NexPoint Residential Trust, Inc. Reports Third Quarter Results

PR Newswire

DALLAS, Nov. 10, 2016

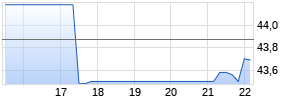

DALLAS, Nov. 10, 2016 /PRNewswire/ -- NexPoint Residential Trust, Inc. (NYSE:NXRT) reported financial results for the quarter ended September 30, 2016.

Third Quarter 2016 Highlights

- NXRT paid a third quarter dividend of $0.206 per share of NXRT common stock on September 30, 2016.

- On November 7, 2016, NXRT's board of directors approved a quarterly dividend of $0.220 per share of NXRT common stock, a $0.014 per share, or 6.8% increase, over the prior quarter's dividend. The dividend is payable on December 30, 2016 to stockholders of record on December 15, 2016.

- Net income totaled $8.8 million, or earnings of $0.33 per common share, which included $9.6 million of gain on sales of four properties, Colonial Forest, Park at Blanding, Willowdale Crossings and Jade Park, and depreciation and amortization of $8.7 million, compared to net income of $16.6 million, or earnings of $0.69 per common share, for the second quarter of 2016, which included $16.4 million of gain on sales of three properties, Meridian, Park at Regency, and Mandarin Reserve, and depreciation and amortization of $8.1 million.

- FFO¹, net of four dispositions made during the quarter, totaled $6.9 million, or $0.32 per common share, compared to $7.2 million, or $0.34 per common share, for the second quarter of 2016.

- AFFO¹ totaled $16.2 million, or $0.76 per common share, which included $8.0 million, the Company's share of gain on sales of four properties. This compared to $22.5 million, or $1.06 per common share, for the second quarter of 2016, which included $14.8 million, the Company's share of gain on sales of three properties.

- NOI¹ was $17.1 million for the third quarter of 2016, compared to $17.4 million for the second quarter of 2016.

- Total revenues were $33.1 million for the quarter, compared to $33.7 million for the second quarter of 2016.

- Same Store total revenues, NOI and occupancy increased 10.2%, 12.8%, and 48 basis points to 93.9%, respectively, as compared to the third quarter of 2015.

- The weighted average effective monthly rent per unit across all 36 properties held as of September 30, 2016, consisting of 11,626 units, was $848, while physical occupancy was 93.6%.

- NXRT completed upgrades on 538 units and leased 569 upgraded units during the third quarter of 2016, achieving a 21.2% ROI on those units. Since inception, we have completed 4,118 upgrades and achieved a $85 average monthly rental increase per unit, equating to a 21.2% ROI on all units leased through September 30, 2016.

- On June 15, 2016, the Company's Board of Directors authorized the repurchase of up to $30.0 million of the Company's common stock. During the third quarter, NXRT purchased 76,214 shares of its common stock at a total cost of approximately $1,435,000, or $18.83 per share. As of November 9, 2016, the Company had purchased a total of 233,346 shares of its common stock under the share repurchase program at a total cost of approximately $4,279,000, or $18.34 per share.

- As mentioned above, the Company completed the disposition of four properties during the quarter: Colonial Forest and Park at Blanding in Jacksonville, Florida, Willowdale Crossings in Frederick, Maryland, and Jade Park in Daytona Beach, Florida for a combined $69.7 million of gross sale proceeds. The Company recognized a $9.6 million gain on the sales while the investments returned an approximate cumulative levered IRR of 17.27% and an approximate equity multiple of 1.39x. The exit from the entire Jacksonville portfolio yielded a 31.5% IRR and 1.62x equity multiple over a 24 month hold period.

1AFFO, FFO and NOI are non-GAAP measures. For reconciliations of AFFO, FFO and NOI to net income and a discussion of why we consider these non-GAAP measures useful, see the "Definitions and Reconciliations" section of this release.

"Having fixed $400 million, or 73.2% of our floating rate debt (swapping LIBOR for 0.9956% for five years), successfully disposing of seven properties, buying back approximately $4.3 million of the Company's stock and redeploying capital into more attractive opportunities in West Palm Beach and Phoenix, we feel it is an appropriate time to increase our quarterly dividend and target a payout ratio of 60 to 65% of our annual funds from operations (FFO). We remain bullish on the internal growth prospects within our existing portfolio and investment opportunities in workforce housing across our core markets and look forward to continuing to deliver value and results for our residents and our stockholders," stated, NXRT Chairman and President, Jim Dondero.

Third Quarter Financial Results

The Company recorded net income in the third quarter of 2016 of $8.8 million, which included gain on sales of real estate of $9.6 million and depreciation and amortization of $8.7 million. This compared to a net loss of $(0.9) million for the third quarter of 2015, which included depreciation and amortization of $9.1 million. For the nine months ended September 30, 2016, NXRT had net income of $25.7 million, which included $25.9 million of gain on sales of real estate and $26.4 million of depreciation and amortization. This compared to net loss of $(9.0) million for the nine months ended September 30, 2015, which included depreciation and amortization of $30.8 million.

For the three months ended September 30, 2016, FFO was $6.9 million, or $0.32 per common share, and AFFO was $16.2 million, or $0.76 per common share. For the nine months ended September 30, 2016, FFO was $22.7 million, or $1.07 per common share, and AFFO was $48.0 million, or $2.25 per common share.

The change in the Company's net income (loss) for the quarter ended September 30, 2016 as compared to the quarter ended September 30, 2015, primarily relate to strong year-over-year performance of our same store portfolio and the disposition of four properties during the third quarter of 2016, as compared to no dispositions during the third quarter of 2015.

Same Store Properties Operating Results

The Company's Same Store property pool at September 30, 2016 included 32 properties totaling 10,292 units, or approximately 88.5% of the Company's 11,626 units. These Same Store properties represented approximately 85.7% of NXRT's NOI for the quarter ended September 30, 2016.

Same Store total revenues, NOI, and occupancy increased 10.2%, 12.8%, and 48 basis points to 93.9%, respectively, in the third quarter of 2016, compared to the third quarter of 2015.

Disposition of Assets

During the third quarter, the Company completed the disposition of Colonial Forest and Park at Blanding in Jacksonville, Florida, Willowdale Crossings in Frederick, Maryland, and Jade Park in Daytona Beach, Florida for a combined $69.7 million of gross sale proceeds, generating an approximate cumulative levered IRR of 17.27% and an approximate equity multiple of 1.39x. Net proceeds from the dispositions were used to retire existing debt, buy back stock and to partially fund the Company's acquisition of The Colonnade (through a 1031 like-kind exchange of Willowdale Crossings) subsequent to quarter end. The exit from the Jacksonville portfolio yielded a 31.5% IRR and 1.62x equity multiple over a 24 month hold period.

Value-Add Programs

For the three months ended September 30, 2016 and 2015, we completed full and partial interior rehabs on 538 and 696 units, respectively. For the nine months ended September 30, 2016 and 2015, we completed full and partial interior rehabs on 1,475 and 1,543 units, respectively.

The following table sets forth a summary of our capital expenditures related to our value-add program for the three and nine months ended September 30, 2016 and 2015 (in thousands):

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | | ||||||||||

| Rehab Expenditures | | 2016 | | | 2015 | | | 2016 | | | 2015 | | ||||

| Interior (1) | | $ | 2,439 | | | $ | 4,773 | | | $ | 7,136 | | | $ | 8,122 | |

| Exterior and common area | | | 1,746 | | | | 8,213 | | | | 8,078 | | | | 18,059 | |

| Total rehab expenditures | | $ | 4,185 | | | $ | 12,986 | | | $ | 15,214 | | | $ | 26,181 | |

| | |

| (1) | Includes total capital expenditures during the period on completed and in-progress interior rehabs. |

Bridge Facility

During the nine months ended September 30, 2016, the Company paid down the entire $29.0 million of principal on its bridge facility, which was funded with $18.0 million of the Company's share of proceeds, net of distributions to noncontrolling interests, from the sales of Park at Regency and Mandarin Reserve, $9.0 million of proceeds drawn under the Company's Credit Facility and $2.0 million of cash on hand. The Bridge Facility was retired on August 2, 2016.

Interest Rate Swap Agreements

In order to fix a portion of, and mitigate the risk associated with, the Company's floating rate indebtedness (without incurring substantial prepayment penalties or defeasance costs typically associated with fixed rate indebtedness when repaid early or refinanced), the Company, through the OP, has entered into four interest rate swap transactions with KeyBank (the "Counterparty") with a combined notional amount of $400.0 million. The interest rate swaps effectively replace the floating interest rate (one-month LIBOR) with a weighted average fixed rate of 0.9956%. During the term of these interest rate swap agreements, the Company is required to make monthly fixed rate payments of 0.9956%, on a weighted average basis, on the notional amounts, while the Counterparty is obligated to make monthly floating rate payments based on one-month LIBOR to the Company referencing the same notional amounts. The Company has designated these interest rate swaps as cash flow hedges of interest rate risk.

The following table contains summary information regarding the Company's outstanding interest rate swaps (dollars in thousands):

| Trade Date | | Effective Date | | Termination Date | | Notional Amount | | | Fixed Rate | | | Floating Rate Option (1) | ||

| May 13, 2016 | | July 1, 2016 | | June 1, 2021 | | $ | 100,000 | | | | 1.1055 | % | | One-month LIBOR |

| June 13, 2016 | | July 1, 2016 | | June 1, 2021 | | | 100,000 | | | | 1.0210 | % | | One-month LIBOR |

| June 30, 2016 | | July 1, 2016 | | June 1, 2021 | | | 100,000 | | | | 0.9000 | % | | One-month LIBOR |

| August 12, 2016 | | September 1, 2016 | | June 1, 2021 | | | 100,000 | | | | 0.9560 | % | | One-month LIBOR |

| | | | | | | $ | 400,000 | | | | 0.9956 | % | (2) | |

| | |

| (1) | As of September 30, 2016, one-month LIBOR was 0.5311%. |

| (2) Werbung Mehr Nachrichten zur NexPoint Residential Trust Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |