ONE Gas Announces Fourth-quarter and Full-year 2016 Financial Results

PR Newswire

TULSA, Okla., Feb. 22, 2017

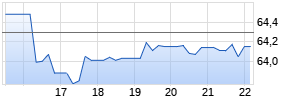

TULSA, Okla., Feb. 22, 2017 /PRNewswire/ -- ONE Gas, Inc. (NYSE: OGS) today announced its fourth-quarter and full-year 2016 financial results, which included diluted earnings per share of $0.80 and $2.65, respectively.

Highlights include:

- Fourth-quarter 2016 net income increased to $42.3 million, or $0.80 per diluted share, compared with $39.2 million, or $0.74 per diluted share, in the fourth quarter 2015;

- Full-year 2016 net income also increased to $140.1 million, or $2.65 per diluted share, compared with $119.0 million, or $2.24 per diluted share, in 2015;

- Full-year 2016 capital expenditures were $309.0 million, compared with $294.3 million in 2015;

- On Jan. 17, 2017, the company increased its quarterly dividend 7 cents to 42 cents per share, or $1.68 per share on an annualized basis, payable on Mar. 10, 2017, to shareholders of record at close of business Feb. 24, 2017; and

- On Jan. 17, 2017, the company announced that its 2017 net income is expected to be in the range of $152 million to $162 million, or $2.87 to $3.07 per diluted share.

"Additional investment in our infrastructure, along with continuing to focus on efficient operations, led to positive results for the fourth quarter and full year," said Pierce H. Norton II, president and chief executive officer. "This strategy enables the company to provide the safe and reliable service our customers expect, while also delivering value for shareholders."

FOURTH-QUARTER 2016 FINANCIAL PERFORMANCE

ONE Gas reported operating income of $78.5 million in the fourth quarter 2016, compared with $73.9 million in the fourth quarter 2015.

Net margin increased by $12.0 million compared with fourth quarter 2015, which primarily reflects:

- A $11.4 million increase from new rates primarily in Oklahoma and Texas; and

- A $1.2 million increase due to higher sales, net of weather normalization and due primarily to colder weather in the fourth quarter 2016 compared with 2015.

Fourth-quarter 2016 operating costs were $127.6 million, compared with $123.1 million in the fourth quarter 2015, which primarily reflects:

- A $4.0 million increase in environmental remediation costs;

- A $2.5 million increase in outside service expenses; and

- A $1.0 million increase in information technology expenses; offset partially by

- A $4.0 million decrease in employee-related expenses.

Fourth-quarter 2016 depreciation and amortization expense was $37.3 million, compared with $34.4 million in the fourth quarter 2015, due primarily to an increase in depreciation expense from capital investments placed in service.

Capital expenditures were $77.7 million for the fourth quarter 2016, compared with $94.6 million in the fourth quarter 2015.

Fourth-Quarter 2016 Key Statistics: More detailed information is listed in the tables.

- Actual heating degree days across the company's service areas were 3,208 in the fourth quarter 2016, 19 percent warmer than normal and 3 percent colder than the same period last year;

- Actual heating degree days in the Oklahoma service area were 1,113 in the fourth quarter 2016, 14 percent warmer than normal and 4 percent colder than the same period last year;

- Actual heating degree days in the Kansas service area were 1,557 in the fourth quarter 2016, 18 percent warmer than normal and 8 percent colder than the same period last year;

- Actual heating degree days in the Texas service area were 538 in the fourth quarter 2016, 29 percent warmer than normal and 13 percent warmer than the same period last year;

- Residential natural gas sales volumes were 35.8 billion cubic feet (Bcf) in the fourth quarter 2016, down 2 percent compared with the same period last year;

- Total natural gas sales volumes were 47.4 Bcf in the fourth quarter 2016, down 1 percent compared with the same period last year;

- Natural gas transportation volumes were 53.2 Bcf in the fourth quarter 2016, down 2 percent compared with the same period last year; and

- Total natural gas volumes delivered were 100.6 Bcf in the fourth quarter 2016, down 1 percent compared with the same period last year.

FULL-YEAR 2016 FINANCIAL PERFORMANCE

Full-year 2016 operating income was $269.1 million, compared with $239.1 million in 2015.

Net margin increased by $43.7 million compared with last year, which primarily reflects:

- A $44.0 million increase from new rates primarily in Oklahoma and Texas;

- A $3.8 million increase attributed to residential customer growth primarily in Oklahoma and Texas; and

- A $1.3 million increase in ad-valorem recoveries in Kansas, which is offset with higher regulatory amortization expense; offset partially by

- A $1.8 million decrease due to lower sales volumes, net of weather normalization, primarily from warmer weather in 2016 compared with 2015;

- A $1.7 million decrease due primarily to lower transportation volumes from weather-sensitive customers in Kansas and Oklahoma; and

- A $1.1 million decrease in CNG revenues in Oklahoma.

2016 operating costs were $472.5 million, compared with $469.6 million in 2015, which primarily reflects:

- A $4.0 million increase in environmental remediation costs;

- A $2.7 million increase in legal-related expenses; and

- A $0.9 million increase in employee-related expenses; offset partially by

- A $2.9 million decrease primarily from the deferral of certain information technology services incurred with the separation from ONEOK, which was approved as a regulatory asset in Oklahoma; and

- A $1.5 million decrease in information technology expenses.

Full-year 2016 depreciation and amortization expense was $143.8 million, compared with $133.0 million in 2015, due primarily to an increase in depreciation expense from capital investments placed in service.

Full-year 2016 capital expenditures were $309.0 million, compared with $294.3 million in 2015, due primarily to increased expenditures for system integrity and extending service to new areas.

The company ended the fourth quarter 2016 with $14.7 million of cash and cash equivalents, $145.0 million in commercial paper, no short-term borrowings and $1.5 million in letters of credit, leaving $553.5 million of credit available under its $700 million credit facility. The total debt-to-capitalization ratio at Dec. 31, 2016, was 41 percent.

REGULATORY UPDATE

Oklahoma

In January 2016, the Oklahoma Corporation Commission approved a joint stipulation and settlement agreement for an increase in Oklahoma Natural Gas' base rates of $29,995,000. The agreement includes the continuation, with certain modifications, of the Performance-Based Rate Change tariff, established in 2009.

Kansas

In May 2016, Kansas Gas Service filed a request with the Kansas Corporation Commission (KCC) for an increase in base rates, reflecting system investments and operating costs necessary to maintain the safety and reliability of its natural gas distribution system. In October 2016, Kansas Gas Service reached a settlement agreement with all parties for an increase in base rates of $8.1 million, net of the Gas System Reliability Surcharge, resulting in a total base rate increase of $15.5 million. The agreement is a "black-box" settlement, meaning the parties agreed to a specific revenue number but no specific return on equity. The KCC issued an order approving the unanimous settlement agreement in November 2016, with new rates effective Jan. 1, 2017.

Texas

Central Texas Service Area:

In June 2016, Texas Gas Service filed a rate case requesting an increase in revenues for its Central Texas and South Texas service areas. The filing included a request to consolidate the South Texas service area with the Central Texas service area. In October 2016, all parties to the filing reached a settlement agreement for an increase in revenues of $6.8 million for the new consolidated service area. New rates were effective November 2016 for customers in the incorporated cities of the former Central Texas service area and the unincorporated areas of the new consolidated Central Texas area. New rates were effective January 2017 for the incorporated cities of the former South Texas service area.

West Texas Service Area:

In March 2016, Texas Gas Service filed a rate case requesting an increase in revenues for its El Paso, Dell City and Permian service areas. The filing included a request to consolidate these three service areas into a new West Texas service area. In September 2016, the Railroad Commission of Texas approved consolidation of the three service areas into the new West Texas service area and a base rate increase of $8.8 million. In October 2016, rates went into effect for all service areas, except for the incorporated cities in the former Permian service area. Texas Gas Service filed for these new rates with the former Permian cities in October 2016 and the rates became effective in December 2016.

Other Service Areas:

In the normal course of business, Texas Gas Service has received approval for increases totaling $2.0 million in 2016 for rate relief under the Gas Reliability Infrastructure Program and cost-of-service adjustments in other Texas jurisdictions to address investments in rate base and changes in expenses.

2017 FINANCIAL GUIDANCE

On Jan. 17, 2017, ONE Gas announced that its 2017 net income is expected to be in the range of $152 million to $162 million, or $2.87 to $3.07 per diluted share.

Capital expenditures are expected to be $350 million in 2017. More than 70 percent of these expenditures are targeted for system integrity and replacement projects.

Rate base in 2017 is expected to average $3.1 billion with 41 percent in Oklahoma, 32 percent in Kansas and 27 percent in Texas. ONE Gas expects to achieve an 8.1 percent return on equity in 2017, which is calculated consistent with utility ratemaking in each jurisdiction.

EARNINGS CONFERENCE CALL AND WEBCAST

The ONE Gas executive management team will conduct a conference call on Thurs., Feb. 23, 2017, at 11 a.m. Eastern Standard Time (10 a.m. Central Standard Time). The call also will be carried live on the ONE Gas website.

To participate in the telephone conference call, dial 888-334-3001, pass code 3701607, or log on to www.onegas.com.

If you are unable to participate in the conference call or the webcast, a replay will be available on the ONE Gas website, www.onegas.com, for 30 days. A recording will be available by phone for seven days. The playback call may be accessed at 888-203-1112, pass code 3701607.

LINK TO EARNINGS TABLES

http://www.onegas.com/~/media/OGS/Earnings/2016/OGS_2016Q4YEEarnings-1dwkK3EDWdE.ashx

ONE Gas, Inc. (NYSE: OGS) is a stand-alone, 100-percent regulated natural gas utility, and trades on the New York Stock Exchange under the symbol "OGS." ONE Gas is included in the S&P MidCap 400 Index, and is one of the largest natural gas utilities in the United States.

ONE Gas provides natural gas distribution services to more than 2 million customers in Oklahoma, Kansas and Texas.

ONE Gas is headquartered in Tulsa, Okla., and its divisions include Oklahoma Natural Gas, the largest natural gas distributor in Oklahoma; Kansas Gas Service, the largest in Kansas, and Texas Gas Service, the third largest in Texas, in terms of customers.

Its largest natural gas distribution markets by customer count are Oklahoma City and Tulsa, Okla.; Kansas City, Wichita and Topeka, Kan.; and Austin and El Paso, Texas. ONE Gas serves residential, commercial, industrial, transportation and wholesale customers in all three states.

For more information, visit the website at http://www.ONEGas.com.

Some of the statements contained and incorporated in this news release are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. The forward-looking statements relate to our anticipated financial performance, liquidity, management's plans and objectives for our future operations, our business prospects, the outcome of regulatory and legal proceedings, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. The following discussion is intended to identify important factors that could cause future outcomes to differ materially from those set forth in the forward-looking statements.

Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "should," "goal," "forecast," "guidance," "could," "may," "continue," "might," "potential," "scheduled," and other words and terms of similar meaning.

One should not place undue reliance on forward-looking statements, which are applicable only as of the date of this news release. Known and unknown risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements. Those factors may affect our operations, markets, products, services and prices. In addition to any assumptions and other factors referred to specifically in connection with the forward-looking statements, factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement include, among others, the following:

- our ability to recover operating costs and amounts equivalent to income taxes, costs of property, plant and equipment and regulatory assets in our regulated rates;

- our ability to manage our operations and maintenance costs;

- changes in regulation of natural gas distribution services, particularly those in Oklahoma, Kansas and Texas;

- the economic climate and, particularly, its effect on the natural gas requirements of our residential and commercial industrial customers;

- competition from alternative forms of energy, including, but not limited to, electricity, solar power, wind power, geothermal energy and biofuels;

- conservation efforts of our customers;

- variations in weather, including seasonal effects on demand, the occurrence of storms and disasters, and climate change;

- indebtedness could make us more vulnerable to general adverse economic and industry conditions, limit our ability to borrow additional funds and/or place us at competitive disadvantage compared with competitors;

- our ability to secure reliable, competitively priced and flexible natural gas transportation and supply, including decisions by natural gas producers to reduce production or shut-in producing natural gas wells and expiration of existing supply, and transportation and storage arrangements that are not replaced with contracts with similar terms and pricing;

- the mechanical integrity of facilities operated;

- operational hazards and unforeseen operational interruptions;

- adverse labor relations;

- the effectiveness of our strategies to reduce earnings lag, margin protection strategies and risk mitigation strategies;

- our ability to generate sufficient cash flows to meet all our cash needs;

- changes in the financial markets during the periods covered by the forward-looking statements, particularly those affecting the availability of capital and our ability to refinance existing debt and fund investments and acquisitions;

- actions of rating agencies, including the ratings of debt, general corporate ratings and changes in the rating agencies' ratings criteria;

- changes in inflation and interest rates;

- our ability to recover the costs of natural gas purchased for our customers;

- impact of potential impairment charges;

- volatility and changes in markets for natural gas;

- possible loss of LDC franchises or other adverse effects caused by the actions of municipalities;

- payment and performance by counterparties and customers as contracted and when due;

- changes in existing or the addition of new environmental, safety, tax and other laws to which we and our subsidiaries are subject;

- the uncertainty of estimates, including accruals and costs of environmental remediation;

- advances in technology;

- population growth rates and changes in the demographic patterns of the markets we serve;

- acts of nature and the potential effects of threatened or actual terrorism, including cyber attacks or breaches of technology systems and war;

- the sufficiency of insurance coverage to cover losses;

- the effects of our strategies to reduce tax payments;

- the effects of litigation and regulatory investigations, proceedings, including our rate cases, or inquiries;

- changes in accounting standards;

- changes in corporate governance standards;

- discovery of material weaknesses in our internal controls;

- our ability to attract and retain talented employees, management and directors;

- declines in the discount rates on, declines in the market value of the debt and equity securities of, and increases in funding requirements for, our defined benefit plans;

- the ability to successfully complete merger, acquisition or divestiture plans, regulatory or other limitations imposed as a result of a merger, acquisition or divestiture, and the success of the business following a merger, acquisition or divestiture;

- the final resolutions or outcomes with respect to our contingent and other corporate liabilities related to the natural gas distribution business and any related actions for indemnification made pursuant to the Separation and Distribution Agreement with ONEOK; and

- the costs associated with increased regulation and enhanced disclosure and corporate governance requirements pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other factors could also have material adverse effects on our future results. These and other risks are described in greater detail in Item 1A, Risk Factors, in our Annual Report. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Other than as required under securities laws, we undertake no obligation to update publicly any forward-looking statement whether as a result of new information, subsequent events or change in circumstances, expectations or otherwise.

| Analyst Contact: | Andrew Ziola |

| | 918-947-7163 |

| Media Contact: | Jennifer Rector |

| | 918-947-7571 |

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/one-gas-announces-fourth-quarter-and-full-year-2016-financial-results-300411826.html

SOURCE ONE Gas, Inc.

Mehr Nachrichten zur One Gas Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.