

| Company Information | 1 |

| Notice of Meeting | 2 |

| Chairman's Statements | 3 |

| Group Strategic Report | 4 |

| Report of the Directors | 5 |

| Report of the Independent Auditors | 7 |

| Consolidated Income Statement | 11 |

| Consolidated Balance Sheet | 12 |

| Company Balance Sheet | 13 |

| Consolidated Statement of Changes in Equity | 14 |

| Company Statement of Changes in Equity | 15 |

| Consolidated Cash Flow Statement | 16 |

| Notes to the Consolidated Financial Statements | 17 |

Secured Properties Developments Plc

Company Information

for the Year Ended 31st December 2019

| DIRECTORS: | R E France R A Shane |

| SECRETARY: | I H Cobden |

| REGISTERED OFFICE: | Unit 6 42 Orchard Road London N6 5TR |

| REGISTERED NUMBER: | 02055395 (England and Wales) |

| AUDITORS: | Lubbock Fine Chartered Accountants & Statutory Auditors Paternoster House 65 St. Paul's Churchyard London EC4M 8AB |

| SHARE DEALING: | The Company’s Ordinary shares are quoted on the NEX Exchange (formerly the ISDX market) and Persons can buy or sell shares through their stockbroker. |

| REGISTRARS: | Avenir Registrars Ltd 5 St. John's Lane London EC 1M 4BH ylva.baeckstrom@avenir-registrars.co.uk www.avenir-registrars.co.uk Telephone 020 7692 5500 |

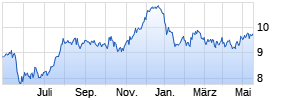

| SHARE PRICE: | The middle market price of the Ordinary shares was quoted At 31 December 2019 on the NEX (previously the IDEX Market) at 17.5 pence per share (2018: 25 pence per share). Please note with effect from 8th June 2020 the NEX market will change its name to AQSE Growth Market with MIC Code NEXG |

SECURED PROPERTY DEVELOPMENTS PLC

Unit 6 ,Orchard Mews ,42 Orchard Road

Highgate,London N6 5TR

Tel: 020 8446 6306 Fax: 020 8446 8975

Secured PLC Accounts Year end 31 12 19

Page 2

Notice of Meeting

NOTICE IS HEREBY GIVEN that the twenty eighth Annual General Meeting (AGM) of Secured Property Development plc will be held at Unit 6 Orchard Mews,42 Orchard Road, Highgate, London N6 5TR on 23 June 2020 at 11am for the purposes shown below.

As a result of the current environment the Company notes the restrictions on public gatherings imposed by the Government.

The Company notifies its shareholders that physical attendance in person at the AGM will not be possible. The Board encourages shareholders to send in their votes by post, or to appoint the Chair of the meeting as their proxy with their voting instructions.

All valid proxy votes, whether submitted electronically or in hard copy form, will be included in the poll to be taken at the meeting.

Shareholders are urged to register their proxy appointment electronically by 11.00am on 23 June 2020.

If shareholders prefer to return a hard copy Form of Proxy (Proxy) they should do so in accordance with the instructions on the Proxy.

The Board is disappointed that they have to adopt these measures and appreciate shareholders’ understanding in these unprecedented circumstances.

By Order of the Board

IH Cobden

Secretary Date: 21 May 2020

Notes:

SECURED PROPERTY DEVELOPMENTS PLC

Unit 6 ,Orchard Mews ,42 Orchard Road

Highgate,London N6 5TR

Tel: 020 8446 6306 Fax: 020 8446 8975

Chairman’s Statement Year End 31st December 2019

The Coronavirus pandemic is causing global turmoil and creating an uncertain outlook worldwide.

On behalf of the Board we hope shareholders and their loved ones are safe and healthy.

At the time of writing the UK Government has placed increasingly strict restrictions on public gatherings and this has resulted in our having to make special arrangements for the Annual General Meeting (AGM).

The pandemic has resulted in the Bank of England reducing interest rates and increasing money supply in order to enable HM Government to financially support individuals and companies during the economic turmoil caused by the lockdown.

During the year the Board continued to search for suitable properties in which to invest. We identified a residential property for refurbishment close to the new development at the rear of Kings Cross station. We were unable to complete the purchase but continue with our search.

The political and economic uncertainty caused by the Brexit debate was partially resolved by the outcome of the General Election in December 2019. The Conservative party victory saw a return of confidence in the property market which has since been extinguished by the Coronavirus pandemic.

The Board has decided to reduce overheads wherever possible in order to preserve cash resources.

On 25th February 2020 John Townsend and John Soper resigned from office. The Board wishes to record their thanks on behalf of all shareholders to John Townsend and John Soper for their service to the company. Their detailed knowledge of the property market gained as a result of many years experience will be greatly missed.

We live in uncertain times and shareholders will be aware that buying opportunities may occur as the property market adjusts to the present market turmoil.

R.A.Shane

Chairman

Company No. 2055395

Registered office: as above

Secured Properties Developments Plc

Group Strategic Report

for the Year Ended 31st December 2019

Business Model

At Secured Property Developments, we focus on maximising the return from our portfolio of properties whilst looking for new acquisitions where we can, by development, increase value and thereby create value for shareholders.

We create value by:

Acquiring properties

- We seek to acquire properties and unlock value.

Optimise Income

- Optimising income by development and carrying out improvements and good estate management.

- Employ our knowledge of occupiers' needs to let to high quality tenants from a wide range of businesses and to minimise the level of voids in our portfolio and

- Collecting our rental income on due dates.

Recycle Capital

- Identify properties for disposal where value has been optimised and dispose of those which do not fit the Group's long-term plans.

Maintain robust and flexible financing

- Negotiate flexible financing and retain a healthy level of interest cover and gearing.

PRINCIPAL RISKS AND UNCERTAINTIES

The main risks arising from the Group's financial instruments are interest rate risk and liquidity risk. The Board reviews and agrees policies for managing each of these risks and they are summarised below.

Interest rate risk

The Group has no exposure at the present time to interest rate risk however the Group's policy is to borrow at lowest rates for periods that do not carry excessive time premiums.

Liquidity risk

As regards liquidity, the Group's policy has throughout the year been to ensure that the group is able at all times to meet its financial commitments as and when they fall due.

ON BEHALF OF THE BOARD:

R A Shane - Director

Date: 21 May 2020

Secured Properties Developments Plc

Report of the Directors

for the Year Ended 31st December 2019

The directors present their report with the financial statements of the company and the group for the year ended 31st December 2019.

PRINCIPAL ACTIVITY

The principal activity of the group in the year under review was that of the principal activity of Secured Property Developments Plc which is investment in commercial and residential property. The group comprises the holding company, a finance company and a second property company.

REVIEW OF BUSINESS

The results for the year are set out on page 11 of these consolidated financial statements.

The Group's investment properties have now all been sold, and all borrowings have been repaid. A review of the business is included in the Chairman's Statement set out on page 3.

DIRECTORS

The directors shown below have held office during the whole of the period from 1st January 2019 to the date of this report.

| Director | Company | Class | Interest at 31 December 2019 Number | Interest at 31 December 2018 Number | |||

| J Townsend | SPD plc* | Ordinary shares | 85,076 | 85,076 | |||

| R France | SPD plc* | Ordinary shares | 88,888 | 88,888 | |||

| R Shane | SPD plc* | Ordinary shares | 574,456 | 567,335 | |||

| Deferred shares | 154,666 | 154,666 | |||||

| J Soper | SPD plc* | Ordinary shares | 85,076 | 85,076 |

*SPD plc is used above as an abbreviation for Secured Property Developments plc.

According to the register of director’s interest, no rights to subscribe for shares in or debentures of the Company or any other group company was granted to any of the directors or their immediate families, or exercised by them, during the financial year.

Other changes in directors holding office are as follows:

J S Soper and J P Townsend ceased to be directors after 31st December 2019 but prior to the date of this report.

Substantial shareholding of ordinary shares of 20p each as at 31 December 2019

| Director | Company | |

| R France | 4.51% | |

| G Green | 4.57% | |

| R Shane | 29.15% | |

| J Townsend | 4.32% | |

| J Soper | 4.32% |

PROPOSED DIVIDEND AND TRANSFER TO RESERVES

The directors do not recommend the payment of a dividend (2018: £nil).

The loss for the year retained in the group is £83,902 (2018: £91,741).

EVENTS SINCE THE END OF THE YEAR

There have been no significant events since the year end

Secured Properties Developments Plc

Report of the Directors

for the Year Ended 31st December 2019

FINANCIAL INSTRUMENTS

Details of the group financial risk management objectives and policies are included in the notes to the financial statements.

FUTURE DEVELOPMENTS

Following the sale of the last of the investment properties and repayment of loans the Directors are now able to actively consider investment and development opportunities that arise.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the Report of the Directors and the financial statements in accordance with applicable law and regulations.

Company law requires the directors to prepare financial statements for each financial year. Under that law the directors have elected to prepare the financial statements in accordance with United Kingdom Generally Accepted Accounting Practice (United Kingdom Accounting Standards and applicable law). Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the company and the group and of the profit or loss of the group for that period. In preparing these financial statements, the directors are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- ensure applicable UK accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements; and

- prepare the financial statements on the going concern basis unless it is inappropriate to presume that the group will continue in business.

The directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company's and the Group's transactions and disclose with reasonable accuracy at any time the financial position of the Company and the Group and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the Company and the Group and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

STATEMENT AS TO DISCLOSURE OF INFORMATION TO AUDITORS

So far as the directors are aware, there is no relevant audit information (as defined by Section 418 of the Companies Act 2006) of which the group's auditors are unaware, and each director has taken all the steps that he ought to have taken as a director in order to make himself aware of any relevant audit information and to establish that the group's auditors are aware of that information.

AUDITORS

Under section 487(2) of the Companies Act 2006, Lubbock Fine will be deemed to have been reappointed as auditors 28 days after these financial statements were sent to members or 28 days after the latest date prescribed for filing the accounts with the registrar, whichever is earlier.

ON BEHALF OF THE BOARD:

I H Cobden - Secretary

Date: 21 May 2020

Secured Property Developments Plc

Independent Audit Report

For the Year Ended 31 December 2019

To the members of Secured Property Developments Plc,

OPINION

We have audited the consolidated financial statements of Secured Property Developments Plc (the 'parent Company') and its subsidiaries (the 'Group') for the year ended 31 December 2019, which comprise the Group Income Statement, the Group and Company Balance Sheets, the Group and Company Statement of Changes in Equity and the related notes, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards, including Financial Reporting Standard 102 ‘The Financial Reporting Standard applicable in the UK and Republic of Ireland' (United Kingdom Generally Accepted Accounting Practice).

In our opinion the consolidated financial statements:

- give a true and fair view of the state of the Group's and of the parent Company's affairs as at 31 December 2019 and of the Group's profit for the year then ended;

- have been properly prepared in accordance with United Kingdom Generally Accepted Accounting Practices; and

- have been prepared in accordance with the requirements of the Companies Act 2006.

BASIS FOR OPINION

Mehr Nachrichten zur Frasers Group plc Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.