First Reliance Bancshares Reports 4th Quarter 2017 Results And Completes Acquisition Of Independence Bancshares

PR Newswire

FLORENCE, S.C., Feb. 28, 2018

FLORENCE, S.C., Feb. 28, 2018 /PRNewswire/ -- First Reliance Bancshares, Inc. (OTC: FSRL), the holding company (the "Company") for First Reliance Bank (the "Bank"), reported a fourth quarter 2017 net loss of $2,719,627, or $0.34 per diluted share. The Company's adjusted net income was $426,266, or $0.05 per diluted share, excluding an estimated tax charge of $2.7 million, related to the Tax Cuts and Jobs Act and non-recurring merger related expenses incurred in the fourth quarter of $501,265 totaling $0.39 per diluted share. The tax charge was attributed entirely to the revaluation of the Company's deferred tax assets ("DTAs").

The Company's DTAs are estimates of future tax benefits that arose primarily from expenses that were reported on current and previous years' financial statements but are not deductible for tax purposes until future years' tax returns (e.g., provisions for loan losses for probably incurred losses that are reported on financial statements as compared to tax returns where deductions are reported only when loans are charged off). On December 22, 2017, when the Tax Cuts and Jobs Act was enacted, the Company's federal income tax rate decreased from 34% to 21% effective in 2018, and the DTAs were revalued accordingly. While the revaluation of DTAs decreases 2017 net income, the lower federal tax rate beginning in 2018 is expected to increase net income in the future years.

Core profitability continues to be driven by strong loan and deposit growth and expanding operating efficiencies, but has been impacted temporarily with the opening of two new branch offices, an OREO write-down of $541,527 on a pending sale totaling $1.6 million expected to close in the first quarter of 2018, and a decline in mortgage income stemming from a slowdown in correspondent bank mortgage originations.

On January 22, 2018, we completed the legal closing of the acquisition of Independence Bancshares, Inc. and its wholly-owned subsidiary, Independence National Bank ("Independence"). The operational conversion is scheduled for early March 2018. This expansion into the attractive Greenville market will continue to broaden our footprint throughout South Carolina. The closing of this transaction comes on the heels of several new significant developments for the Bank over the past six months, including raising $25.1 million of additional capital in September 2017, Jack McElveen joining the bank in September 2017 as Chief Credit Officer, Kemper Kenan joining the bank as City Executive for Greenville, South Carolina in late 2017, David Barksdale joining the bank as President of North Carolina in early 2018, and Ben Brazell being named as President of South Carolina in early 2018. In early first quarter of 2018, we received regulatory approval to open our Myrtle Beach branch location and hired Ron Paige as City Executive for the Myrtle Beach market.

Financial Highlights (at or for the twelve months ended December 31, 2017, except as noted)

- Completed legal closing of Independence Banchshares on January 22, 2018. The combined company is expected to have approximately $532.9 million in assets. Operational full conversion of systems is expected to be completed by March 5, 2018.

- Received regulatory approval for expansion into Myrtle Beach, South Carolina.

- Planned expansion into Charlotte, North Carolina Q1 2018.

- Opened a loan production office in Winston-Salem, North Carolina.

- Loan growth is up $45.5 million, or 16%, while earning asset yields at the Bank remain stable at 4.61% for the twelve months ended December 31, 2017 compared to 4.60% for the same period of 2016.

- Non-interest bearing checking accounts increased $10 million to 24% of total deposits from one year ago, as we continue to attract new customers through unique programs and the convenience of mobile banking.

- Total Deposits increased $16.5 million from one year ago as the Company continues to leverage its low cost of funds at 36bps.

- Net interest margin (NIM) was 4.29% for the twelve months ended December 31, 2017.

Review of Income Statement

Net interest income improved 9% at $1.2 million for the twelve months ended December 31, 2017, compared to the same period of 2016. Late in the third quarter of 2017, the Company paid off its $7.0 million senior secured loan, which will reduce interest expense by approximately $350,000 annually. The improvement in net interest income is due to growth in earning assets while earning asset yields remain stable at 4.61% for the twelve months ended December 31, 2017 compared to 4.60% for the same period 2016.

