Recon Technology Reports Fiscal 2018 First Quarter and First Three Months Financial Results

PR Newswire

BEIJING, Nov. 15, 2017

BEIJING, Nov. 15, 2017 /PRNewswire/ -- Recon Technology, Ltd. (NASDAQ: RCON), ("Recon" or the "Company"), a China-based independent solutions integrator in the oilfield service, electric power and coal chemical industries, today reported its financial results for the first quarter and first three months of fiscal year 2018, which ended September 30, 2017.

First Quarter FY2018 Financial Highlights (all comparable to the prior year period):

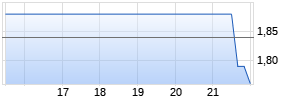

- Total revenues for the first quarter of FY2018 increased by 56% to RMB 12.2 million ($1.8 million);

- Gross profit for the first quarter of FY2018 was RMB 2.1 million ($0.3 million);

- Gross profit margin increased to 17.2%, largely due to continued higher margin generated from automation business;

- Net loss attributable to Recon for the first quarter of FY2018 was RMB 6.7 million ($1.0 million), or RMB 0.97 ($0.15) per basic and diluted share, compared to net loss attributable to Recon of RMB 5.5 million, or RMB 0.92 per basic and diluted share, for the same period of last fiscal year;

- Non-GAAP net loss attributable to common shareholders excluding certain non-cash expenses was RMB 2.3 million ($341,093), or RMB 0.33 ($0.05) per basic and diluted share, for the first quarter of FY2018, compared to non-GAAP net loss attributable to common shareholders of RMB 3.2 million, or RMB 0.54 per basic and diluted share, for the same period last fiscal year.

Management Commentary

Mr. Shenping Yin, Chairman and CEO of Recon stated, "Revenue of this quarter is mainly driven by equipment and integration of automation business, the basic two legs of Recon, as we stated in our open letter to shareholders (Refer to the following link for more details: http://recon.mediaroom.com/2017-06-12-Recon-Outlines-2017-Strategy-and-China-Oil-and-Gas-Market-Outlook-in-Open-Letter-to-Shareholders?pagetemplate=widgetpopup). As most of our projects of waste water treatments are currently in progress, we expect revenue of this business line will contribute significantly to the overall revenues in the coming quarters. The rally in crude prices helped generate positive sentiment and we did see more investments in oil extraction by our clients and thus more opportunities for Recon. Based on our current estimation, we remain confident in our ability to achieve our goal of a minimum 30% increase in revenues for this fiscal year. This estimation was also mentioned by the open letter to shareholders as above."

Mr. Yin continued, "Our Gansu subsidiary construction projects, focusing on oilfield sewage treatment and oily sludge disposal treatment project with an annual processing capacity of 60,000 tons of oily waste ("Project"), is also proceeding well (Refer to the following link for more details: http://recon.mediaroom.com/2017-11-07-Recon-Announces-Investment-to-Expand-Services-for-Oily-Sludge-Market-in-Yumen-Oilfield?pagetemplate=widgetpopup). Total investment of this project is expected to about RMB100 million. Approximately RMB5.4 million, which mainly consisted of the purchase of land use right and prepayment for equipments and construction supplies, has been devoted into the first stage of construction. We expect this project to be operational by June 2018 and annual revenue to be generated by the Project is estimated to be over RMB 50 million."

Results of Operations

The following unaudited condensed consolidated results of operations which include the Company's wholly owned subsidiaries, their variable interest entities ("VIEs") and VIE's subsidiaries. The VIEs are Nanjing Recon Technology Co. Ltd ("Nanjing Recon"), Beijing BHD Petroleum Technology Co, Ltd ("BHD"). BHD owns 100% of the equity interest of Huang Hua BHD Petroleum Equipment Manufacturing Co. LTD ("HH BHD") and 51% of the equity interest of Gansu BHD Environmental Technology Ltd ("Gansu BHD").

On November 25, 2016, the Company began reporting under Rule 3b-4 of the Securities Exchange Act of 1934 as a foreign private issuer, including the filing of annual reports on Form 20-F and current reports on Form 6-K. By this current report on Form 6-K, Recon has provided selected fiscal 2018 first quarter results, with greater detail on its first quarter financial results.

The translation has been made at the rate of US$ 1.0: RMB 6.65, the approximate exchange rate prevailing on September 30, 2017.

| Selected Financial Highlights in RMB | |||||||

| | 3 months ended | | 3 months ended | ||||

| Sales | | 7,802 | | | 12,171 | ||

| Cost of Revenues | | 6,710 | | | 10,077 | ||

| Gross Profit | | 1,092 | | | 2,094 | ||

| Gross Profit Margin | | 14% | | | 17% | ||

| | | | | | | ||

| Loss from Operations | | (5,484) | | | (6,868) | ||

| | | | | | | ||

| Net Loss Attributable to Recon Technology, Ltd | | (5,461) | | | (6,745) | ||

| Non U.S. GAAP Net Loss attributable to common stockholders | | (3,224) | | | (2,270) | ||

| Basic and Weighted Average Number of Diluted Common Shares | | 5,957,733 | | | 6,919,001 | ||

| Basic and Diluted Loss per Share | | (0.92) | | | (0.97) | ||

| Non U.S. GAAP adjusted loss per basic and diluted share | | (0.54) | | | (0.33) | ||

| 3 MONTHS ENDED SEPTEMBER 30, 2017 UNAUDITED FINANCIAL RESULTS | ||||||||||||||

| Revenue | ||||||||||||||

| | ||||||||||||||

| | For the Three Months Ended | |||||||||||||

| | September 30, | |||||||||||||

| | | | | | | | Percentage | |||||||

| | 2016 | | 2017 | | Increase | | Change | |||||||

| Hardware and software | ¥ | 7,802,103 | | ¥ | 12,170,614 | | ¥ | 4,368,511 | | | 56.0% | |||

| Total revenues | ¥ | 7,802,103 | | ¥ | 12,170,614 | | ¥ | 4,368,511 | | | 56.0% | |||

| | ||||||||||||||

| Total revenues for the three months ended September 30, 2017 were approximately ¥12.2 million ($1.8 million), | ||||||||||||||

| | ||||||||||||||

| | For the Three Months Ended | |||||||||||||

| | September 30, | |||||||||||||

| | | | | | Increase / | | Percentage | |||||||

| | 2016 | | 2017 | | (Decrease) | | Change | |||||||

| Automation product and software | ¥ | 2,076,736 | | ¥ | 5,513,331 | | ¥ | 3,436,595 | | | 165.5% | |||

| Equipment and accessories | | 3,803,918 | | | 6,462,925 | | | 2,659,007 | | | 69.9% | |||

| Waste water treatment products | | 1,921,449 | | | 194,358 | | | (1,727,091) | | | (89.9)% | |||

| Total revenue - Hardware and software | ¥ Werbung Mehr Nachrichten zur Recon Technology Ltd Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||||||||