S&T Bancorp, Inc. Announces Record Third Quarter 2016 Net Income

PR Newswire

INDIANA, Pa., Oct. 20, 2016

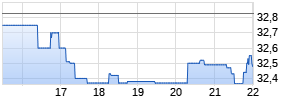

INDIANA, Pa., Oct. 20, 2016 /PRNewswire/ -- S&T Bancorp, Inc. (S&T) (NASDAQ: STBA), the holding company for S&T Bank with locations in Pennsylvania, Ohio and New York, announced today its third quarter 2016 earnings. Third quarter earnings were a record $20.6 million, or $0.59 per diluted share, compared to second quarter of 2016 earnings of $17.1 million, or $0.49 per diluted share, and third quarter of 2015 earnings of $18.6 million, or $0.54 per diluted share.

Third Quarter of 2016 Highlights:

- Earnings per share of $0.59 represents a 20% increase over the prior quarter and a 9.3% increase over the year ago quarter.

- Annualized performance metrics for the third quarter of 2016 were strong, with return on average assets of 1.23%, return on average equity of 9.85% and return on tangible equity of 15.46%.

- Net interest margin improved 2 basis points to 3.46 % and net interest income increased $1.7 million, or 3.5%, to $51.5 million compared to the prior quarter.

- Expenses were well controlled during the quarter, decreasing by $0.3 million, resulting in an efficiency ratio of 51.65% compared to 54.37% in the prior quarter.

- Net loan charge-offs were only $0.9 million, representing 0.07% of average loans on an annualized basis for the third quarter of 2016.

- S&T's Board of Directors approved a 5.3% increase in the quarterly cash dividend to $0.20 per share.

"We are pleased to announce record quarterly net income," said Todd Brice, president and chief executive officer of S&T. "Our strong performance was driven by improvements in all key areas, with higher net interest income and noninterest income, and lower expenses and provision for loan loss."

Net Interest Income

Net interest income increased $1.7 million, or 3.5%, to $51.5 million for the third quarter of 2016 compared to $49.7 million in the prior quarter. Higher net interest income was primarily due to an increase of $101 million in average loans and one additional day in the third quarter compared to the second quarter. Net interest margin on a fully taxable equivalent basis (FTE) increased 2 basis points to 3.46% compared to 3.44% in the prior quarter. Total interest-bearing liability costs were stable at 0.56% for both the third and second quarter of 2016.

Asset Quality

Asset quality continued to improve during the third quarter of 2016. Total nonperforming loans decreased $2.4 million to $40.5 million, or 0.75% of total loans, at September 30, 2016 compared to $42.9 million, or 0.79% of total loans, at June 30, 2016. Net loan charge-offs decreased $2.1 million to $0.9 million for the third quarter of 2016 compared to $3.0 million in the prior quarter. The provision for loan losses decreased $2.3 million to $2.5 million in the third quarter of 2016 compared to $4.8 million in the second quarter of 2016. The allowance for loan losses was $53.8 million, or 0.99% of total loans, at September 30, 2016 compared to $52.2 million, or 0.97% of total loans, at June 30, 2016.

Noninterest Income and Expense

Noninterest income increased $1.0 million to $13.4 million for the third quarter of 2016 compared to $12.4 million in the second quarter of 2016. Mortgage banking increased $0.5 million due to increased volume and the favorable interest rate environment. Debit and credit card fees increased $0.3 million primarily due to higher debit and credit card activity.

Expenses were well controlled in the third quarter with a decrease in noninterest expense of $0.3 million to $34.4 million compared to $34.7 million for the second quarter of 2016. Other expenses decreased $1.4 million, due to lower loan related costs resulting primarily from recovered expenses on impaired loans. Data processing expense decreased $0.6 million due to savings from the renegotiation of a core data processing contract and seasonality of data processing expense. These decreases were offset by an increase in salaries and employee benefits of $1.4 million related to the timing of benefit accruals and higher pension expense.

