Ormat Technologies Reports 2013 First Quarter Results

PR Newswire

RENO, Nevada, May 7, 2013

RENO, Nevada, May 7, 2013 /PRNewswire/ -- Ormat Technologies, Inc. (NYSE: ORA) today announced financial results for the first quarter of 2013.

Financial highlights & Recent Developments:

- Total revenues amounted to $121.7 million; a 8.0% decrease from the first quarter of 2012, mainly due to a reduction in the electricity segment revenues of $9.3 million related to our SO#4 PPAs in California and a net loss of $4.6 million related to derivative instruments;

- Product segment strength continues with a Backlog of $224 million as of May 7, 2013.

- Replaced two SO#4 PPAs tied to natural gas at the Mammoth complex with up to 21.5 MW of new long-term fixed price PPAs, with higher rates.

- Net loss amounted to $1.9 million or $0.04 per share compare to net income of $8.0 million or $0.17 per share; net income excluding one-time termination fee of $9.0 million related to the replacement of Mammoth PPAs and a $4.6 million loss related to oil and gas derivative instruments was $11.6 million or $0.26 per share;

- Received $35.7 million in cash as a result of the ORTP tax equity transaction.

- Reached commercial operation for the 36 MW Olkaria III Plant 2 in Kenya; increasing our worldwide generating capacity to 611 MW;

- Signed the Sarulla agreements and secured our role as a supplier for approximately $254 million;

- Signed a 20-year PPA with Southern California Public Power Authority (SCPPA) for our 16 MW Wild Rose project in Nevada;

Commenting on the results, Dita Bronicki, Chief Executive Officer of Ormat, stated: "Since the beginning of the year, we have achieved significant milestones that will further improve both segments performance. Our 2013 organic growth plan to reach 637 MW is on schedule. The 36 MW Plant 2 in the Olkaria III complex in Kenya reached commercial operation bringing the total capacity of our portfolio to 611 MW, and we are progressing with the construction of Heber Solar and Wild Rose projects that we expect to complete by the end of 2013. In 2014, we plan to bring on line plant 3 at the Olkaria III complex increasing its capacity to approximately 100 MW."

"The power generation rose 4.2% over the same period last year, driven mainly by our McGinness Hills power plant, which began operations in July 2012. Additionally, we continue to take action to increase earnings and reduce the effect that natural gas prices have on our financial performance. We replaced two of the SO#4 PPAs with new long-term fixed price PPAs for our Mammoth complex in California. The improved energy rates under the new PPAs are secured until 2033 and will significantly improve the Mammoth complex profitability."

"Our product segment continued to benefit from strong demand for new geothermal power plants and other power generating units. The strong backlog coupled with recent positive development in the Sarulla project provide enhanced visibility on our product revenue for the coming few years."

Ms. Bronicki added, "We reaffirm our 2013 guidance and expect total revenues to be between $515 million to $535 million with electricity revenues between $335 million and $345 million and product segment revenues between $180 million and $190 million."

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Ormat Technologies | ||

|

MD3RYA

| Ask: 1,18 | Hebel: 4,73 |

| mit moderatem Hebel |

Zum Produkt

| |

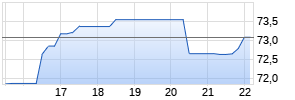

Kurse

|

Financial Summary

For the three months ended March 31, 2013, total revenues decreased 8.0 percent to $121.7 million from $132.4 million in the first quarter of 2012. Product revenues increased slightly to $50.6 million from $50.1 million in the three months ended March 31, 2012. Electricity revenues decreased 13.6 percent to $71.1 million from $82.2 million in the three months ended March 31, 2012. The decrease was mainly due to a reduction of $9.3 million in revenues due to the transition to short run avoided cost pricing linked to natural gas prices in our SO#4 PPAs in California and a net loss of $4.6 million loss related to derivative instruments; this decrease was offset by revenue contribution from Tuscarora and McGinness power plants.

Operating income for the three months ended March 31, 2013 was $8.5 million, compared to operating income of $25.7 million for the three months ended March 31, 2012. The decrease was primarily due to a decrease in our gross margin as a result of the reduction in the electricity revenues and a one-time termination fee related to the replacement of two Mammoth SO#4 PPAs included in the selling and marketing expenses.

For the three months ended March 31, 2013, the company reported a net loss of $1.9 million, or $0.04 per share, compared to net income of $8.0 million or $0.17 per share for the three months ended March 31, 2012. Net income excluding a one-time termination fee of $9.0 million related to the replacement of two Mammoth PPAs and $4.6 million loss related to derivative instruments was $11.6 million or $0.26 per share;

Adjusted EBITDA for the three months ended March 31, 2013 was $45.7 million, compared to $51.5 million for the three months ended March 31, 2012. The reconciliation of GAAP net cash provided by operating activities to Adjusted EBITDA and additional cash flows information is set forth below in this release.

Net cash provided by operating activities was $18.2 million in the three months ended March 31, 2013, compared to $41.9 million in the three months ended March 31, 2012.

As of March 31, 2013, cash, cash equivalents and a short-term bank deposit were $60.6 million. In addition, as of March 31, 2013, the company had available committed lines of credit with commercial banks aggregating $440.9 million, of which $152.9 million was unused.

Conference Call Details

Ormat will host a conference call to discuss its financial results and other matters discussed in this press release at 9:00 A.M. EDT on Wednesday, May 8, 2013. The call will be available as a live, listen-only webcast at www.ormat.com. During the webcast, management will refer to slides that will be posted on the web site. The slides and accompanying webcast can be accessed through the Webcast & Presentations in the Investor Relations section of Ormat's website.

A webcast will be available approximately two hours after the conclusion of the live call. A replay of the call will be available beginning approximately at 1 p.m. EDT on May 8, 2013 through 11:59 p.m. EDT, May 15, 2013. To access the replay, interested investors should call: (800) 585-8367 (U.S. and Canada) or (404) 537-3406 (International) and enter the Reply code: 55307557.

About Ormat Technologies

With over four decades of experience, Ormat Technologies, Inc. is a leading geothermal company and the only vertically integrated company solely engaged in geothermal and recovered energy generation (REG). The company owns, operates, designs, manufactures and sells geothermal and REG power plants primarily based on the Ormat Energy Converter – a power generation unit that converts low-, medium- and high-temperature heat into electricity. With over 82 U.S. patents, Ormat's power solutions have been refined and perfected under the most grueling environmental conditions. Ormat's flexible, modular solutions for geothermal power and REG are ideal for the vast range of resource characteristics. The company has engineered and built power plants, which it currently owns or has supplied to utilities and developers worldwide, totaling approximately 1600 MW of gross capacity. Ormat's current generating portfolio of 611 MW (net) includes in the U.S.; in Guatemala; in Kenya; and, in Nicaragua.

Ormat's Safe Harbor Statement

Information provided in this press release may contain statements relating to current expectations, estimates, forecasts and projections about future events that are "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally relate to Ormat's plans, objectives and expectations for future operations and are based upon its management's current estimates and projections of future results or trends. Actual future results may differ materially from those projected as a result of certain risks and uncertainties. For a discussion of such risks and uncertainties, see "Risk Factors" as described in Ormat Technologies, Inc.'s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 11, 2013 and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 8, 2012.

These forward-looking statements are made only as of the date hereof, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

| Ormat Technologies Contact: | Investor Relations Contact: |

| Dita Bronicki | Todd Fromer/Rob Fink |

| CEO | KCSA Strategic Communications |

| 775-356-9029 | 212-896-1215 (Todd) /212-896-1206 (Rob) |

| Ormat Technologies, Inc. and Subsidiaries | |||||

| Condensed Consolidated Statements of Operations | |||||

| For the Three-Month Periods Ended March 31, 2013 and 2012 | |||||

| (Unaudited) | |||||

| | | | | | |

| | Three Months Ended March 31, | ||||

| | 2013 | | 2012 | ||

| | | | | | |

| | (In thousands, except per share data) | ||||

| Revenues: | | | | | |

| Electricity | $ | 71,102 | | $ | 82,247 |

| Product | | 50,608 | | | 50,105 |

| Total revenues | | 121,710 | | | 132,352 |

| Cost of revenues: | | | | | |

| Electricity | | 56,937 | | | 57,931 |

| Product | | 37,041 | | | 34,627 |

| Total cost of revenues | | 93,978 | | | 92,558 |

| Gross margin | | 27,732 | | | 39,794 |

| Operating expenses: | | | | | |

| Research and development expenses | | 1,000 | | | 1,048 |

| Selling and marketing expenses | | 11,571 | | | 4,922 |

| General and administrative expenses | | 6,650 | | | 7,314 |

| Write-off of unsuccessful exploration activities | | — | | | 768 |

| Operating income | | 8,511 | | | 25,742 |

| Other income (expense): | | | | | |

| Interest income | | 41 | | | 388 |

| Interest expense, net | | (15,863) | | | (14,878) |

| Foreign currency translation and transaction gains (losses) | | 1,682 | | | 14 |

| Income attributable to sale of tax benefits | | 3,532 Werbung Mehr Nachrichten zur Ormat Technologies Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |||