Genuine Parts Company Reports 2016 Sales And Earnings For The Fourth Quarter And Full Year

PR Newswire

ATLANTA, Feb. 21, 2017

ATLANTA, Feb. 21, 2017 /PRNewswire/ -- Genuine Parts Company (NYSE: GPC) announced today sales and earnings for the fourth quarter and twelve months ended December 31, 2016.

Sales for the fourth quarter ended December 31, 2016 were $3.78 billion, a 3% increase compared to $3.68 billion for the same period in 2015. Net income for the fourth quarter was $152.5 million compared to $161.3 million recorded for the same period in the previous year. Earnings per share on a diluted basis were $1.02 compared to $1.07 for the fourth quarter last year.

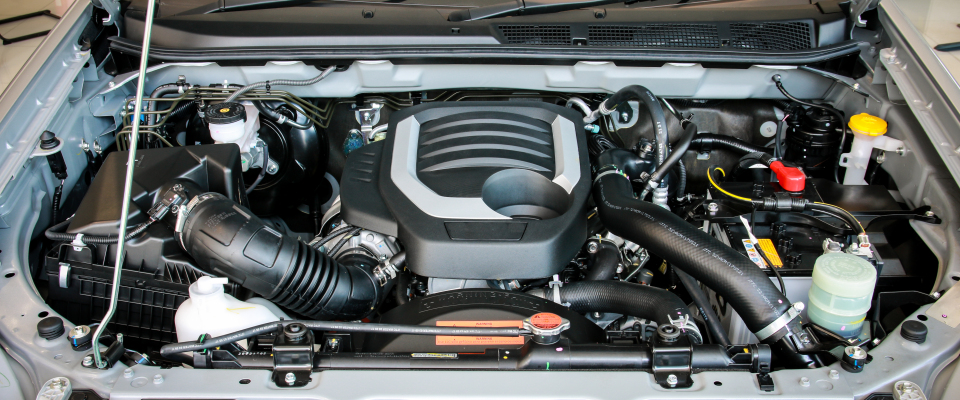

Fourth quarter sales for the Automotive Group were up 2%, including an approximate 1% comparable sales increase. Sales at Motion Industries, our Industrial Group, were up 4%, sales at EIS, our Electrical/Electronic Group, were basically unchanged and sales for S. P. Richards, our Office Products Group, were up 4% for the quarter.

Paul Donahue, President and Chief Executive Officer, commented, "The fourth quarter was our strongest quarterly sales performance of the year, with acquisitions being the primary growth driver in each of our four business segments. With that said, we did see improvement in our comparable sales trends in the Automotive, Industrial and Electrical/Electronic businesses relative to the second and third quarters of 2016. Generally, we operated in more favorable market conditions as the fourth quarter progressed, and our teams were in position to benefit from that."

Sales for the twelve months ended December 31, 2016 were $15.34 billion, up 0.4% compared to $15.28 billion for the same period in 2015. Net income for the twelve months was $687.2 million, down 3% from 2015, and earnings per share on a diluted basis were $4.59, down 1% compared to $4.63 in 2015.

Mr. Donahue concluded, "We worked hard in every aspect of our business to overcome the challenging sales environment that persisted in our U.S. markets throughout most of 2016. We also enhanced our measures to control rising costs and manage our assets to further strengthen the balance sheet and generate strong cash flows. Due to these efforts, as well as the global growth initiatives across our operations and geographies, the Company enters 2017 well positioned for sustainable long-term growth."

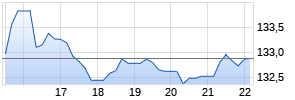

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Genuine Parts Company | ||

|

MB8ZUA

| Ask: 2,82 | Hebel: 4,96 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

2017 Outlook

The Company is establishing its full year 2017 sales guidance at up 3% to 4%. Diluted earnings per share is expected to be $4.70 to $4.80.

Conference Call

Genuine Parts Company will hold a conference call today at 11:00 a.m. EST to discuss the results of the quarter and the future outlook. Interested parties may listen to the call on the Company's website, www.genpt.com, by clicking "Investors", or by dialing 877-604-9665, conference ID 5619563. A replay will also be available on the Company's website or at 844-512-2921, conference ID 5619563, two hours after the completion of the call until 12:00 a.m. Eastern time on March 7, 2017.

