FREEMAN FILES PRELIMINARY ECONOMIC ASSESSMENT TECHNICAL REPORT FOR LEMHI GOLD PROJECT

PR Newswire

VANCOUVER, BC, Nov. 30, 2023

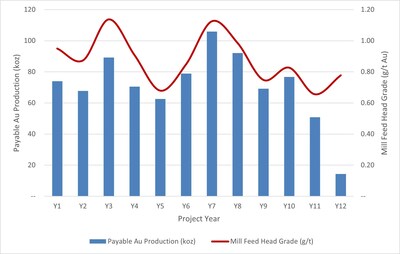

VANCOUVER, BC, Nov. 30, 2023 /PRNewswire/ - Freeman Gold Corp. (TSXV: FMAN) (OTCQX: FMANF) (FSE: 3WU) ("Freeman" or the "Company") is pleased to announce that it has filed a National Instrument ("NI") 43-101 Technical Report entitled "Lemhi Gold Project, NI 43-101 Technical Report and Preliminary Economic Assessment, Idaho, United States" dated effective of October 13, 2023 (the "Report") on SEDAR+ at www.sedarplus.ca. The Report is with respect to Freeman's Preliminary Economic Assessment ("PEA") on the Lemhi Gold Project, Idaho, USA, the results of which were announced in an October 13, 2023 news release. The PEA outlines a high-grade, low-cost, open pit operation with an average annual production of 80,100 ounces of gold ("Au") in the first eight years. The production strategy outlined in the PEA consists of a phased development with an increase in throughput during the fifth year of operation, with a flowsheet utilizing a carbon-in-leach ("CIL") processing facility. The objective of the study has been to maximize the value of Lemhi, while minimizing the footprint and environmental impact of the facility.

Lemhi PEA Highlights:

- After-tax NPV(5%) of US$212.4 million and IRR of 22.8% using a base case gold price of US$1,750/oz.

- After-tax NPV (5%) of US$ 345.7 million and IRR of 31.9% using spot gold price of $2,042.60 US$/oz.

- Average annual gold production of 75,900 oz Au for a total life-of-mine ("LOM") 11.2 years payable output of 851,900 oz Au.

- LOM cash costs of US$809/oz Au and all-in sustaining cash costs ("AISC") of US$957/oz Au.

- Initial CAPEX of US$190 million.

- Average gold recovery of 96.7%.

- High average mill head grade of 0.88 g/t Au.

- Average annual gold production of 80,100 oz Au in the first 8 years of production.

- Average mill throughput of 2.5 Mt/a (6.8 kt/d), increasing to 3.0 Mt/a (8.2 kt/d) after four years of operation.

To view an interactive 3D walkthrough of the Lemhi Gold Project, please use the following link or visit the Company's website:

Table 1: Project Economics & Upside

| Gold price (US$/oz Au) | Post-Tax NPV5% (US$M) | Post-Tax IRR |

| $1,600 | $144 | 17.6 % |

| $1,750Ŧ | $212 | 22.8 % |

| $1,900 | $281 | 27.6 % |

| $2,050 | $349 | 32.1 % |

| Ŧ base case scenario |

Production Profile & Economic Analysis

The results of the PEA demonstrate Lemhi has the potential to become a profitable, low-cost gold producer. With an average annual gold production of 75,900 oz Au over the 11.2-year LOM, Lemhi has a life of mine payable output of 851,900 oz Au and average annual gold production of 80,100 oz Au in the first eight years of production.

With an average operating cost of US$21.53/t milled over the LOM, the operation has cash costs of US$809/oz Au and AISC of US$957/oz Au. The project has an initial capital cost of US$190 million.

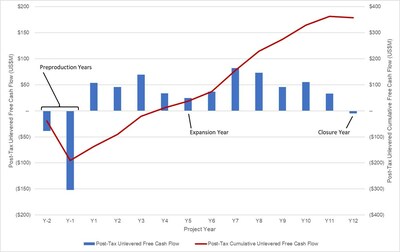

The economic analysis was performed assuming a 5% discount rate. Cash flows have been discounted to the start of construction, assuming that the project execution decision will be taken, and major project financing will be carried out at this time.

The preliminary economic assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

On a post-tax basis, the NPV discounted at 5% is US$212.4 million; the IRR is 22.8%; and payback period is 3.6 years. A summary of the post-tax project economics is shown graphically in Figure 2 and listed in Table 2.

Table 2: Economic Analysis Summary

| General | Unit | LOM Total/Avg |

| Gold Price | US$/oz | 1,750 |

| Mine Life | years | 11.2 |

| Total Waste Tonnes Mined | kt | 121,903 |

| Total Mill Feed Tonnes | kt | 31,128 |

| Strip Ratio | waste: mineralized rock | 3.9 |

| Production | Unit | LOM Total/Avg |

| Mill Head Grade | g/t | 0.88 |

| Mill Recovery Rate | % | 96.7 |

| Total Payable Mill Ounces Recovered | koz | 851.9 |

| Total Average Annual Payable Production | koz | 75.9 |

| Operating Costs | Unit | LOM Total/Avg |

| Mining Cost (incl. rehandle) | US$/t mined | 2.51 |

| Mining Cost (incl. rehandle) | US$/t milled | 11.43 |

| Processing Cost | US$/t milled | 9.03 |

| General & Administrative Cost | US$/t milled | 1.07 |

| Total Operating Costs | US$/t milled | 21.53 |

| Treatment & Refining Cost | US$/oz | 4.30 |

| Net Smelter Royalty | % | 1.0 |

| Cash Costs1 | US$/oz Au | 809 |

| All-In Sustaining Costs2 | US$/oz Au | 957 |

| Capital Costs | Unit Werbung Mehr Nachrichten zur Freeman Gold Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |