Hawesko Holding meets its targets for 2015

HAWESKO Holding AG / Hawesko Holding meets its targets for 2015 . Processed and transmitted by NASDAQ OMX Corporate Solutions. The issuer is solely responsible for the content of this announcement.

- Sales in 2015 rose as planned by 0.8% to just under € 477 million

- Sales increase by 1.7% on a like-for-like basis

- Adjusted EBIT approximately € 26-27 million as expected

Hamburg, 2 February 2016. Hawesko Holding AG (HAW, HAWG.DE, DE0006042708) expanded its market position as the leading wine trading group in the past fiscal year (1.1. to 31.12.2015). Consolidated sales rose from € 472.8 million to € 476.6 million, corresponding to an increase of 0.8% and meeting the expectations of the management board. Adjusted for the advance sales of the Bordeaux subscription wines and the sales of the terminated wholesale operations in Bordeaux, sales increased by 1.7%. The management board estimates that the Hawesko Group once again succeeded in increasing its share of the market in 2015 and thus reasserting its position in a tough market environment.

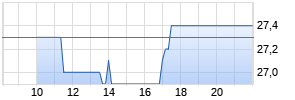

According to preliminary calculations, the consolidated operating result (EBIT) of the Hawesko Group is in the range of € 26-27 million on an adjusted basis (previous year, adjusted: € 24.6 million), so that the expectations of the management board have been confirmed in this regard as well. The figure is adjusted for non-recurring charges of approximately € 7 million in conjunction with the change-of-control. As a result, consolidated EBIT to be reported is in the range of € 19-20 million (previous year: € 20.1 million). Thus, the management board of Hawesko Holding reckons with consolidated net income after deductions for taxes and non-controlling interests in the range of € 12-13 million and € 1.34-1.44 per share (previous year: € 14.8 million and € 1.65 per share).

For 2016 the management board expects sales development at the level of the previous year. However, rises in EBIT and the EBIT margin are expected - even on an adjusted basis - compared to the previous year. "We can be satisfied with the key figures for 2015. Despite challenging market conditions, we achieved our targets and maintained our position as the leading wine trading company. Once again we were able to rely on the competence and commitment of our staff members. We intend to continue on our course of profitable growth in the future as well," said CEO Thorsten Hermelink Tuesday on the announcement of the preliminary financial results.

Hawesko Holding AG is a leading supplier of premium wines and champagnes. In fiscal year 2014, the Group achieved sales of € 473 million and employed 925 persons in the company's three sales channels: specialty retail (Jacques' Wein-Depot), wholesale operations (Wein Wolf and CWD Champagner- und Wein-Distributionsgesellschaft) and distance selling (especially Hanseatisches Wein- and Sekt-Kontor and Wein & Vinos). The shares of Hawesko Holding AG are listed on the Hanseatic Stock Exchange in Hamburg as well as in the prime standard segment of the Frankfurt Stock Exchange.

# # #

The complete 2015 annual report and accounts will be presented at the annual press conference on 21 April 2016.

Publisher: Hawesko Holding AG

20247 Hamburg

Internet: http://www.hawesko-holding.com (Company information)

http://www.hawesko.de (Online shop)

http://www.jacques.de (Jacques' Wein-Depot information and online shop)

http://www.vinos.de (Spanish wines sold through Wein & Vinos)

Press Contact and Investor Relations:

Thomas Hutchinson, Hawesko Holding AG

Phone: +49 (0)40 30 39 21 00

Fax +49 (0)40 30 39 21 05

E-mail: ir@hawesko-holding.com

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: HAWESKO Holding AG via Globenewswire

--- End of Message ---

HAWESKO Holding AG

Plan 5 Hamburg Germany

WKN: 604270;ISIN: DE0006042708;Index:CLASSIC All Share,CDAX,SDAX,Prime All Share,GEX;

Listed: Freiverkehr in Börse Stuttgart,

Freiverkehr in Börse Berlin,

Freiverkehr in Börse Düsseldorf,

Freiverkehr in Bayerische Börse München,

Freiverkehr in Niedersächsische Börse zu Hannover,

Prime Standard in Frankfurter Wertpapierbörse,

Regulierter Markt in Frankfurter Wertpapierbörse,

Regulierter Markt in Hanseatische Wertpapierbörse zu Hamburg;

Mehr Nachrichten zur Hawesko Holding SE Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.