Forward Looking Statements

Some statements in this report, as well as in other materials we file with the Securities and Exchange Commission (SEC) or otherwise release to the public and in materials that we make available on our website, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Senior officers may also make verbal statements to analysts, investors, the media and others that are forward-looking. Forward-looking statements may relate, for example, to future operations, prospects, strategies, financial condition, economic performance (including growth and earnings), industry conditions and demand for our products and services. The Company cautions that its forward-looking statements involve risks and uncertainties, and while we believe that our expectations for the future are reasonable in view of currently available information, you are cautioned not to place undue reliance on our forward-looking statements. Actual results or events may differ materially from those indicated as a result of various important factors. Such factors may include, among other things, the Company's ability to successfully implement its business initiatives in each of its four business segments; slowing demand for the Company's products; changes in legislation or government regulations or policies; changes in general economic conditions, including unemployment, inflation or deflation; changes in tax policies; volatile exchange rates; high energy costs; uncertain credit markets and other macro-economic conditions; competitive product, service and pricing pressures; the ability to maintain favorable vendor arrangements and relationships; disruptions in our vendors' operations; the Company's ability to successfully integrate its acquired businesses; the uncertainties and costs of litigation; disruptions caused by a failure or breach of the Company's information systems, as well as other risks and uncertainties discussed in the Company's Annual Report on Form 10-K for 2015 and from time to time in the Company's subsequent filings with the SEC.

Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent Forms 10-K, 10-Q, 8-K and other reports to the SEC.

About Genuine Parts Company

Genuine Parts Company is a distributor of automotive replacement parts in the U.S., Canada, Mexico and Australasia. The Company also distributes industrial replacement parts in the U.S., Canada and Mexico through its Motion Industries subsidiary. S. P. Richards Company, the Office Products Group, distributes business products in the U.S. and Canada. The Electrical/Electronic Group, EIS, Inc., distributes electrical and electronic components throughout the U.S., Canada and Mexico.

| GENUINE PARTS COMPANY and SUBSIDIARIES | ||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | ||||||||

| | ||||||||

| | Three Months Ended Dec. 31, | | Year Ended Dec.31, | | ||||

| | 2016 | | 2015 | | 2016 | | 2015 | |

| | | | | | | |||

| | (in thousands, except per share data) | |||||||

| | | | | | | | | |

| Net sales | $3,780,065 | | $3,681,790 | | $15,339,713 | | $15,280,044 | |

| Cost of goods sold | 2,648,982 | | 2,586,312 | | 10,740,106 | | 10,724,192 | |

| Gross profit | 1,131,083 | | 1,095,478 | | 4,599,607 | | 4,555,852 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| Selling, administrative & other expenses | 855,557 | | 797,959 | | 3,377,780 | | 3,290,496 | |

| Depreciation and amortization | 39,240 | | 35,911 | | 147,487 | | 141,675 | |

| | 894,797 | | 833,870 | | 3,525,267 | | 3,432,171 | |

| | | | | | | | | |

| Income before income taxes | 236,286 | | 261,608 | | 1,074,340 | | 1,123,681 | |

| Income taxes | 83,766 | | 100,335 | | 387,100 | | 418,009 | |

| | | | | | | | | |

| Net income | $ 152,520 | | $ 161,273 | | $ 687,240 | | $ 705,672 | |

| | | | | | | | | |

| Basic net income per common share | $1.03 | | $1.07 | | $4.61 | | $4.65 | |

| | | | | | | | | |

| Diluted net income per common share | $1.02 | | $1.07 | | $4.59 | | $4.63 | |

| | | | | | | | | |

| Weighted average common shares outstanding | 148,478 | | 150,552 | | 149,051 | | 151,667 | |

| | | | | | | | | |

| Dilutive effect of stock options and | | | | | | | | |

| non-vested restricted stock awards | 699 | | 803 | | 753 | | 829 | |

| | | | | | | | | |

| Weighted average common shares outstanding – assuming dilution | 149,177 | | 151,355 | | 149,804 | | 152,496 Werbung Mehr Nachrichten zur Genuine Parts Company Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |