First Community Corporation Announces Earnings and Increased Cash Dividend

PR Newswire

LEXINGTON, S.C., Jan. 17, 2018

LEXINGTON, S.C., Jan. 17, 2018 /PRNewswire/ --

Highlights

- Net income of $5.8 million in 2017 and $502 thousand for the fourth quarter

- Increased cash dividend to $0.10 per common share, the 64th consecutive quarter of cash dividends paid to common shareholders, highest dividend ever paid by the company

- Adjustment to deferred tax asset of $1.2 million as a result of new tax rate legislation

- Merger expenses of $619 thousand in the quarter and $945 thousand for the year

- Completed acquisition of Cornerstone Bancorp

- Assets now in excess of $1 billion

- Organic loan growth of $18.2 million during the quarter, a 12.8% annualized growth rate

- Key credit quality metrics continue to be excellent with a year-to-date net loan recovery of $145 thousand and non-performing assets of 0.51% at year end

Today, First Community Corporation (Nasdaq: FCCO), the holding company for First Community Bank, reported net income for the fourth quarter and year end of 2017. For the year ended December 31, 2017 net income was $5.8 million. Diluted earnings per share for 2017 were $0.83. Net income for the fourth quarter of 2017 was $502 thousand. Diluted earnings per share were $0.07 for the fourth quarter of 2017. During the fourth quarter, the company recognized an adjustment to deferred tax asset of $1.2 million related to the Tax Cuts and Jobs Act which was signed by President Trump on December 22, 2017. During the quarter, the company also recognized $619 thousand in merger expenses, of which approximately $349 thousand is tax deductible, related to the acquisition of Cornerstone Bancorp. For the year, the company recognized total merger expenses of $945 thousand, of which approximately $675 thousand is tax deductible.

First Community President and CEO Michael Crapps commented, "While the new tax law had a negative impact on earnings in the fourth quarter, we are excited about the long term benefit that we will recognize. In addition, the acquisition of Cornerstone Bancorp gives us an expanded presence in the growing Upstate market."

Cash Dividend and Capital

The Board of Directors has approved an increase in the cash dividend for the fourth quarter of 2017 to $0.10 per common share. This dividend is payable on February 15, 2018 to shareholders of record of the company's common stock as of February 1, 2018. Mr. Crapps commented, "The entire board is pleased that our company's strong financial performance enables us to increase the cash dividend to the highest level ever paid by the company. We are also proud that dividend payments have continued uninterrupted for 64 consecutive quarters."

Each of the regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) exceeds the well capitalized minimum levels currently required by regulatory statute. At December 31, 2017, the company's regulatory capital ratios (Leverage, Tier I Risk Based and Total Risk Based) were 10.35%, 14.25%, and 15.05%, respectively. This compares to the same ratios as of December 31, 2016 of 10.23%, 14.46%, and 15.28%, respectively. Additionally, the regulatory capital ratios for the company's wholly owned subsidiary, First Community Bank, were 9.86%, 13.59%, and 14.39% respectively as of December 31, 2017. Further, the company's ratio of tangible common equity to tangible assets indicates a high quality of capital with a ratio of 8.56% as of December 31, 2017. The common equity tier one ratio for the company and the bank was 12.26% and 13.59%, respectively, at December 31, 2017.

Asset Quality

The company's asset quality remains strong. The non-performing assets ratio increased on a linked quarter basis to 0.51% of total assets at December 31, 2017, as compared to the ratio of 0.41% at the end of the third quarter of 2017 and down from 0.58% at December 31, 2016. The nominal level of non-performing assets was $5.3 million at year end 2017 up from $3.7 million at the end of the third quarter of 2017 and $5.2 million at the end of 2016. This increase was driven by Other Real Estate Owned (OREO) acquired in the merger with Cornerstone Bancorp. These properties were marked to market as of the merger date and the bank is seeking to sell these properties. The past due ratio for all loans was 0.33% at year-end 2017 down from 0.37% at the end of third quarter 2017 and 0.34% at year-end 2016. The Special Mention category was $10.1 million at year end an increase on a linked quarter and year-over-year primarily attributable to one credit which is adequately secured by real estate and has been performing as expected. Trouble debt restructurings, that are still accruing interest, were $1.9 million at year end 2017 compared to 1.7 million at the end of the third quarter and $1.8 million at year end 2016.

Net loan recoveries were $146 thousand for the year of 2017 and $1,000 for the fourth quarter. The ratio of classified loans plus OREO now stands at 8.86% of total bank regulatory risk-based capital as of December 31, 2017.

Balance Sheet

(Numbers in millions)

| | Quarter 12/31/17 | Quarter 12/31/16 | Quarter 9/30/17 |

12 Month $ Variance |

12 Month % Variance |

| Assets | | | | | |

| Investments | $284.4 | $272.4 | $248.7 | $12.0 | 4.4% |

| Loans | 646.8 | 546.7 | 568.5 | 100.1 | 18.3% |

| | | | | | |

| Liabilities | | | | | |

| Total Pure Deposits | $729.5 | $611.9 | $630.8 | $117.6 | 19.2% |

| Certificates of Deposit | 158.8 | 154.7 | 139.3 | 4.1 | 2.7% |

| Total Deposits | $888.3 | $766.6 | $770.1 | 121.7 | 15.9% |

| | | | | | |

| Customer Cash Management | $19.3 | $19.5 | $17.5 | ($0.2) | (1.0)% |

| FHLB Advances | 14.3 | 24.0 | 17.3 | (9.7) | (40.4%) |

| | | | | | |

| Total Funding | $921.9 | $810.1 | $804.09 | $111.8 | 13.8% |

| Cost of Funds (including demand deposits) | 0.30% | 0.35% | 0.34% | | -5bps |

| Cost of Deposits | 0.22% | 0.24% | 0.24% | | -2bps |

Mr. Crapps commented, "A highlight of the fourth quarter was strong organic loan growth of $18.2 million, a 12.8% annualized growth rate. This loan growth is especially impressive given our commitment to credit quality and the strong performance of our loan portfolio. Pure deposit growth was strong during the year and with the additional liquidity provided by the acquisition of Cornerstone Bancorp we have the funding available to support significant additional loan growth. The strength of our deposit franchise continues to shine as our cost of deposits decreased to 0.22% even in this rising rate environment."

Revenue

Net Interest Income/Net Interest Margin

Net interest income increased on a linked quarter basis to $8.1 million for the fourth quarter up from $7.2 million in the third quarter of 2017 and year-over-year increased to $29.4 million at December 31, 2017 from $26.5 million at December 31, 2016. The net interest margin, on a taxable equivalent basis, increased to 3.54% for the fourth quarter of 2017 from 3.52% in the third quarter of the year. This is the sixth consecutive quarter of net interest margin expansion, after adjusting the net interest margin for the first quarter of 2017 as previously discussed.

Non-Interest Income

Non-interest income for the year, adjusted for securities gains and loss on the early extinguishment of debt, increased year-over-year to $9.7 million in 2017 compared to $8.8 million in 2016. Fourth quarter non-interest income was $2.5 million, up year-over-year from $2.2 million in the fourth quarter of 2016, and flat on a linked quarter basis.

Revenues in the mortgage line of business for the year increased year-over-year to $3.8 million in 2017 from $3.4 million in 2016 and for the quarter decreased slightly year-over-year to $828 thousand in 2017 from $867 thousand in 2016. Mortgage production year-over-year increased 5.9% to $108.6 million. Also adding to the mortgage revenue was an 18 basis point improvement in yields in 2017. Revenue in the investment advisory line of business increased year-over-year to $1.3 million in 2017 compared to $1.1 million in 2016, and on a linked quarter basis to $383 thousand in the fourth quarter of 2017 compared to $337 thousand in the third quarter. Mr. Crapps noted, "Our strategy of generating revenue streams from multiple lines of business continues to serve us well and we are focused on continuing to leverage each of our lines of business."

Non-Interest Expense

Non-interest expenses were $8.4 million in the fourth quarter of 2017 compared to $6.9 million in the third quarter. This $1.5 million increase on a linked quarter basis included $360 thousand in additional salary and benefit expense, $200 thousand in additional marketing expense, $392 thousand in additional merger related expenses, $164 thousand for the purchase of a South Carolina Rehabilitation Tax Credit, and a $256 thousand increase in core system processing expenses mostly related to the addition of the Cornerstone customer base.

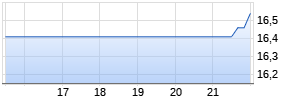

First Community Corporation stock trades on the NASDAQ Capital Market under the symbol "FCCO" and is the holding company for First Community Bank, a local community bank based in the Midlands of South Carolina. First Community Bank operates eighteen banking offices located in the Midlands and Upstate regions of South Carolina and Augusta, Georgia, a loan production office in Greenville, South Carolina, in addition to two other lines of business, First Community Bank Mortgage and First Community Financial Consultants, a financial planning/investment advisory division.

FORWARD-LOOKING STATEMENTS

Mehr Nachrichten zur First Community Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.