Genpact Reports First Quarter 2018 Results

PR Newswire

NEW YORK, May 3, 2018

NEW YORK, May 3, 2018 /PRNewswire/ -- Genpact Limited (NYSE: G), a global professional services firm focused on delivering digital transformation, today announced financial results for the first quarter ended March 31, 2018.

"We had a strong start to the year, highlighted by double-digit growth in a number of our chosen verticals and service lines, leading to mid-teen Global Client BPO revenue growth on a constant currency basis," said "Tiger" Tyagarajan, Genpact's president and CEO. "Our two highly synergistic routes to market, Transformation Services and Intelligent Operations, are unlocking many opportunities for us to win new logos as well as increase penetration with existing clients, including more sole-sourced deals."

Key Financial Results – First Quarter 2018

- Total revenue was $689 million, up 11% year-over-year (up ~9% on a constant currency basis).

- Income from operations was $64 million, down 19% year-over-year, with a corresponding margin of 9.3%. Adjusted income from operations was $97 million, up 11% year-over-year, with a corresponding margin of 14.1%.3

- Diluted earnings per share were $0.33, up 25% year-over-year, and adjusted diluted earnings per share were $0.39, up 27% year-over-year. The current quarter diluted earnings per share includes a $0.02 foreign currency gain resulting from balance sheet re-measurement.

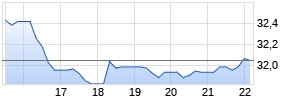

- Genpact repurchased approximately 3.2 million of its common shares during the quarter for total consideration of $100 million at an average price per share of $31.44.

Revenue Details – First Quarter 2018

- Revenue from Global Clients was $631 million, up 14% year-over-year (up ~12% on a constant currency basis), representing approximately 92% of total revenues.

- Revenue from GE was $58 million, down 16% year-over-year, representing approximately 8% of total revenues.

- Total BPO revenue was $574 million, up 12% year-over-year, representing approximately 83% of total revenues.

- Global Client BPO revenue was $540 million, up 17% year-over-year (up ~15% on a constant currency basis).

- GE BPO revenue was $34 million, down 31% year-over-year.

- Total IT revenue was $115 million, up 3% year-over-year, representing approximately 17% of total revenues.

- Global Client IT revenue was $91 million, down 1% year-over-year.

- GE IT revenue was $24 million, up 19% year-over-year.

Cash Flow from Operations

- Genpact utilized $27 million of cash in operations in the first quarter of 2018, compared to generating $31 million in cash from operations during the first quarter of 2017.

2018 Outlook

ARIVA.DE Börsen-Geflüster

Weiter aufwärts?

| Kurzfristig positionieren in Genpact | ||

|

MD4FQM

| Ask: 0,22 | Hebel: 4,26 |

| mit moderatem Hebel |

Zum Produkt

| |

Kurse

|

Genpact continues to expect:

- Total revenue for the full year 2018 of $2.93 to $3.0 billion.

- Global Client revenue growth in the range of 9% to 11%, both on an as-reported and constant currency basis.

- Adjusted income from operations margin4 of approximately 15.8%.

- Genpact now expects:

- Adjusted diluted EPS5 to increase to $1.72 to $1.76, from our prior outlook of $1.70 to $1.74.

Conference Call to Discuss Financial Results

Genpact's management will host an hour-long conference call beginning at 4:30 p.m. ET on May 3, 2018 to discuss the company's performance for the first quarter ended March 31, 2018. To participate, callers can dial +1 (877) 654-0173 from within the U.S. or +1 (281) 973-6289 from any other country. Thereafter, callers will be prompted to enter the conference ID, 8895845.

A live webcast of the call will also be made available on the Genpact Investor Relations website at http://investors.genpact.com. For those who cannot join the call live, a replay will be archived on the Genpact website after the end of the call. A transcript of the call will also be made available on the website.

About Genpact

Genpact (NYSE: G) is a global professional services firm that makes business transformation real. We drive digital-led innovation and digitally-enabled intelligent operations for our clients, guided by our experience running thousands of processes for hundreds of Global Fortune 500 companies. We think with design, dream in digital, and solve problems with data and analytics. We obsess over operations and focus on the details – all 78,000+ of us. From New York to New Delhi and more than 20 countries in between, Genpact has the end-to-end expertise to connect every dot, reimagine every process, and reinvent companies' ways of working. We know that rethinking each step from start to finish will create better business outcomes. Whatever it is, we'll be there with you – putting data and digital to work to create bold, lasting results – because transformation happens here.

Safe Harbor

This press release contains certain statements concerning our future growth prospects and forward-looking statements, as defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those in such forward-looking statements. These risks, uncertainties and other factors include but are not limited to a slowdown in the economies and sectors in which our clients operate, a slowdown in the business process outsourcing and information technology services sectors, the risks and uncertainties arising from our past and future acquisitions, our ability to convert bookings to revenues, our ability to manage growth, factors which may impact our cost advantage, wage increases, changes in tax rates and tax legislation and other laws and regulations, our ability to attract and retain skilled professionals, risks and uncertainties regarding fluctuations in our earnings, foreign currency fluctuations, general economic conditions affecting our industry as well as other risks detailed in our reports filed with the U.S. Securities and Exchange Commission, including Genpact's Annual Report on Form 10-K. These filings are available at www.sec.gov. Genpact may from time to time make additional written and oral forward-looking statements, including statements contained in our filings with the Securities and Exchange Commission and our reports to shareholders. Although Genpact believes that these forward-looking statements are based on reasonable assumptions, you are cautioned not to put undue reliance on these forward-looking statements, which reflect management's current analysis of future events and should not be relied upon as representing management's expectations or beliefs as of any date subsequent to the time they are made. Genpact undertakes no obligation to update any forward-looking statements that may be made from time to time by or on behalf of Genpact.

| Contacts | | |

| | | |

| Investors | | Roger Sachs, CFA |

| | | +1 (203) 808-6725 |

| | | |

| | | |

| Media | | Gail Marold +1 (919) 345-3899 |

| GENPACT LIMITED AND ITS SUBSIDIARIES Consolidated Balance Sheets (Unaudited) (In thousands, except per share data and share count) | | ||||||

| | | ||||||

| | | ||||||

| | As of December 31, | | | As of March 31, | | ||

| | 2017 | | | 2018 | | ||

| Assets | | | | | | | |

| Current assets | | | | | | ||

| Cash and cash equivalents | $ | 504,468 | | | $ | 424,226 | |

| Accounts receivable, net | 693,085 | | | 703,066 | | ||

| Prepaid expenses and other current assets | 236,342 | | | 199,208 | | ||

| Total current assets | $ | 1,433,895 | | | $ | 1,326,500 | |

| Property, plant and equipment, net | 207,030 | | | 205,035 | | ||

| Deferred tax assets | 76,929 | | | 81,734 | | ||

| Investment in equity affiliates | 886 | | | 919 | | ||

| Intangible assets, net | 131,590 | | | 125,781 | | ||

| Goodwill | 1,337,122 | | | 1,337,051 | | ||

| Contract cost assets | | — | | | | 162,435 | |

| Other assets | 262,169 | | | 157,672 | | ||

| Total assets | $ | 3,449,621 | | | $ | 3,397,127 | |

| Liabilities and equity | | | | | | ||

| Current liabilities | | | | | | ||

| Short-term borrowings | $ | 170,000 | | | $ | 275,000 | |

| Current portion of long-term debt | 39,226 | | | 39,237 | | ||

| Accounts payable | 15,050 | | | 13,811 | | ||

| Income taxes payable | 30,026 | | | 40,026 | | ||

| Accrued expenses and other current liabilities | 584,482 | | | 503,116 Werbung Mehr Nachrichten zur Genpact Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | |||