Gibson Energy Inc. Reports First Quarter 2013 Financial Results

PR Newswire

CALGARY, May 7, 2013

All financial figures are in Canadian dollars unless otherwise stated

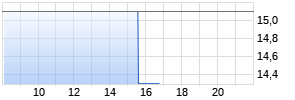

CALGARY, May 7, 2013 /PRNewswire/ - Gibson Energy Inc. ("Gibson" or the "Company"), TSX: GEI, announced today record results for the first quarter 2013 supported by profit increases across all businesses.

Highlights include:

- Adjusted EBITDA1 increased by 69% to $121.0 million in the three months ended March 31, 2013 compared to $71.8 million in the three months ended March 31, 2012. Pro Forma Adjusted EBITDA2 for the twelve months ended March 31, 2013 was $398.6 million;

- Segment profit3 increased by 62% to $127.0 million in the three months ended March 31, 2013 compared to $78.4 million in the three months ended March 31, 2012, with increases in all of the Company's segments;

- In early May, the Company received committed support from a large oil sands producer for a 500,000 bbl oil storage tank at Hardisty Terminal. This is the fourth large storage tank to be announced in the past seven months for a combined total of 1.7 million barrels of new storage capacity; and

- On May 7, 2013, the Board of Directors approved a quarterly dividend rate of $0.275 per common share to shareholders of record at the close of business on June 28, 2013 that is payable on July 17, 2013.

"This record quarter for the Company reflects the advantage 60 years of knowledge brings to our business segments," said Stewart Hanlon, Gibson's President and Chief Executive Officer. "These results highlight the fact that our portfolio is well balanced and that the diversity and integration of our businesses generates profitable results throughout the year."

Other Highlights for the First Quarter ended March 31, 2013:

- Cash provided by operations in the three months ended March 31, 2013 was $88.0 million compared to $64.6 million in the three months ended March 31, 2012. The increase was primarily attributable to an increase in overall segment profitability in the three months ended March 31, 2013 compared to the three months ended March 31, 2012;

- Capital expenditures were $46.7 million in the three months ended March 31, 2013, of which $34.2 million related to internal growth projects. The internal growth project expenditures are primarily related to the construction of tankage and pipeline connections at the Company's facilities, in particular at Hardisty, the expansion of the Environmental Services business and the growth of the Truck Transportation fleet; and

- Total dividends declared were $33.3 million in the three months ended March 31, 2013 compared to $24.7 million in the three months ended March 31, 2012. For the twelve months ended March 31, 2013, distributable cash flow was $220.8 million resulting in a dividend payout ratio of 52%.

| (1) | Adjusted EBITDA is defined as consolidated net income (loss) before interest expense, income taxes, depreciation, amortization, other non-cash expenses and charges deducted in determining consolidated net income (loss), including movement in the unrealized gains and losses on the Company's financial instruments, stock based compensation expense, impairment of goodwill and intangible assets, and non-cash inventory write-downs. It also takes into account the impact of foreign exchange movements in the Company's U.S. dollar denominated long-term debt, management fees, debt extinguishment costs and other adjustments that are considered non-recurring in nature. |

| (2) | Includes pro forma effect of acquisitions that took place in the twelve month period as if the acquisitions took place at the beginning of the twelve month period in which the acquisition occurred |

| (3) | Segment profit is defined as revenue minus (i) cost of sales; and (ii) operating costs. It excludes depreciation, amortization, impairment charges, stock based compensation and corporate expenses |

Management's Discussion and Analysis and Financial Statements

The Management's Discussion and Analysis and the interim Condensed Consolidated Financial Statements provide a detailed explanation of Gibson's operating results for the three months ended March 31, 2013 as compared to the three months ended March 31, 2012. These documents are available at www.gibsons.com and at www.sedar.com.

2013 First Quarter Results Conference Call

A conference call to discuss Gibson's first quarter will be held at 7:00 a.m. MT (9:00 a.m. ET) on Wednesday, May 8, 2013 for interested investors, analysts and media representatives.

The conference call dial-in numbers are:

- 866-696-5910 from Canada and the US

- 416-340-2217 from Toronto and International

- Participant Pass Code: 7015666#

Shortly after the call, an audio archive will be posted on the Investor Relations and Media section at http://www.gibsons.com.

The call will also be recorded and available for playback 60 minutes after the meeting end time, until August 7, 2013, using the following dial in process:

- 905-694-9451 / 800-408-3053

- Pass code: 6991702#

About Gibson

Gibson is a large, independent midstream energy company in Canada and an integrated service provider to the oil and gas industry in the United States. Gibson is engaged in the movement, storage, blending, processing, marketing and distribution of crude oil, condensate, natural gas liquids, water, oilfield waste and refined products. Gibson transports energy products by utilizing its network of terminals, pipelines, storage tanks, and trucks located throughout western Canada and through its significant truck transportation and injection station network in the United States. Gibson also provides emulsion treating, water disposal and oilfield waste management services in Canada and the United States and is the second largest retail propane distribution company in Canada.

Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking information and statements (collectively, "forward-looking statements"). These statements relate to future events or the Company's future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words ''anticipate'', ''plan'', ''contemplate'', ''continue'', ''estimate'', ''expect'', ''intend'', ''propose'', ''might'', ''may'', ''will'', ''shall'', ''project'', ''should'', ''could'', ''would'', ''believe'', ''predict'', ''forecast'', ''pursue'', ''potential'' and ''capable'' and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. In addition, this news release may contain forward-looking statements and forward-looking information attributed to third party industry sources. The Company does not undertake any obligations to publicly update or revise any forward looking statements except as required by securities law. Actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties including, but not limited to, the risks and uncertainties described in "Forward-Looking Statements" and "Risk Factors" included in the Company's Annual Information Form dated March 5, 2013 as filed on SEDAR and available on the Gibson website at www.gibsons.com.

This news release refers to certain financial measures that are not determined in accordance with International Financial Reporting Standards ("IFRS"). Adjusted EBITDA and Pro Forma Adjusted EBITDA are not measures recognized under IFRS and do not have standardized meanings prescribed by IFRS. Management considers these to be important supplemental measures of the Company's performance and believes these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in its industries with similar capital structures. See ''Summary of Quarterly Results" in the Company's MD&A for a reconciliation of EBITDA to net income (loss), the IFRS measure most directly comparable to EBITDA, and for a reconciliation of Adjusted EBITDA and Pro Forma Adjusted EBITDA to EBITDA. Distributable cash flow is used to assess the level of cash flow generated from ongoing operations and to evaluate the adequacy of internally generated cash flow to fund dividends. See ''Distributable Cash Flow" in the Company's MD&A for a reconciliation of distributable cash flow to cash flow from operations, the IFRS measure most directly comparable to distributable cash flow. Investors are encouraged to evaluate each adjustment and the reasons the Company considers it appropriate for supplemental analysis. Investors are cautioned, however, that these measures should not be construed as an alternative to net income (loss) determined in accordance with IFRS as an indication of the Company's performance.

| First Quarter- Selected Financial Highlights | ||||

| Three months ended March 31 | ||||

| 2013 | 2012 | |||

| (thousands) | ||||

| Segment Profit: | ||||

| Terminals and Pipelines | $22,742 | $19,389 | ||

| Truck Transportation | 20,679 | 19,362 | ||

| Environmental Services | 16,935 | 3,664 | ||

| Propane and NGL Marketing and Distribution | 19,465 | 15,334 | ||

| Processing and Wellsite Fluids | 17,658 | 10,729 | ||

| Marketing | 29,489 | 9,956 | ||

| Total Segment Profit | $126,968 | $78,434 | ||

| Statement of Cash Flows Data: | ||||

| Cash flows provided by (used in): | ||||

| Operating Activities | $87,966 | $64,641 | ||

| Investing Activities | (39,220) | (34,655) | ||

| Financing Activities | (64,400) | (20,203) | ||

| Other Financial Data: | ||||

| Capital Expenditures: | ||||

| Internal Growth Projects | $34,205 | $33,050 | ||

| Upgrade and Replacement Capital | 12,455 | 8,979 | ||

| Adjusted EBITDA | $121,044 | $71,789 | ||

| Twelve months ended March 31, 2013 | ||||

| Pro Forma Adjusted EBITDA | $398,578 | |||

SOURCE Gibson Energy Inc.

Mehr Nachrichten zur Gibson Energy Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.