Lincoln Financial Group Collaborates With Leading Firms To Study Annuity Policyholder Behavior

PR Newswire

RADNOR, Pa., May 28, 2013

RADNOR, Pa., May 28, 2013 /PRNewswire/ -- Lincoln Financial Group (NYSE: LNC) today announced it has collaborated with global professional services company Towers Watson (NYSE, NASDAQ: TW) and global management consulting firm Oliver Wyman, to implement two advanced analytic modeling techniques in its study of variable annuity policyholder behavior. These techniques are intended to help guide and improve assumptions setting, valuation, risk management and new product development.

"At the core of Lincoln's annuity franchise is disciplined product development and risk management, which enables us to create sustainable products that balance financial integrity with customer value," said Mark Konen, President, Insurance and Retirement Solutions, Lincoln Financial Group. "Lincoln is bolstering this approach through the use of advanced analytics that bring greater clarity around factors that influence policy lapse rates and client income utilization. These techniques will move our industry forward as they have done in other segments, such as Property & Casualty, and we believe we are among the first in the Variable Annuity space to utilize them."

Working with Towers Watson, Lincoln has implemented Predictive Modeling in its analysis of linkage between lapse behavior and variables such as age, gender, and policy size and duration. Predictive modeling is the synthesis and transformation of data into actionable information.

"With traditional experience studies, data is most frequently segmented across one or two risk variables at a time. In contrast, Predictive Modeling techniques analyze multiple risk variables simultaneously, allowing Lincoln to better attribute behavior across a broader set of variables," said Guillaume Briere-Giroux, Senior Consultant, Towers Watson. "By using Predictive Modeling, life insurers get deeper and more robust insights from their experience data, which in turn allows for improved pricing analyses and more precise risk management."

Through its work with Oliver Wyman, Lincoln combined predictive analytics with new Attribution-Based Modeling techniques to refine its understanding of two key aspects of policyholder income utilization: income start time; and withdrawal amounts. This utilization study advances Lincoln's understanding of how interaction between different policyholder characteristics and behaviors affects policy-level value.

"By using emerging experience data, customer science and new modeling techniques, Lincoln has enhanced its ability to translate observed withdrawal behavior into robust valuation estimates for variable annuity Guaranteed Living Benefits," said Aaron Sarfatti, partner, Oliver Wyman. "This multi-faceted approach reflects the leading edge in how companies represent guarantee utilization in liability models, improving valuation precision, governance and stakeholder communication."

Disclosure

ARIVA.DE Börsen-Geflüster

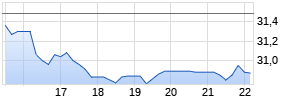

Kurse

|

|

|

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity's value fluctuates with the market value of the underlying investment options, and all assets accumulate tax-deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59 1/2, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment options. Please call 888-868-2583 for a free prospectus. Read it carefully before investing or sending money. Products and features are subject to state availability.

Lincoln variable insurance and annuity products are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker/dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Contracts and policies sold in New York are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY, and distributed by Lincoln Financial Distributors, Inc., a broker/dealer.

All contract and rider guarantees, including those for optional benefits, fixed subaccount crediting rates, or annuity payout rates, are backed by the claims-paying ability of the issuing insurance company. They are not backed by the broker/dealer or insurance agency from which this annuity is purchased, or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

About Lincoln Financial Group

Lincoln Financial Group is the marketing name for Lincoln National Corporation (NYSE:LNC) and its affiliates. With headquarters in the Philadelphia region, the companies of Lincoln Financial Group had assets under management of $186 billion as of March 31, 2013. Through its affiliated companies, Lincoln Financial Group offers: annuities; life, group life, disability and dental insurance; employer-sponsored retirement plans; savings plans; and comprehensive financial planning and advisory services. For more information, including a copy of our most recent SEC reports containing our balance sheets, please visit www.LincolnFinancial.com.

About Towers Watson

Towers Watson (NYSE, NASDAQ: TW) is a leading global professional services company that helps organizations improve performance through effective people, risk and financial management. The company offers solutions in the areas of benefits, talent management, rewards, and risk and capital management. Towers Watson has 14,000 associates around the world and is located on the web at towerswatson.com.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 50+ cities across 25 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm's 3,000 professionals help clients optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh & McLennan Companies (NYSE: MMC). For more information, visit www.oliverwyman.com.

LCN: 201305-2081077

(Logo: http://photos.prnewswire.com/prnh/20050830/LFLOGO )

SOURCE Lincoln Financial Group

Mehr Nachrichten zur Lincoln National Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.