Original-Research: Landi Renzo S.p.A. - von GBC AG

Einstufung von GBC AG zu Landi Renzo S.p.A.

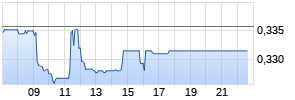

Unternehmen: Landi Renzo S.p.A. ISIN: IT0004210289

Anlass der Studie: Research study (Initial Coverage) Empfehlung: Buy Kursziel: 0.98 EUR Letzte Ratingänderung: Analyst: Marcel Goldmann, Cosmin Filker

The specialist for alternative fuels and hydrogen/biogas infrastructures; Leading market positioning in alternative fuel systems and gas and hydrogen infrastructures; Strong market trend towards biomethane and hydrogen ensures high growth potential in gas/hydrogen mobility and infrastructure business of the technology group; Promising growth strategy should enable dynamic growth in revenue and earnings; Target price: 0.98 EUR; Rating: Buy

Revenue and earnings development 2021

The Landi Renzo Group's past financial year was characterised by significant growth, the first-time consolidation of the SAFE & CEC joint venture and the Metatron acquisition, as well as the ongoing corona pandemic.

In the past financial year, the Landi Renzo Group was able to continue on its growth path with a dynamic increase in Group revenue of 69.9% to EUR 241.99 million (PY: EUR 142.46 million). In particular, the first-time consolidation of the SAFE & CEC Group (infrastructure business; with revenue contribution through consolidation of EUR 69.08 million), after Landi Renzo had previously gained control over the joint venture (51.0% stake), led to this leap in growth. Adjusted for the consolidation effects of SAFE & CEC and the Metatron acquisition (revenue contribution through consolidation: EUR 6.10 million), there was a significant increase in revenue for the core business (Green Transportation), also on a comparable basis to the previous year, increasing by 17.1% to EUR 166.82 million. In terms of the regional distribution of revenues, the Landi Renzo Group generated 55.5% of its consolidated revenues of EUR 241.99 million in Europe in the past financial year. The remaining revenues were generated in North and South America (15.9%) and Asia and the rest of the world (28.6%).

Through the acquisition of Metatron in the summer of 2021, Landi Renzo has significantly strengthened its Green Transportation segment in the area of gas and hydrogen technologies for the propulsion of medium and heavy-duty commercial vehicles (Mid & Heavy Duty) and at the same time significantly expanded its geographical presence and customer base in this business segment.

Significant increases were also achieved at the operating result level. EBITDA (Adj. EBITDA) adjusted for special and non-recurring costs rose significantly by 82.3% to EUR 14.61 million (previous year: EUR 8.02 million) compared to the previous year. The same applies to the reported EBITDA, which jumped by 89.8% to EUR 12.62 million (previous year: EUR 6.65 million). The adjusted EBITDA margin (Adj. EBITDA margin) increased by slightly to 6.0% (previous year: 5.6%). An even more positive margin development was countered by negative effects, mainly in the form of high material price inflation and supply chain problems, from the ongoing corona pandemic.

The earnings contribution from the first-time full consolidation of the infrastructure business of SAFE & CEC (Adj. EBITDA contribution: EUR 7.40 million) had a particularly positive effect on the operating result.

Taking into account depreciation, financing and tax effects, the net result (after minority interests) for the past financial year was EUR -0.98 million, which is a significant improvement over the previous year (PY: EUR -7.66 million). The net result was positively influenced by a positive consolidation gain from the fair value valuation of SAFE & CEC (EUR 8.80 million).

The company also announced that on a pro forma basis (i.e. assuming full consolidation of Metatron, SAFE & CEC, and the Indian JV for a full 12 months), it would have achieved consolidated sales of EUR 297.8 million and adjusted EBITDA (Adj. EBITDA) of EUR 22.3 million in the past financial year. The Clean Tech Solutions business segment accounted for more than 30.0% of this revenue.

Furthermore, in August of this year, the company announced the successful completion of their subscription period (subscribed volume: EUR 57.1 million) for its initiated capital measure with a volume of up to EUR 60.0 million. With the help of this cash inflow, the company refinanced acquisitions (Metatron, Idro Meccanica) and, at the same time, strengthened its capital structure in order to advance the further growth-oriented development of the company. In the course of this capital increase, a new strategic shareholder, Itaca/Tamburi, was added to the shareholder base to support the majority shareholder, the Landi family, in the long-term development of the company. The current CEO, Christiano Musi, also participated in the capital increase as a co-investor.

Overall, the Landi Renzo Group succeeded in returning to its growth path last year and benefited from significant recovery effects in its core business. The first-time consolidation of their infrastructure business clearly boosted their revenue and earnings situation. The negative influences of the still ongoing corona pandemic has stood in the way of an even more positive operational development. On a strategic level, the company has also significantly expanded its product portfolio with gas and hydrogen solutions through the targeted acquisitions of Metatron and Idro Meccanica, thereby substantially strengthening its market position. In addition, the previously installed base of gas compressors (>6,000) was increased by around 150 hydrogen compressors as part of their inorganic growth.

Revenues and earnings forecasts

The Landi Renzo Group generally pursues a growth-oriented corporate strategy. Key elements of this strategy are the further expansion of the two divisions 'Green Transportation' and 'Clean Tech Solutions'.

In the core business 'Green Transportation' (components and systems for gas and hydrogen mobility), growth is to be driven forward with the help of an increased focus on emerging markets, such as India with strong growth in gas mobility in this region and new markets. In addition, the Group intends to strongly expand segment growth by expanding its business in the field of gas and hydrogen mobility for medium and heavy trucks (the so-called Mid & Heavy Duty segment). Market experts see a high growth potential for gas and hydrogen technologies in this niche in particular, as gas-related technologies in this area represent the only practicable alternative to traditional diesel-powered trucks to date.

In the second division, 'Clean Tech Solutions' (compressor solutions for infrastructures), the company aims to further expand its infrastructure business with a focus on natural gas, biogas and hydrogen infrastructures (including biogas and hydrogen filling stations, etc.). The expansion of the compressor installation base associated with the compressor business should also significantly increase the related high-margin maintenance and service revenues and thus lead to lucrative recurring after-sales revenues.

M&As are also an important factor in the company's strategy. The company always keeps the option open to expand or strengthen its technological competence and customer base as well as its geographical presence through targeted transactions.

For the current business year, Landi Renzo expects improvements in consolidated sales and earnings compared to the previous year. Despite this merely qualitative outlook for the current business period, the technology company has published a long-term sales and earnings plan (new Business Plan 2022 to 2025). According to this, the technology group expects average annual revenue growth of 15.0% (CAGR) and double-digit EBITDA growth of 25.0% (CAGR) until 2025, whereby inorganic growth effects are not included in this planning.

In Q1 2022, the company already achieved significant growth in revenue (+100.1% to EUR 66.90 million) and EBITDA (+350.0% to EUR 1.80 million) and thus already achieved a positive opening quarter. According to our estimates, the order backlog in the Clean Tech Solutions segment amounted to around EUR 85.0 million at the end of the first quarter and thus provided a good starting point for further growth.

Against the background of this good positioning, the high innovative strength and the promising growth strategy of the company, we also expect dynamic sales development in the coming years. Both the 'Green Transportation' segment and the 'Clean Tech Solutions' business field should be able to record significant sales growth in the future due to their strong market positions. Accordingly, we expect an increase in revenue to EUR 287.74 million (previous year: EUR 241.99 million) for the current financial year. For the following financial years 2023 and 2024, we expect a further increase in revenue to EUR 323.88 million and EUR 357.17 million respectively.

Parallel to their dynamic growth in revenue, we expect significant improvements in earnings in the coming years. Significant earnings growth should be achieved primarily through the increased expansion of the components and systems business for medium and heavy trucks and the expansion of their infrastructure business (primarily thanks to the highmargin after-sales business) since these business areas generally have significantly higher margins than the previous core business (improved revenue mix). In addition, we assume that the high scalability of the business model and expected volume effects will lead to a disproportionate increase in future earnings at all earnings levels. In addition, we expect significant synergy effects from the integration of the companies acquired in the past and from the even closer integration of the complementary business areas, which should also significantly boost future earnings development. According to its own information, Landi Renzo expects annual savings of EUR 6.00 to 7.00 million from the group integration of the acquired companies. Furthermore, expected price adjustments due to higher procurement prices should also positively influence their future margin development.

Specifically, we calculate an EBITDA of EUR 16.77 million for the current financial year. In the following financial years 2024 and 2025, a further increase in earnings to EUR 30.61 million and EUR 38.50 million respectively should be possible due to the onset of economies of scale/ volume effects, synergies and a further improvement in the revenue mix. In parallel, we expect a gradual increase in the EBITDA margin from 5.2% in 2021 to 10.8% in 2024.

Overall, we believe that the Landi Renzo Group is well positioned in both business segments to benefit from the growth area of 'Green Mobility' and the increased investments in gas and hydrogen infrastructures (due to the biogas and hydrogen boom). This should enable the company to dynamically continue on its growth path and achieve a disproportionately high development of earnings.

Die vollständige Analyse können Sie hier downloaden: http://www.more-ir.de/d/25205.pdf

Kontakt für Rückfragen GBC AG Halderstrasse 27 86150 Augsburg 0821 / 241133 0 research@gbc-ag.de ++++++++++++++++ Offenlegung möglicher Interessenskonflikte nach § 85 WpHG und Art. 20 MAR. Beim oben analysierten Unternehmen ist folgender möglicher Interessenkonflikt gegeben: (6a,11); Einen Katalog möglicher Interessenkonflikte finden Sie unter: http://www.gbc-ag.de/de/Offenlegung +++++++++++++++ Date (time) of completion: 29/08/2022 (10:08 am) Date (time) of first distribution: 29/08/2022 (11:00 am)

-------------------übermittelt durch die EQS Group AG.-------------------

Für den Inhalt der Mitteilung bzw. Research ist alleine der Herausgeber bzw. Ersteller der Studie verantwortlich. Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte.