Kirby Corporation Announces 2016 Third Quarter Results

PR Newswire

HOUSTON, Oct. 26, 2016

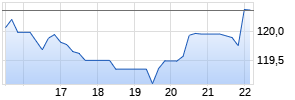

HOUSTON, Oct. 26, 2016 /PRNewswire/ -- Kirby Corporation ("Kirby") (NYSE: KEX) today announced net earnings attributable to Kirby for the third quarter ended September 30, 2016 of $32.0 million, or $0.59 per share, compared with $56.8 million, or $1.04 per share, for the 2015 third quarter. Consolidated revenues for the 2016 third quarter were $434.7 million compared with $532.6 million reported for the 2015 third quarter.

David Grzebinski, Kirby's President and Chief Executive Officer, commented, "Our results in the third quarter reflected trends across our markets that were largely as expected. In our inland marine transportation market, barge utilization was in the low-to-mid 80% range, down from the high-80% to low-90% range during the second quarter. The third quarter was aided somewhat by increased demand for refined petroleum product and black oil movements following a series of customer supply chain disruptions late in the quarter. In the coastal marine transportation market, tank barge utilization was in the low-to-mid 80% range during the third quarter and the trend of customers moving to the spot market continued."

Mr. Grzebinski continued, "Within our diesel engine services segment, the land-based market experienced some improvement in service activity, but customer demand for engines, transmissions and parts remained weak. We received orders for pressure pumping unit service and remanufacturing work in increasing numbers through the quarter in terms of both quantity and diversity of customers. In our marine diesel engine services business, we experienced continued weakness in the Gulf of Mexico oilfield services market, but this was largely offset by strong performance in our power generation market."

Segment Results – Marine Transportation

Marine transportation revenues for the 2016 third quarter were $359.0 million compared with $418.3 million for the 2015 third quarter. Operating income for the 2016 third quarter was $55.5 million compared with $93.7 million for the 2015 third quarter.

Demand for inland tank barge transportation of petrochemicals was stable, aside from the impact of plant maintenance turnarounds, and black oil demand was weaker both on a year-over-year and sequential basis, while seasonal demand for agricultural chemical transportation and the demand for certain upriver petrochemicals was strong. Demand for refined petroleum products transportation was sequentially weaker, but increased relative to the 2015 third quarter due to the addition of acquired assets in the 2016 second quarter. Kirby's inland tank barge utilization was in the low-to-mid 80% range during the quarter. Both spot and term contract pricing were at lower levels relative to last year. Operating conditions during the quarter were seasonally normal, although there was significant flooding in Louisiana that caused some disruptions in the Gulf Intracoastal Waterway for a short period during the quarter.

In the coastal marine transportation market, demand for the transportation of black oil, petrochemicals, and dry products was stable. Demand for the transportation of refined petroleum products declined, primarily as a result of weak distillate and gasoline demand in the Northeast. Additionally, the growing number of vessels trading in the spot market continued to drive increased idle time and voyage costs. Utilization for the coastal tank barge fleet was in the low-to-mid 80% range.

The marine transportation segment's 2016 third quarter operating margin was 15.4% compared with 22.4% for the third quarter of 2015.

Segment Results – Diesel Engine Services

Diesel engine services revenues for the 2016 third quarter were $75.7 million with operating income of $4.6 million, compared with 2015 third quarter revenues of $114.2 million and operating income of $5.6 million.

The lower revenues and operating income as compared to the third quarter of 2015 were primarily due to a lack of new pressure pumping unit manufacturing and lower sales of engines, transmissions and parts in the land-based diesel engine services market. Partially offsetting the decline was an increase in pressure pumping unit remanufacturing and service activity. Additionally, results in the marine diesel engine services markets contributed to the decline, a result of continued weakness in the Gulf of Mexico oilfield services market and customer deferrals of major maintenance projects. Demand in the power generation market was relatively strong during the quarter.

The diesel engine services operating margin was 6.1% for the 2016 third quarter compared with 4.9% for the 2015 third quarter on lower revenues, reflecting the benefit of cost reductions and efficiency improvements made in both the land-based and marine diesel engine services markets.

Cash Generation

EBITDA of $336.1 million for the 2016 first nine months contributed to Kirby's cash flow from operations during the 2016 first nine months, which compares with EBITDA of $437.5 million for the 2015 first nine months. Cash flow was used to fund capital expenditures of $169.3 million, including $5.6 million for new inland tank barge and towboat construction, $78.3 million for progress payments on the construction of three new coastal articulated tank barge and tugboat units ("ATBs"), two 4900 horsepower coastal tugboats and a 35,000 barrel coastal petrochemical tank barge, and $85.4 million primarily for upgrades to the existing inland and coastal fleets. In addition, acquisitions totaled $125.6 million, including $85.5 million for the acquisition of the SEACOR inland tank barge fleet, $13.6 million to acquire a leased coastal barge from the lessor and $26.5 million to purchase four coastal tugboats. Total debt as of September 30, 2016 was $726.0 million and Kirby's debt-to-capitalization ratio was 23.3%.

Outlook

Commenting on the 2016 fourth quarter and full year market outlook and guidance, Mr. Grzebinski said, "Our earnings guidance for the 2016 fourth quarter is $0.45 to $0.60 per share compared with $0.94 per share for the 2015 fourth quarter. As a result of our expectations for the quarter, our full year earnings per share guidance is narrowed to $2.47 to $2.62 from the previous guidance range of $2.40 to $2.70. Our fourth quarter guidance range contemplates inland marine transportation utilization in the low-to-mid 80% range at the low end and mid-to-high 80% range at the high end. We believe the industry is responding to lower utilization by cutting capital spending and accelerating barge retirements which should bring supply and demand back into balance. In our coastal market, we expect utilization in the low-80% range and we continue to anticipate having more coastal equipment trade in the spot market which leads to lower utilization, higher costs and lower operating margins. Additionally, Hurricane Matthew impacted operations for two weeks in October and drove a cessation of operations along the Eastern Seaboard."

Mr. Grzebinski continued, "In our diesel engine services markets, we expect the fourth quarter to reflect a normal seasonal decline in our marine and power generation markets. In our land-based diesel engine services market, we expect to incur an operating loss for the quarter, as a more meaningful recovery in the land-based market isn't likely until next year when customer inventories for parts, transmissions and engines are depleted, which will necessitate new orders for products and parts."

Kirby expects 2016 capital spending to be in the $230 to $250 million range, unchanged from previous guidance. Capital spending guidance includes approximately $10 million for the construction of seven inland tank barges, five of which are scheduled to deliver in 2016, and one inland towboat. The capital spending guidance range also includes approximately $100 million in progress payments on new coastal equipment, including one 185,000 barrel coastal ATB, two 155,000 barrel coastal ATBs, two 4900 horsepower coastal tugboats, and a new coastal petrochemical tank barge. The balance of $120 to $140 million is primarily for capital upgrades and improvements to existing inland and coastal marine equipment and facilities, as well as diesel engine services facilities.

Conference Call

A conference call is scheduled for 7:30 a.m. central time tomorrow, Thursday, October 27, 2016, to discuss the 2016 third quarter performance as well as the outlook for the 2016 fourth quarter and year. The conference call number is 888-317-6003 for domestic callers and 412-317-6061 for international callers. The confirmation number is 2839308. An audio playback will be available at 1:00 p.m. central time on Thursday, October 27, 2016, through 5:00 p.m. central time on Thursday, November 3, 2016, by dialing 877-344-7529 for domestic callers and 412-317-0088 for international callers. The replay access code is 10094118. A live audio webcast of the conference call will be available to the public and a replay available after the call by visiting Kirby's website at http://www.kirbycorp.com/.

