First Community Corporation Announces Third Quarter Results and Cash Dividend

PR Newswire

LEXINGTON, S.C., Oct. 21, 2015

LEXINGTON, S.C., Oct. 21, 2015 /PRNewswire/ --

Highlights

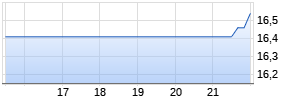

- Net income increase of 16.4% on a linked quarter basis. Third quarter net income of $1.679 million ($0.25 per share) as compared to $1.443 million ($0.22 per share) in the prior quarter.

- Strong loan growth continues with $9.9 million in net loan growth during the third quarter. Annualized growth rate of 8.4% and year-to-date net loan growth in excess of $40 million with production in excess of $90 million.

- Pure deposit growth (including customer cash management accounts) of $23.6 million during the third quarter. Annualized growth rate of 17.3% and year-to-date net pure deposit growth (including customer cash management accounts) of $48 million.

- Key credit quality metrics were excellent with charge-offs of less than 0.01% during the quarter and 0.17% year-to-date and non-performing assets of .88% at quarter end.

- Cash dividend of $0.07 per common share, which is the 55th consecutive quarter of cash dividends paid to common shareholders

- Regulatory capital ratios remain strong at 10.34% (Tier 1 Leverage) and 16.48% (Total Capital) along with Tangible Common Equity / Tangible Assets (TCE/TA) ratio of 8.50%

Today, First Community Corporation (Nasdaq: FCCO), the holding company for First Community Bank, reported net income for the third quarter of 2015. On a linked quarter basis, net income increased 16.4% to $1.679 million in the third quarter of the year as compared to $1.443 million in the second quarter of 2015. Diluted earnings per common share increased to $0.25 for the third quarter of 2015 as compared to $0.22 for the second quarter of 2015. Year-to-date 2015 net income was $4.526 million, a 25.2% increase over the $3.615 million earned in the first nine months of 2014. Year-to-date diluted earnings per share were $0.68 compared to $0.55 during the same time period in 2014.

Cash Dividend and Capital

The Board of Directors has approved a cash dividend for the third quarter of 2015. The company will pay a $0.07 per share dividend to holders of the company's common stock. This dividend is payable November 13, 2015 to shareholders of record as of November 2, 2015. Mr. Crapps commented, "Our entire board is pleased that our performance enables the company to continue its cash dividend for the 55th consecutive quarter."

Each of the regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) exceed the well capitalized minimum levels currently required by regulatory statute. At September 30, 2015, the company's regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) were 10.34%, 15.67%, and 16.48%, respectively. This compares to the same ratios as of September 30, 2014, of 10.33%, 15.78%, and 16.61%, respectively. Additionally, the regulatory capital ratios for the company's wholly owned subsidiary, First Community Bank, were 9.83%, 14.92%, and 15.74% respectively as of September 30, 2015. Further, the company's ratio of tangible common equity to tangible assets was 8.50% as of September 30, 2015.

Asset Quality

The non-performing assets ratio declined to 0.88% of total assets, as compared to the prior quarter ratio of 0.94%. The nominal level of non-performing assets decreased to $7.519 million from $7.872 million at the end of the prior quarter, a 4.5% decrease. Trouble debt restructurings, that are still accruing interest, declined slightly during the quarter to $1.654 million from $1.674 million at the end of the second quarter of 2015.

Net loan charge-offs for the quarter were $6 thousand (less than 0.01%) and for the first nine months of 2015 were $654 thousand (0.17%). The ratio of classified loans plus OREO now stands at 14.76% of total bank regulatory risk-based capital as of September 30, 2015.

|

Balance Sheet (Numbers in millions)

| |||||||||

| | Quarter | | Quarter | | Quarter | | | | |

| | Ended | | Ended | | Ended | | 3 Month | | 3 Month |

| | 9/30/15 | | 6/30/15 | | 12/31/14 | | $ Variance | | % Variance |

| Assets | | | | | | | | | |

| Investments | $273.7 | | $271.2 | | $282.8 | | $2.5 | | 0.9% |

| Loans | 483.9 | | 474.0 | | 443.8 | | 9.9 | | 2.1% |

| | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Total Pure Deposits | $549.9 | | $526.7 | | $504.5 | | $23.2 | | 4.2% |

| Certificates of Deposit | 154.5 | | 157.3 | | 165.1 | | (2.8) | | (1.8)% |

| Total Deposits | $704.4 | | $684.0 | | $669.6 | | $20.4 | | 3.0% |

| | | | | | | | | | |

| Customer Cash Management | $19.9 | | $19.5 | | $17.4 | | $0.4 | | 2.1% |

| FHLB Advances | 27.5 | | 35.5 | | 28.8 | | (8.0) | | (22.5%) |

| | | | | | | | | | |

| Total Funding | $751.8 | | $739.0 | | $715.8 | | $12.8 | | 1.7% |

| Cost of Funds* | 0.45% | | 0.45% | | 0.47% | | | | (0 bps) |

| (*including demand deposits) | | | | | | | | | |

| Cost of Deposits | 0.26% | | 0.25% | | 0.26% | | | | 1 bps |

Mr. Crapps commented, "This was another quarter of strong performance by our company led by continued growth in loans and pure deposits. We continue to see the benefit of focused efforts in these key areas."

Revenue

Net Interest Income/Net Interest Margin

Net interest income increased on a linked quarter basis to $6.3 million for the third quarter up from $6.2 million in the second quarter of 2015. The net interest margin, on a taxable equivalent basis, decreased slightly to 3.32% for the third quarter from 3.34% in the second quarter of the year.

Non-Interest Income

Non-interest income, adjusted for securities gains and losses, decreased 2.9% on a linked quarter basis to $2.329 million in the third quarter of 2015, down from $2.398 million in the second quarter of this year. Revenues in the mortgage line of business were relatively flat on a linked quarter basis at $964 thousand in the third quarter of 2015. Production levels remained constant on a linked quarter basis at approximately $30 million in total loan volume. Yields for the third quarter decreased slightly from the second quarter average of 3.27% to 3.20% in the third quarter. The investment advisory line of business saw a decrease in revenue in the third quarter from $407 thousand in the second quarter of 2015 to $290 in the third quarter. Deposit fees generated in the commercial and retail banking line of business increased $44 thousand (12.7%) during the quarter. Mr. Crapps commented, "Our strategy of generating revenue streams from multiple lines of business continues to serve us well. As anticipated, our mortgage line of business experienced another good quarter on par with the results of the second quarter. Our financial planning line of business also had a good quarter, although it was down from the second quarter production which included one major piece of business."

Non-Interest Expense

Non-interest expense decreased significantly by $322 thousand (5.0%) on a linked quarter basis. This is primarily attributable to a decrease in compensation and benefit expense and marketing costs. Marketing expenses were higher in the first part of the year due to the creative and production costs associated with the development of the marketing initiatives along with higher media costs to support the strategy of an early and heavy media presence targeted to assist with the bank's commercial loan growth.

Other

Mehr Nachrichten zur First Community Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.