| Lyxor International Asset Management (U35G ) LYXOR ETF - Liquidation - Lyxor Core iBoxx $ Treasuries 3-5Y (DR) UCITS ETF 22-Apr-2020 / 17:23 GMT/BST Dissemination of a Regulatory Announcement that contains inside information according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement. MULTI UNITS LUXEMBOURG Société d'investissement à capital variable Registered Office : 28-32 Place de la Gare L-1616 Luxembourg RCS Luxembourg B 115 129 (the "Company") _______________________________________________________________

NOTICE TO THE SHAREHOLDERS OF THE SUB-FUND Lyxor Core iBoxx $ Treasuries 3-5Y (DR) UCITS ETF

Terms not specifically defined herein shall have the same meaning as in the Articles of Incorporation and in the latest Prospectus of the Company or any supplement.

Luxembourg, April 8, 2020,

Dear Shareholder,

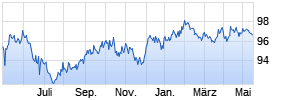

The board of directors of the Company (the "Board") considers that the value of the net assets in the sub-fund Lyxor Core iBoxx $ Treasuries 3-5Y (DR) UCITS ETF (the "Sub-Fund") has decreased to an amount determined by the Board to be below the minimum level for the Sub-Fund to be operated in an economically efficient manner. Considering that the level of assets is not sufficient to carry out an efficient replication of the Markit iBoxx USD Treasuries 3-5 Mid Price TCA TRI Index and in accordance with article 34 of the Articles of Incorporation of the Company, the Board has decided to liquidate the Sub-Fund as specified in the below:

Please note that any fees or costs incurred within the context of the liquidation will be borne by the Sub-Fund. Further, the Board has decided to suspend the Subscription and the Redemption of Shares within the Sub-Fund as from April 23, 2020. Until such date, the Shareholders may therefore continue to request the Redemption of their Shares free of charge on the Primary Market in accordance with the provisions of the Prospectus. For Shares sold on any exchange where the Sub-Fund is listed, market intermediaries may charge broker fees, and taxes may be levied if applicable. The delisting of the Shares from all of the stock exchanges on which they are listed will be effective as from April 22, 2020 (after the close of the stock exchanges). Finally, the Board has decided that all the remaining Shareholders will be compulsory redeemed as of April 29, 2020 at the final Net Asset Value of April 29,2020 calculated on April 30, 2020. Any liquidation proceeds which cannot be distributed to Shareholders will be deposited on their behalf with the Caisse de Consignation in Luxembourg. This liquidation will be reflected in the Prospectus at the next opportunity. For any questions, do not hesitate to contact Lyxor Client Services at the following contact details: Phone number +33 1 42 13 42 14 - Email address: client-services-etf@lyxor.com. Yours sincerely, For the Board.

We would like to let the Shareholders know about the existence of the "MULTI UNITS LUXEMBOURG - Lyxor Core iBoxx $ Treasuries 5-7Y (DR) UCITS ETF" (ISIN: LU1407888996) as a potential alternative to their current investments.

The Sub-Fund "MULTI UNITS LUXEMBOURG - Lyxor Core iBoxx $ Treasuries 5-7Y (DR) UCITS ETF" (ISIN: LU1407888996) will change its Benchmark Index and its name in the near future. It will become the "MULTI UNITS LUXEMBOURG - Lyxor Core US Treasury 3-7Y (DR) UCITS ETF" with the "Bloomberg Barclays US Treasury 3-7 Year Index" as a new benchmark index. The aim of this change is to provide the Shareholders with an exposure to the new benchmark index that grant a broader exposure to its relevant underlying bond market.

Nevertheless, the characteristics of this sub-fund are different than the Sub-Fund being liquidated, as a result the Shareholders should read carefully the "Risk Profile" section of the sub-fund's prospectus and the "Risk and Return Profile" section of its Key Information for Investors Document (KIID) and get advice from their financial advisor in order to get the most appropriate solution corresponding to their situation and objectives.

For any questions, do not hesitate to contact Lyxor Client Services at the following contact details: Phone number +33 1 42 13 42 14 - Email address: client-services-etf@lyxor.com

|

| ISIN: | LU1237527673, LU1237527673 |

| Category Code: | MSCH |

| TIDM: | U35G |

| Sequence No.: | 59869 |

| EQS News ID: | 1027773 |

| End of Announcement | EQS News Service |

| |