Santacruz Silver Reports Second Quarter Financial Results

PR Newswire

VANCOUVER, Aug. 30, 2016

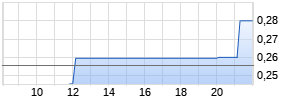

TSX.V: SCZ

FSE: 1SZ

VANCOUVER, Aug. 30, 2016 /PRNewswire/ - Santacruz Silver Mining Ltd. (TSX.V:SCZ) (the "Company" or "Santacruz") reports on its financial and operating results for the second quarter of 2016 ("Q2"). The full version of the financial statements and accompanying management discussion and analysis can be viewed on the Company's website at www.santacruzsilver.com or on SEDAR at www.sedar.com. All financial information is prepared in accordance with IFRS and all dollar amounts are expressed in thousands of US dollars, except per unit amounts, unless otherwise indicated.

Q2 HIGHLIGHTS:

- Silver equivalent payable ounces sold of 251,189

- Revenues of $3,375

- Gross Income from mining operations was $597

- Adjusted EBITDA of $670

- Cash operating cost per AgEq ounce sold was $11.57/oz

- All-in sustaining cash cost (AISC) per AgEq ounce sold was $14.60/oz

- Production cost per tonne of $79.26

- Subsequent to quarter end of June 30th, the Company raised Canadian $15 million in an equity offering to restructure senior debt and for working capital purposes.

"During the quarter we made significant progress on strengthening our balance sheet by advancing negotiations for a CAD $15 million equity raise which was closed subsequent to the quarter end. This allowed us to restructure our senior debt obligations into a new debt facility with a significantly lower principal balance, resulting in a substantial improvement of our capital structure," said Arturo Préstamo, President and CEO. "From a production viewpoint, at the Rosario Mine operating income increased to $0.6 million, an increase of 29% over the prior quarter. Additionally, our operations at the Veta Grande Mine continue moving towards the commencement of commercial production following which we expect the mine to be a significant and complementary cash-flow generator to the Rosario Mine."

Second Quarter 2016 Financial Summary (Q2 2016 compared to Q1 2016 and Q2 2015)

| | | | | |

| Highlights (US$000's except per share amount) | Q2 2016 | Q1 2016 | Q2 vs Q1 % change | Q2 2015 |

| Revenue | $3,375 | $3,537 | -5% | $3,147 |

| Mine Operations Income1 | $597 | $462 | 29% | $127 |

| Net Loss | $(796) | $(3,000) | 73% | $(2,018) |

| Adjusted EBITDA1 | $670 | $601 | 11% | $139 |

| Basic Loss per Share | $(0.01) | $(0.03) | 67% | $(0.02) |

| | | | | |

| |

| 1 The Company reports additional non-IFRS measures which include Mine Operations Income and |

| |

Second Quarter 2016 Mine Operations Summary (Q2 2016 compared to Q1 2016 and Q2 2015)

| | | | | |

|

Highlights | Q2 2016 | Q1 2016 | Q2 vs Q1 % change | Q2 2015 |

| Mill Production (tonnes) | 26,419 | 24,053 | 10% | 26,492 |

| Silver Equivalent Production (ounces)(1) | 271,985 | 290,569 | -6% | 265,834 |

| Silver Equivalent Sold (payable ounces)(2) | 251,189 | 318,596 | -21% | 247,135 |

| Cash Cost per Silver Equivalent Sold ($/oz.)(3) | $11.57 | $10.93 | 6% | $13.01 |

| Production Cost ($/tonne)(3) | $79.26 | $103.28 | -23% | $87.23 |

| All-in Sustaining Cost per Silver Equivalent Sold ($/oz.)(3) | $14.60 | $14.10 | 4% | $16.97 |

| Average Realized Silver Price ($/oz.)(3) | $16.50 | $17.00 | -3% | $17.00 |

| | |

| (1) | Silver equivalent ounces produced in 2016 have been calculated using prices of US$14.50/oz., |

| (2) | Silver equivalent sold ounces in the second quarter of 2015 and the first quarter of 2016, have |

| (3) | The Company reports non-IFRS measures which include Cash Cost per Silver Equivalent, |

| | |

Operational Update

The Veta Grande milling facility is currently operating at approximately 400 tpd.

During the second quarter mine development and production focused on the Garcia Mine (comprised of La Flor, Armados, San José, and Veta Grande veins) and the Guadalupana Mine (comprised of the La Cantera vein). In late June the Company took delivery of a new jumbo drill and one new scooptram, followed in July and August by the delivery of another new scooptram and a new underground haulage truck. This equipment has allowed the Company to significantly increase both mine production and development since its delivery. As a result management expects the Veta Grande Project to exit 2016 at a production rate of approximately 800 tpd.

Additionally, the Company is currently taking delivery of a 1,250 tpd ball mill and 4,000 tpd crushing circuit. The current plan is to have the 1,250 tpd ball mill installed and ready for commissioning late in the fourth quarter and then follow this with the installation and commissioning of the crushing circuit in the first half of 2017. Management estimates that with the completion of these mill facility modifications the Veta Grande Mine production will increase to 1,500 tpd by the end of 2017.

About Santacruz Silver Mining Ltd.

Santacruz is a Mexican focused silver company with a producing silver mine (Rosario); the right to operate a silver mine and mill facility (Veta Grande); an advanced-stage project (San Felipe) and four exploration properties including the Gavilanes property, El Gachi property, Minillas property and Zacatecas properties. The Company is managed by a technical team of professionals with proven track records in developing, operating and discovering silver mines in Mexico. Our corporate objective is to become a mid-tier silver producer.

'signed'

Arturo Préstamo Elizondo,

President, Chief Executive Officer and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking information

Mehr Nachrichten zur SantaCruz Silver Mining Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.