Glass Lewis Recommends Casella Shareholders Vote for Both JCP Investment Management Nominees on GOLD Proxy

PR Newswire

HOUSTON, Oct. 22, 2015

HOUSTON, Oct. 22, 2015 /PRNewswire/ -- JCP Investment Management, LLC (together with its affiliates "JCP"), and the other participants in its solicitation, the collective beneficial owners of approximately 5.8% of the outstanding Class A shares of Casella Waste Systems, Inc. ("Casella" or the "Company") (NASDAQ: CWST), today announced that Glass, Lewis & Co., LLC ("Glass Lewis"), a leading independent proxy voting advisory firm, has recommended that Casella shareholders vote on the GOLD JCP proxy card to elect both of JCP's highly-qualified director candidates, Brett W. Frazier and James C. Pappas, at the November 6, 2015 Annual Meeting of Casella. JCP urges all Casella shareholders to vote for change on Casella's Board of Directors (the "Board") by following Glass Lewis' recommendation and voting the GOLD proxy card to elect both JCP nominees TODAY.

James C. Pappas, the Managing Member of JCP, responded to Glass Lewis' report saying, "We are gratified to receive Glass Lewis' strong endorsement of our call for change at Casella. Glass Lewis recognized Casella's need for a fresh, shareholder-focused perspective after years of significant value destruction under the leadership of the incumbent Board and agreed with us that Casella would significantly benefit from Brett's and my election to the Board."

Glass Lewis recommended that shareholders vote on JCP's GOLD proxy card stating:

"we believe shareholders should support JCP's solicitation, which we consider strikes an appropriate balance between the benefits of additional waste management experience and the need for fresh, independent, investor-focused representation in the current board room."

Glass Lewis highlights Casella's poor operational performance and governance failures in its support for JCP:

"Afforded a full review of the arguments presented here, we find the incumbent board provides investors with little cause to support the status quo. Among a long list of concerns, Casella's performance -- both in terms of shareholder returns and standardized operating metrics -- has been indisputably poor over virtually any relevant time period under the lengthy oversight of the Company's existing management group, an issue the board attempts to deflect by pointing to an abstrusely interleaved array of inconsistent and unconvincing short-term performance periods. Further still, a turn toward Casella's governance yields no alternative footing for the board, in our view, as recently announced changes appear both modest and reactive, and, in any case, completely fail to address the single corporate governance issue about which a substantial majority of the Company's investors have already expressed an unquestionable preference."

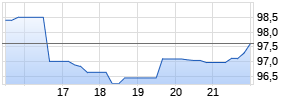

Glass Lewis recognizes Casella's poor total shareholder returns (TSR) under the incumbent Board's leadership:

"Casella's returns have trailed both the broader market and the Peer Composite over all selected periods, generally by indisputably substantial margins. We believe this data works strongly against the board's argument that investors have already realized any purported benefit from "strong execution" of the strategic plan, and instead suggests Casella investors have suffered very poor returns over both short and long-term unaffected review periods."

"Perhaps just as damaging to the board's case is the fact that between April 27, 2015 and the recent market close on October 20, 2015 -- a period covering substantially all of JCP's public involvement with the Company -- Casella's shares climbed 16.2%, while the Peer Composite gained just 1.4% and the S&P 500 Index lost 3.7%."

Glass Lewis agrees that a quantitative analysis of Casella's performance does not favor the Board:

"That narrative worsens considerably with reference to the Company's unadjusted EBITDA growth, which trails the peer average over every selected review period. Indeed, over the longest horizons, an argument could be made for Casella's poor performance in absolute terms, as the Company's unadjusted EBITDA has actually contracted on a CAGR basis by 1.4% per year over the last ten years. This decidedly mediocre performance in matched in lockstep with marked declines in Casella's EBITDA margins over the same period, which declines are in no way matched by the stable average posted by the Peer Composite."

Glass Lewis recognizes that recent changes at Casella were merely reactive and questions the motivations of the Board:

"On the corporate governance front, we acknowledge the board frequently highlights its apparent willingness to proactively implement progressive governance changes as part of its regular review procedures."

"we would cast these changes -- which were announced on September 1, 2015, well after JCP's public involvement -- as rather starkly reactive and unlikely to represent the board's willingness to implement more substantive changes to Casella's corporate governance." (emphasis added)

"the incumbent board -- facing significant external pressure from JCP -- sidesteps the issue entirely in favor of undertaking less noteworthy and, to our knowledge, entirely unrequested governance reforms, a framework we believe offers a more accurate depiction of the incumbent board's commitment to progressive corporate governance protocols. Taken collectively, we believe these issues represent a substantial failure on the part of the committee to fulfill their obligations to shareholders." (emphasis added)

Glass Lewis concludes that the time for change at Casella is now and shareholders should vote the GOLD proxy card:

"Notwithstanding the board's attempt to frame the incumbent management group as architects of a decisive turn-around warranting continued investor support, we believe a more detailed evaluation of Casella suggests unaffiliated shareholders are in sore need of alternative board-level perspectives that might produce more fruitful operating strategies and mitigate the overwhelming influence of the board's long-term members. In this regard, we believe JCP successfully argues appointment of its nominees -- which would represent a clear minority on the continuing board -- would offer shareholders both additional industry insight and fresh shareholder representation within a stagnant, underperforming board room.'"

"Accordingly, we recommend shareholders vote FOR all nominees using the Dissident's GOLD proxy card."

CASELLA SHAREHOLDERS, GLASS LEWIS HAS SPOKEN, THE TIME FOR ACTION IS NOW. VOTE YOUR GOLD JCP PROXY CARD FOR BOTH OF THE JCP NOMINEES TODAY.

If you have any questions, or require assistance with your vote, please call InvestorCom, Inc., toll- free at (877) 972-0090 or direct at (203) 972-9300

About JCP Investment Management:

JCP Investment Management, LLC is an investment firm headquartered in Houston, TX that engages in value-based investing across the capital structure. JCP follows an opportunistic approach to investing across different equity, credit and distressed securities largely in North America.

Investor Contact:

John Glenn Grau

InvestorCom, Inc.

(203) 972-9300 ext. 11

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/glass-lewis-recommends-casella-shareholders-vote-for-both-jcp-investment-management-nominees-on-gold-proxy-300164863.html

SOURCE JCP Investment Management, LLC

Mehr Nachrichten zur Casella Waste A Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.