Mesa Labs Reports 8% Increase in Second Quarter Revenues

PR Newswire

LAKEWOOD, Colo., Nov. 5, 2013

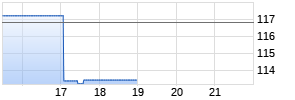

LAKEWOOD, Colo., Nov. 5, 2013 /PRNewswire/ -- Mesa Laboratories, Inc. (NASDAQ: MLAB) (we, us, our, "Mesa" or the "Company") today reported an eight percent increase in revenues for the second quarter ended September 30, 2013.

Revenues for the second quarter increased eight percent to $12,676,000 as compared to $11,706,000 for the same quarter last year. Net income for the second quarter decreased 14 percent to $1,932,000 or $0.54 per diluted share of common stock as compared to $2,248,000 or $0.64 per diluted share of common stock for the same quarter last year. Net income for the second quarter was impacted by a net $638,000 (before tax) of unusual items, comprised of a $1,106,000 expense for uncollected sales tax liabilities which was partially offset by a gain of $468,000 related to the sale of the Nusonics product line. The net impact of these unusual items (after tax) reduced our net income per diluted share of common stock by $0.12 for the second quarter.

Revenues for the six months ended September 30, 2013 increased seven percent to $23,894,000 as compared to $22,266,000 for the same period last year. Net income for the six months ended September 30, 2013 decreased 13 percent to $3,792,000 or $1.06 per diluted share of common stock as compared to $4,348,000 or $1.23 per diluted share of common stock for the same period last year. Net income for the six months ended was impacted by the same second quarter unusual items noted above. The net impact of these unusual items (after tax) reduced our net income per diluted share of common stock by $0.11 for the six months ended September 30, 2013.

On a non-GAAP basis, adjusted net income (which excludes the non-cash impact of amortization of intangible assets, net of tax) for the second quarter decreased 13 percent to $2,337,0001 or $0.65 per diluted share of common stock as compared to $2,684,000 or $0.76 per diluted share of common stock for the same quarter last year. Adjusted net income for the six months ended September 30, 2013 decreased 11 percent to $4,574,000 or $1.28 per diluted share of common stock as compared to $5,167,000 or $1.46 per diluted share of common stock for the same period last year. Adjusted net income for the second quarter and the six months ended September 30, 2013 was impacted by the same second quarter unusual items noted above.

"Mesa experienced solid revenue growth during the first six months of fiscal year 2014", commented John J. Sullivan, President and CEO. "Organic growth in our Biological Indicators ("BI") division of four percent was complemented by 10 percent growth in our Instruments division, driven primarily by the Bios and SureTorque acquisitions, partially offset by the divestiture of our Nusonics line of instruments. Additionally gross profit increased by five percent for the six month period, however gross profit margin percentage for the same period decreased by two percentage points. This was due primarily to a BI product replacement initiative in the first quarter and the application of purchase accounting on assets associated with the SureTorque acquisition in the second quarter. We expect our gross profit margin percentage to recover to normal levels during the second half of the fiscal year."

"Mesa's operating income decreased by $973,000 and $1,150,000 for the second quarter and the six months ended September 30, 2013, respectively as compared to the same periods last year", continued John Sullivan. "The decrease was primarily due to the $1,106,000 (before tax) expense associated with uncollected sales tax liabilities associated with prior periods. This expense was accrued for in the second quarter, although the actual cash outlay will likely be spread out over several quarters (if not years) into the future. It is however important to note that without this unusual expense, operating income would have been relatively flat for both the second quarter and six month period. We believe that the unusual sales tax expense is behind us and as a result, we expect Mesa's profitability to return to normal levels in the second half of the fiscal year."

1 The non-GAAP measures of adjusted net income and adjusted net income per diluted share are defined to exclude the non-cash impact of amortization of intangible assets, net of tax. A reconciliation between these non-GAAP measures and their GAAP counterparts is set forth in the table below, along with additional information regarding their use.

Financial Summary

| Statements of Income (Unaudited) | ||||

| | ||||

| (Amounts in thousands, except per share data) | Three months ended | Six months ended | ||

| | 2013 | 2012 | 2013 | 2012 |

| Revenues | $ 12,676 | $ 11,706 | $ 23,894 | $ 22,266 |

| Cost of revenues | 5,076 | 4,458 | 9,497 | 8,562 |

| Gross profit | 7,600 | 7,248 | 14,397 | 13,704 |

| Operating expenses | 5,085 | 3,760 | 8,839 | 6,996 |

| Operating income | 2,515 | 3,488 | 5,558 | 6,708 |

| Other income (expense), net | 423 | (36) | 395 | (70) |

| Earnings before income taxes | 2,938 | 3,452 | 5,953 | 6,638 |

| Income taxes | 1,006 | 1,204 | 2,161 | 2,290 |

| Net income | $ 1,932 | $ 2,248 | $ 3,792 | $ 4,348 |

| | | | | |

| Net income per share (basic) | $ 0.57 | $ 0.67 | $ 1.11 | $ 1.30 |

| Net income per share (diluted) | 0.54 | 0.64 | 1.06 | 1.23 |

| | | | | |

| Weighted average common shares outstanding: | | | | |

| Basic | 3,412 | 3,349 | 3,403 | 3,343 |

| Diluted | 3,592 | 3,538 | 3,568 | 3,531 |

| Balance Sheets | ||

| | ||

| (Amounts in thousands) | September 30, | March 31, |

| Cash and cash equivalents | $ 3,424 | $ 4,006 |

| Other current assets | 15,177 | 15,449 |

| Total current assets | 18,601 | 19,455 |

| Property, plant and equipment, net | 7,772 Werbung Mehr Nachrichten zur Mesa Labs Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. | |