GAAP to Non-GAAP Financial Measures

The financial and other information to be discussed in the conference call is available in this press release and in a Form 8-K filed with the Securities and Exchange Commission. This press release and the Form 8-K include a non-GAAP financial measure, EBITDA, which Kirby defines as net earnings attributable to Kirby before interest expense, taxes on income, depreciation and amortization. A reconciliation of EBITDA with GAAP net earnings attributable to Kirby is included in this press release. This earnings press release includes marine transportation performance measures, consisting of ton miles, revenue per ton mile, towboats operated and delay days. Comparable performance measures for the 2015 year and quarters are available at Kirby's website, http://www.kirbycorp.com/, under the caption Performance Measurements in the Investor Relations section.

Forward-Looking Statements

Statements contained in this press release with respect to the future are forward-looking statements. These statements reflect management's reasonable judgment with respect to future events. Forward-looking statements involve risks and uncertainties. Actual results could differ materially from those anticipated as a result of various factors, including cyclical or other downturns in demand, significant pricing competition, unanticipated additions to industry capacity, changes in the Jones Act or in U.S. maritime policy and practice, fuel costs, interest rates, weather conditions and timing, magnitude and number of acquisitions made by Kirby. Forward-looking statements are based on currently available information and Kirby assumes no obligation to update any such statements. A list of additional risk factors can be found in Kirby's annual report on Form 10-K for the year ended December 31, 2015 filed with the Securities and Exchange Commission.

About Kirby Corporation

Kirby Corporation, based in Houston, Texas, is the nation's largest domestic tank barge operator transporting bulk liquid products throughout the Mississippi River System, on the Gulf Intracoastal Waterway, coastwise along all three United States coasts, and in Alaska and Hawaii. Kirby transports petrochemicals, black oil, refined petroleum products and agricultural chemicals by tank barge. Kirby also operates offshore dry-bulk barge and tugboat units engaged in the offshore transportation of dry-bulk cargoes in the United States coastal trade. Through the diesel engine services segment, Kirby provides after-market service for medium-speed and high-speed diesel engines and reduction gears used in marine and power generation applications. Kirby also distributes and services diesel engines, transmissions and pumps, and manufactures and remanufactures oilfield service equipment, including pressure pumping units, for land-based oilfield service and oil and gas operator and producer markets.

| CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS | ||||||||

| | | | | |||||

| | Third Quarter | Nine Months | | |||||

| | 2016 | 2015 | 2016 | 2015 | | |||

| | (unaudited, $ in thousands except per share amounts) | | ||||||

| Revenues: | | | | | ||||

| Marine transportation | $ 359,031 | $ 418,343 | $ 1,115,677 | $ 1,263,301 | ||||

| Diesel engine services | 75,677 | 114,222 | 219,346 | 400,093 | ||||

| | 434,708 | 532,565 | 1,335,023 | 1,663,394 | ||||

| Costs and expenses: | | | | | ||||

| Costs of sales and operating expenses | 282,168 | 333,115 | 847,975 | 1,061,641 | ||||

| Selling, general and administrative | 40,645 | 48,759 | 133,948 | 148,968 | ||||

| Taxes, other than on income | 5,445 | 5,482 | 16,317 | 15,405 | ||||

| Depreciation and amortization | 50,142 | 49,759 | 148,427 | 142,350 | ||||

| Loss (gain) on disposition of assets | 122 | 400 | (39) | (1,246) | ||||

| | 378,522 | 437,515 | 1,146,628 | 1,367,118 | ||||

| Operating income | 56,186 | 95,050 | 188,395 | 296,276 | ||||

| Other income (expense) | (120) | 22 | 194 | (221) | ||||

| Interest expense | (4,507) | (4,449) | (13,213) | (14,458) | ||||

| Earnings before taxes on income | 51,559 Werbung Mehr Nachrichten zur Kirby Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||||||