KeyCorp Reports Third Quarter 2017 Net Income Of $349 Million, Or $.32 Per Common Share

PR Newswire

CLEVELAND, Oct. 19, 2017

CLEVELAND, Oct. 19, 2017 /PRNewswire/ --

| | Earnings Per Share | Cash Efficiency(a) | Return on Tangible | |||

| Reported | $.32 | | 62.2% | | 12.2% | |

| Adjusted (Non-GAAP)(b) | $.35 | | 59.7% | | 13.2% | |

| (a) | Non-GAAP measure; see pages 15-17 for reconciliation |

| (b) | Excludes notable items; see page 15 for detail |

KeyCorp (NYSE: KEY) today announced third quarter net income from continuing operations attributable to Key common shareholders of $349 million, or $.32 per common share, compared to $393 million or $.36 per common share, for the second quarter of 2017 and $165 million, or $.16 per common share, for the third quarter of 2016. During the third quarter of 2017, Key's results included $36 million of merger-related charges and a $5 million merchant services gain adjustment, resulting in a pre-tax net impact of $41 million, or $.03 per common share.

"Third quarter results reflect strong returns and the seventh consecutive quarter of positive operating leverage compared to the prior year, as we continue to execute on our strategic priorities, grow our businesses, and deliver on the commitments we have made. Key's return on average tangible common equity, excluding notable items, was 13.2% for the quarter."

"We continue to have momentum in our fee-based businesses, including investment banking and debt placement fees, which were up 4% from the second quarter, and cards and payments income, which grew 7% on a linked-quarter basis. The cash efficiency ratio for the third quarter, excluding notable items, was 59.7%."

"We continue to invest for growth in support of our relationship strategy, including the recent HelloWallet and merchant services acquisitions, as well as Cain Brothers, which closed early in the fourth quarter. These investments enhance our focus on organic growth by investing in our people, products and capabilities to continue to drive positive operating leverage and future growth."

- Beth Mooney, Chairman and CEO

| Selected Financial Highlights | | | | | | | |||||||||

| | | | | | | | | ||||||||

| dollars in millions, except per share data | | | | | Change 3Q17 vs. | ||||||||||

| | | 3Q17 | 2Q17 | 3Q16 | | 2Q17 | 3Q16 | ||||||||

| Income (loss) from continuing operations attributable to Key common shareholders | $ | 349 | $ | 393 | $ | 165 | | (11.2)% | 111.5% | ||||||

| Income (loss) from continuing operations attributable to Key common shareholders per | .32 | .36 | .16 | | (11.1) | 100.0 | |||||||||

| Return on average total assets from continuing operations | 1.07% | 1.23% | .55% | | N/A | N/A | |||||||||

| Common Equity Tier 1 ratio (a) | 10.26 | 9.91 | 9.56 | | N/A | N/A | |||||||||

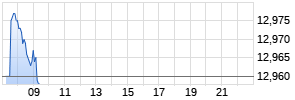

| Book value at period end | $ | 13.18 | $ | 13.02 | $ | 12.78 | | 1.2% | 3.1% | ||||||

| Net interest margin (TE) from continuing operations | 3.15% | 3.30% | 2.85% | | N/A | N/A | |||||||||

| | | | | | | | | ||||||||

| | | | | | | | | ||||||||

| (a) | 9/30/2017 ratio is estimated. | | | | | | |||||||||

| | | | | | | | |||||||||

| TE = Taxable Equivalent, N/A = Not Applicable | | | | | | ||||||||||

| INCOME STATEMENT HIGHLIGHTS | | | | | | | ||||||||

| | | | | | | | ||||||||

| Revenue | | | | | | | ||||||||

| | | | | | | | ||||||||

| dollars in millions | | | | | Change 3Q17 vs. | |||||||||

| | 3Q17 | 2Q17 | 3Q16 | | 2Q17 | 3Q16 | ||||||||

| Net interest income (TE) | $ | 962 | | $ | 987 | | $ | 788 | | | (2.5)% | 22.1% | ||

| Noninterest income | 592 | | 653 | | 549 | | | (9.3) Werbung Mehr Nachrichten zur KeyCorp Inc. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||