Power Corporation Reports Fourth Quarter and 2020 Financial Results

Canada NewsWire

MONTRÉAL, March 17, 2021

| Readers are referred to the sections "Non-IFRS Financial Measures and Presentation" and "Forward-Looking Statements" at the end of this release. |

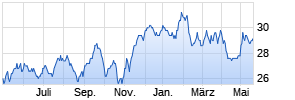

MONTRÉAL, March 17, 2021 /CNW Telbec/ - Power Corporation of Canada (Power Corporation or the Corporation) (TSX: POW) today reported earnings results for the fourth quarter and twelve months ended December 31, 2020.

Power Corporation

Consolidated results for the period ended December 31, 2020

HIGHLIGHTS

- The Corporation's net asset value (NAV) per share [1] was $41.27 at December 31, 2020, compared with $34.94 at September 30, 2020, an increase of 18.1%.

- The Corporation was one of only three Canadian companies, along with Great-West Lifeco Inc. (Lifeco), to earn an A ("Leadership") rating on CDP's 2020 Climate Change Questionnaire, a rating which identifies the global leaders in the management of carbon, climate change risks and low-carbon opportunities.

- The Corporation announced its notice of intention to make a normal course issuer bid on February 23, 2021.

- On December 31, 2020, Empower Retirement, a subsidiary of Lifeco, completed the acquisition of the retirement services business of Massachusetts Mutual Life Insurance Company (MassMutual) for US$2.3 billion, strengthening Empower Retirement's position as the second-largest retirement services provider in the U.S. based on assets under administration and number of retirement plan participants.

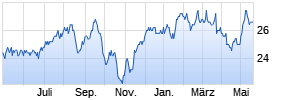

- Lifeco's assets under administration were $2.0 trillion at December 31, 2020, an increase of 21% from December 31, 2019 primarily due to the MassMutual transaction.

- IGM Financial Inc. (IGM) reported record-high assets under management and advisement of $240.0 billion, up 6.7% in the quarter and 10.3% in the year (excluding $30.3 billion in net business acquisitions).

- On December 31, 2020, Mackenzie Financial Corporation (Mackenzie) acquired GLC Asset Management Group Ltd. (GLC), a wholly owned subsidiary of Lifeco. This transaction allows Mackenzie to become one of Canada's largest asset managers and expands its distribution reach.

- The merger between Pargesa Holding SA (Pargesa) and Parjointco Switzerland SA, a wholly owned subsidiary of Parjointco SA, was completed on November 20, 2020. Accordingly, Pargesa was delisted from the Swiss Stock Exchange.

- Sagard Holdings Inc. (Sagard Holdings) has recently announced:

- First closing of its second credit fund, Sagard Credit II, with commitments of US$650 million. Fundraising efforts will continue in 2021.

- Launch of its Canadian Private Equity platform, a strategy which will focus on the middle market in Canada.

- Final closing of Sagard Healthcare Royalty Partners, LP (SHRP) with commitments totalling approximately US$725 million.

- Power Sustainable Capital Inc. (Power Sustainable) announced the launch of the Power Sustainable Energy Infrastructure Partnership, a $1 billion investment platform dedicated to the North American renewable energy sector, on January 19, 2021.

- The Lion Electric Co. (Lion) announced it intends to combine with Northern Genesis Acquisition Corp. (Northern Genesis), a public corporation, on November 30, 2020.

| [1] | NAV, NAV per share, adjusted net earnings and adjusted net earnings per share are non-IFRS measures. See the Non-IFRS Financial Measures and Presentation section later in this news release. ARIVA.DE Börsen-GeflüsterKurse

|

Net Asset Value

Net asset value per share represents management's estimate of the fair value of participating equity. Net asset value is the fair value of the combined Power Financial Corporation (Power Financial) and Power Corporation non-consolidated balance sheet less their net debt and preferred shares. Refer to the Net Asset Value section later in this news release for a reconciliation to the non-consolidated combined balance sheet.

The Corporation's net asset value per share was $41.27 at December 31, 2020, compared with $34.94 at September 30, 2020, representing an increase of 18.1%.

| | (in millions of Canadian dollars, | December 31, 2020 | September 30, 2020 | Variation % |

| Publicly Traded | Lifeco | 18,825 | 16,139 | 17 |

| IGM | 5,105 | 4,516 | 13 | |

| GBL | 2,870 | 2,678 | 7 | |

| | | 26,800 | 23,333 | 15 |

| | | | | |

| Alternative Asset | Sagard Holdings [1] | | | |

| Investments | 1,298 | 1,292 | − | |

| Power Sustainable [1] | | | | |

| Power Pacific | 1,142 | 977 | 17 | |

| Power Energy Corporation | 730 | 735 | (1) | |

| | | 3,170 | 3,004 | 6 |

| | | | | |

| Other | China AMC [2] | 715 | 709 | 1 |

| Standalone businesses [3] | 1,351 | 625 | 116 | |

| Other assets and investments | 548 | 624 | (12) | |

| Cash and cash equivalents | 1,226 | 1,216 | 1 | |

| | Gross asset value | 33,810 | 29,511 | 15 |

| | Liabilities and preferred shares | (5,859) | (5,884) | − |

| | Net asset value | 27,951 | 23,627 | 18 |

| | Shares outstanding (millions) | 677.2 | 676.3 | |

| | Net asset value per share | 41.27 | 34.94 | 18 |

| [1] | The management companies of the investment funds are included at their carrying value. |

| [2] | China Asset Management Co., Ltd. |

| [3] | Includes Lumenpulse Group Inc. (Lumenpulse), Peak Achievement Athletics Inc. (Peak), Lion and GP Strategies. |

Power Corporation's Ownership in Publicly Traded Operating Companies

| | | | | | |

| | | Shares held [1] | | Share price | |

| | Ownership [1] | December 31, 2020 | September 30, 2020 | ||

| Lifeco | 66.8 Werbung Mehr Nachrichten zur Power Corporation Of Canada Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||