New Affinity Rewards Credit Card From BetterInvesting

PR Newswire

MADISON HEIGHTS, Mich., Jan. 7, 2013

MADISON HEIGHTS, Mich., Jan. 7, 2013 /PRNewswire/ -- BetterInvesting and UMB CardPartner (cardpartner.com) have joined forces to launch the BetterInvesting affinity Visa® Platinum Rewards credit card.

For the life of the card program, BetterInvesting will receive a portion of every purchase. The BetterInvesting Visa® Platinum Rewards card offers qualified cardholders exceptional benefits including no annual fee* and a low APR*.

"Using the BetterInvesting Visa® affinity Platinum Rewards credit card for everyday purchases is an easy way for people to support BetterInvesting's mission of investment education," said Kamie Zaracki, CEO of BetterInvesting.

The BetterInvesting Visa® Platinum Rewards card is just one of many benefits available to BetterInvesting members. Other features of membership include easy-to-use online mutual fund and stock analysis tools; investing classes and webinars; stock studies prepared by members of the BetterInvesting community; discounts on subscriptions on publications and software; commission-free trading via Folio Investing, BetterInvesting Magazine and strong support from volunteers and other members of the BetterInvesting community.

Find out more about the BetterInvesting Visa® Platinum Rewards card and apply online by visiting http://www.cardpartner.com/pro/app/bi.

About CardPartner

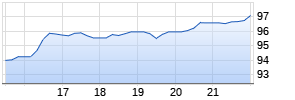

CardPartner (www.cardpartner.com) specializes in helping U.S.-based membership organizations and charities create affinity credit card programs. CardPartner is owned and operated by UMB Bank, n.a., the lead bank of UMB Financial Corporation (NASDAQ: UMBF) – a financial services holding company headquartered in Kansas City, Mo. Visa credit cards offered through CardPartner are issued by UMB Bank, n.a., and the bank approves credit decisions, grants credit, and manages the administration for card programs offered by CardPartner. For more information about UMB, visit www.umb.com UMB does not provide the other member benefits delivered by BetterInvesting to its members.

About BetterInvesting

BetterInvesting is a national nonprofit organization that has been empowering individual investors since 1951. Founded in Detroit, the association (formerly known as National Association of Investors Corporation) was borne out of the conviction that anyone can become a successful long-term investor by following commonsense investing practices. BetterInvesting has helped more than 5 million people become better, more informed investors by providing webinars, in-person events, easy-to-use online tools for analyzing stocks and mutual funds, a monthly magazine and a community of volunteers and like-minded investors. For more information about BetterInvesting, visit its website at www.betterinvesting.org or call toll-free (877) 275-6242. For additional BetterInvesting data and news releases, visit the Media Center at www.betterinvesting.org/mediacenter.

*Purchases and balances transfers made within the first 6 months from the date the account is open will have a monthly periodic rate of 0.00%, which corresponds to an Annual Percentage Rate of 0.00%. Thereafter, the Purchase Advance rate is a variable of 9.74% + Prime, which is currently 12.99% as of January 1, 2013. After 6 months, any amount remaining unpaid from any Purchases or Balance Transfers will bear interest at the rate for Purchase Advances applicable to your Account at that time. We may end your 0.00% APR and immediately apply the Purchase Advance rate of 12.99%, if you make a late payment. Minimum Finance Charge is $.50. Balance Transfer Fee after the first 6 months will be 3% of the amount of the Balance Transfer, with a $15 minimum and no maximum. Foreign Transaction Fee when making purchases outside the US will be 2% of the US dollar amount of each Cash Advance or Purchase. Cash Advance Fee is 3% of the amount of the Cash Advance, with a $15 minimum and a $50 maximum considered a Purchase Advance. The balance transferred must be from an existing account with an issuer other than UMB Bank, or its Affiliates.

SOURCE BetterInvesting

Mehr Nachrichten zur UMB Financial Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.