Financial Condition

Total assets were essentially unchanged at $6.7 billion for both September 30, 2016 and June 30, 2016. Loan growth for the quarter was primarily in consumer loans which increased $29.1 million, or a 9.5% annualized rate, with growth in all consumer categories. Total deposits increased $25.1 million, or a 2.0% annualized rate, with growth in noninterest-bearing demand and money market accounts. Risk-based capital ratios increased this quarter due to earnings retention and a decline in risk weighted assets. All capital ratios remain above the well-capitalized thresholds of federal bank regulatory agencies.

Dividend

The Board of Directors of S&T declared a $0.20 per share cash dividend at its regular meeting held October 16, 2016, representing a 5.3% increase over the prior quarter cash dividend. The dividend is payable on November 17, 2016 to shareholders of record on November 3, 2016.

Conference Call

S&T will host its third quarter 2016 earnings conference call live over the Internet at 1:00 p.m. ET on Thursday, October 20, 2016. To access the webcast, go to S&T's webpage at www.stbancorp.com and click on "Events & Presentations." Select "3rd Quarter 2016 Conference Call" and follow the instructions.

About S&T Bancorp, Inc. and S&T Bank

S&T Bancorp, Inc. is a $6.7 billion bank holding company that is headquartered in Indiana, Pa. and trades on the NASDAQ Global Select Market under the symbol STBA. Its principal subsidiary, S&T Bank, was established in 1902, and operates locations in Pennsylvania, Ohio and New York. For more information visit www.stbancorp.com or www.stbank.com.

This information may contain forward-looking statements regarding future financial performance which are not historical facts and which involve risks and uncertainties. Actual results and performance could differ materially from those anticipated by these forward-looking statements. Factors that could cause such a difference include, but are not limited to, general economic conditions, change in interest rates, deposit flows, loan demand, and asset quality, including real estate and other collateral values and competition. In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), S&T management uses and this press release contains or references, certain non-GAAP financial measures, such as net interest income on a fully taxable equivalent basis. S&T believes these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial services industry. Although S&T believes that these non-GAAP financial measures enhance investors' understanding of S&T's business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. A reconciliation of these non-GAAP financial measures is presented in the attached selected financial data spreadsheet. This information should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K for S&T Bancorp, Inc. and subsidiaries.

| S&T Bancorp, Inc. | |||||||||

| Consolidated Selected Financial Data | |||||||||

| Unaudited | |||||||||

| | |||||||||

| | |||||||||

| | 2016 | | 2016 | | 2015 | | |||

| | Third | | Second | | Third | | |||

| (dollars in thousands, except per share data) | Quarter | | Quarter | | Quarter | | |||

| INTEREST INCOME | | | | | | | |||

| Loans, including fees | $53,956 | | $52,019 | | $49,578 | | |||

| Investment securities: | | | | | | | |||

| Taxable | 2,570 | | 2,580 | | 2,522 | | |||

| Tax-exempt | 907 | | 915 | | 988 | | |||

| Dividends | 375 | | 336 | | 581 | | |||

| Total Interest Income | 57,808 | | 55,850 | | 53,669 | | |||

| | | | | | | | |||

| INTEREST EXPENSE | | | | | | | |||

| Deposits | 5,119 | | 5,029 | | 3,275 | | |||

| Borrowings and junior subordinated debt securities | 1,234 | | 1,113 | | 798 | | |||

| Total Interest Expense | 6,353 | | 6,142 | | 4,073 | | |||

| | | | | | | | |||

| NET INTEREST INCOME | 51,455 | | 49,708 | | 49,596 | | |||

| Provision for loan losses | 2,516 | | 4,848 | | 3,206 | | |||

| Net Interest Income After Provision for Loan Losses | 48,939 | | 44,860 | | 46,390 | | |||

| | | | | | | | |||

| NONINTEREST INCOME | | | | | | | |||

| Securities (losses) gains, net | | — | | | — | | | — | |

| Service charges on deposit accounts | 3,208 | | 3,065 | | 3,069 | | |||

| Debit and credit card fees | 3,163 | | 2,869 | | 2,996 | | |||

| Wealth management fees | 2,565 | | 2,630 | | 2,814 | | |||

| Insurance fees Werbung Mehr Nachrichten zur S&T Bancorp Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||