IndexIQ Hedge Fund Indexes Continue Positive Trend In January

PR Newswire

RYE BROOK, N.Y., Feb. 22, 2017

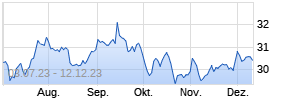

RYE BROOK, N.Y., Feb. 22, 2017 /PRNewswire/ -- IndexIQ, the leading provider of innovative investment solutions, today announced the January 2017 performance of its family of IQ Hedge™ Indexes and the updated holdings in the firm's IQ Merger Arbitrage ETF (NYSE Arca: MNA).

Five of the six IndexIQ Hedge Indexes were positive for the month, with the IQ Hedge Event Drive Index up 1.7% and the IQ Hedge Long/Short Index up 1.17%. The IQ Hedge Global Macro Index, which had declined slightly in December, bounced back to return 1.34% in January. The IQ Hedge Market Neutral Index was the sole decliner, dropping -0.02%.

"The so-called 'Trump' market marched on in January, while international stocks had an additional tailwind following a drop in the dollar, also inspired by the President," said Salvatore Bruno, IndexIQ's Chief Investment Officer. "This set the stage for what was another very positive month for liquid alternatives."

Designed as investable benchmarks that replicate the performance characteristics of sophisticated hedge fund strategies, the IQ Hedge Indexes comprise the first family of investable benchmark indexes covering hedge fund replication/alternative beta strategies. IQ Hedge Index returns for the period ended January 31, 2017 were as follows:

| IQ Hedge Indexes | | |||||||||||||||||||||||||||||||

| | | 1 Month ARIVA.DE Börsen-GeflüsterKurse

| 3 Month | YTD | 1 Year | 3 Year | 5 Year | | ||||||||||||||||||||||||

| IQ Hedge Multi-Strategy Index | IQHGMS | 0.45% | 0.00% | 0.45% | 3.64% | 2.05% | 2.88% | | ||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||

| IQ Hedge Market Neutral Index | IQHGMN | -0.02% | 0.08% | -0.02% | 3.17% | 1.71% | 2.24% | | ||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||

| IQ Hedge Global Macro Index | IQHGMA | 1.34% | -0.47% | 1.34% | 4.57% | 0.26% | -0.10% | | ||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||

| IQ Hedge Event Driven Index | IQHGED | 1.70% | 1.98% | 1.70% | 10.84% | 4.80% | 4.85% | | ||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||

| IQ Hedge Long/Short Index | IQHGLS | 1.17% | 3.66% | 1.17% | 10.34% | 3.90% | 5.44% | | ||||||||||||||||||||||||

| | | | | | | | | | ||||||||||||||||||||||||

| IQ Merger Arbitrage Index | IQMNA | 0.82% | 2.65% | 0.82% | 6.35% | 4.58% | 4.77% | | ||||||||||||||||||||||||

| | | | | | | | | |||||||||||||||||||||||||

The latest updates to MNA's holdings, including recent additions and deletions, can be found here:

Additions to the IQ Merger Arbitrage Index

| Target | Acquirer | Target | Target | Announce | Added |

| Name | Name | Sector | Country | Date | Date |

| Actelion Ltd. | Johnson & Johnson | Health Care | Switzerland | 12/21/2016 | 02/03/2017 |

| ARIAD Pharmaceuticals, Inc. | Takeda Pharmaceutical Co., Ltd. | Health Care | United States | 01/09/2017 | 02/03/2017 |

| CEB, Inc. | Gartner, Inc. | Industrials | United States | 01/05/2017 | 02/03/2017 |

| Clayton Williams Energy, Inc. (Delaware) | Noble Energy, Inc. | Energy | United States | 01/16/2017 Werbung Mehr Nachrichten zum Fonds kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |

![IQ Hedge Multi-Strategy Tracker ETF [ETF] Chart IQ Hedge Multi-Strategy Tracker ETF [ETF] Chart](/chart/images/chart.png?z=a102031668~Zs0~b40~i0~j0~o100~wfree~Uyear~z295)