Noninterest income decreased 17% to $8.34 million for the twelve months ended December 31, 2017, compared to $10 million for the same period 2016. The decrease in noninterest income was largely due to a one time gain on the sale of bank premise totaling $652,367 in the fourth quarter 2016 and the decrease in gains on sale of mortgage loans on a year-over-year basis as a result of lower production volumes within the Company's correspondent mortgage channel due to lower levels of refinancing opportunities. However, the Company's retail mortgage channel within each operating market increased production volumes year-over-year by $4 million and continues to build core franchise value and provide customer acquisition opportunities.

Balance Sheet and Asset Quality

Total assets increased $50.2 million, or 12% to $458.4 million at December 31, 2017, compared to $408.1 million from December 31, 2016.

Loans receivable grew by $45.5 million, or 15%, to $333.6 million at December 31, 2017, compared to $288.1 million, at December 31, 2016 largely due to continued growth in all our markets including commercial portfolios, 1-4 family mortgage portfolios and our consumer loan portfolios. 1-4 Family mortgage portfolio loans are up 26%, Commercial Real Estate loans are up 22%, and Consumer loans are up 20% year over year. "Continued earning asset growth is the primary focus going into 2018 with emphasis on consumer and commercial loans throughout the branch network and commercial loan growth in our new markets which include Winston-Salem and Myrtle Beach.

Transaction and Savings deposits increased by $7.1 million, or 11%, to $275.8 million at December 31, 2017, from $268.6 million at December 31, 2016. Household checking accounts increased by 4% reflecting our strong year-over-year branch sales growth. "We continue to focus on creating an exceptional customer experience to drive a differentiated level of service to our customers and we continuously upgrade customer channels to expand customer convenience and improve our efficiency," said Rick Saunders, Chief Executive Officer.

Nonperforming assets declined $2.4 million to $3.0 million at December 31, 2017 compared to one year ago. The Company incurred a write down on OREO totaling $541,527 during the quarter relating to a pending sale totaling $1.6 million expected to close in the first quarter of 2018. The ratio of nonperforming assets to total assets declined to 0.67% at December 31, 2017, compared to 1.34% one year earlier. The allowance for loan losses as a percentage of loans was 0.72% at December 31, 2017, compared to 0.90% one year earlier. For the fourth quarter of 2017, loan charge offs were nominal and largely offset by the bank recoveries.

Capital

First Reliance Bank continues to remain well capitalized under all regulatory measures with capital ratios exceeding the statutory well-capitalized thresholds by an ample margin. At December 31, 2017, capital ratios were as follows:

| Ratio | First Reliance Bank | Well-capitalized Minimum |

| Tier 1 leverage ratio | 9.50% | 5.00% |

| Common equity tier 1 capital | 11.64% | 6.50% |

| Tier 1 capital ratio | 11.64% | 8.00% |

| Total capital ratio | 12.32% | 10.00% |

ABOUT FIRST RELIANCE BANCSHARES, INC.

First Reliance Bancshares, Inc. is the holding company for First Reliance Bank. The Bank was founded in 1999, employs approximately 160 talented associates and serves the Columbia, Lexington, Greenville, Charleston, Mount Pleasant, Summerville, Loris, Myrtle Beach, and Florence markets in South Carolina and Winston-Salem, North Carolina. First Reliance Bank offers several unique customer programs which include a Hometown Heroes package of benefits for those who are serving our communities, Check 'N Save, a community outreach program for the unbanked or under-banked, a Moms First program, and an iMatter program targeted to young people. The Bank also offers a Customer Service Guaranty, a Mortgage Service Guaranty, FREE Coin Machines for customers to use, Mobile Banking, Mobile mortgage applications, and is open on most traditional bank holidays. Its commitment to making customers' lives better and the idea that "There's More to Banking Than Money" has earned the Bank a customer satisfaction rating of 95%. First Reliance Bank is also one of three companies throughout South Carolina who have received the Best Places To Work in South Carolina award all twelve years since the program began.

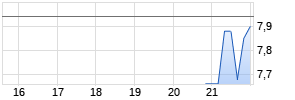

The common stock of First Reliance Bancshares, Inc. is traded under the symbol FSRL.OB. Additional information about the Company is available on the Company's web site at www.firstreliance.com.

Certain statements in this news release contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements relating to future plans and expectations, and are thus prospective. Such forward-looking statements include but are not limited to statements with respect to our plans, objectives, expectations and intentions and other statements that are not historical facts, and other statements identified by words such as "believes," "expects," "anticipates," "estimates," "intends," "plans," "targets," and "projects," as well as similar expressions. Such statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, we can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by the Company or any person that the future events, plans, or expectations contemplated by the Company will be achieved.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) competitive pressures among depository and other financial institutions may increase significantly and have an effect on pricing, spending, third-party relationships and revenues; (2) the strength of the United States economy in general and the strength of the local economies in which we conduct operations may be different than expected resulting in, among other things, a deterioration in the credit quality or a reduced demand for credit, including the resultant effect on the Company's loan portfolio and allowance for loan losses; (3) the rate of delinquencies and amounts of charge-offs, the level of allowance for loan loss, the rates of loan growth, or adverse changes in asset quality in our loan portfolio, which may result in increased credit risk-related losses and expenses; (4) the risk that the preliminary financial information reported herein and our current preliminary analysis will be different when our review is finalized; (5) changes in the U.S. legal and regulatory framework including, but not limited to, the Dodd-Frank Act and regulations adopted thereunder; (6) adverse conditions in the stock market, the public debt market and other capital markets (including changes in interest rate conditions) could have a negative impact on the Company; (7) the business related to the acquisition of Independence may not be integrated successfully or such integration may take longer to accomplish than expected; (8) the expected cost savings and any revenue synergies from the Independence acquisition may not be fully realized within expected timeframes; and (9) disruption from the Independence acquisition may make it more difficult to maintain relationships with clients, associates, or suppliers. All subsequent written and oral forward-looking statements concerning the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

Contact Jeffrey A. Paolucci, Executive Vice President and Chief Financial Officer, (888)543-5510.

| | | | | |||

| First Reliance Bancshares, Inc. and Subsidiary | | | | |||

| Consolidated Balance Sheets | | | | |||

| | | | | |||

| | December 31 | September 30 | December 31 | |||

| | 2017 | 2017 | 2016 | |||

| Assets | | | | |||

| Cash and cash equivalents: | | | | |||

| Cash and due from banks | $ 3,494,466 | $ 3,595,799 | $ 4,810,304 | |||

| Interest-bearing deposits with other banks | 21,136,349 | 34,771,527 | 22,287,560 | |||

| Total cash and cash equivalents | 24,630,815 | 38,367,326 | 27,097,864 | |||

| | | | | |||

| Time deposits in other banks | 102,020 | 102,020 | 101,816 | |||

| | | | | |||

| Securities available-for-sale | 26,894,718 | 17,994,798 | 17,862,635 | |||

| Securities held-to-maturity (Estimated fair value of $17,372,835.21, $18,117,507 | | |||||

| and $20,842,140 at December 31, 2017, September 30, 2017 and December 31, 2016) | 17,018,132 | 17,645,821 | 20,438,084 | |||

| Nonmarketable equity securities | 1,359,200 | 424,200 | 734,300 | |||

| Total investment securities | 45,272,050 | 36,064,819 | 39,035,019 | |||

| | | | | |||

| Mortgage loans held for sale | 7,885,938 | 5,892,189 | 5,355,532 | |||

| | | | | |||

| Loans receivable | 333,675,252 | 327,001,685 | 288,126,331 | |||

| Less allowance for loan losses | (2,453,875) | (2,561,166) | (2,648,535) | |||

| Loans, net | 331,221,377 | 324,440,519 | 285,477,796 | |||

| | | | | |||

| Premises, furniture and equipment, net Werbung Mehr Nachrichten zur First Reliance Bk Sc Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||