EQS-News: Fielmann Group AG / Key word(s): Preliminary Results/Annual Results Preliminary financials for FY2023: Fielmann Group grows sales +12%, EBITDA +21%, EBITDA margin +1 percentage point 29.02.2024 / 07:29 CET/CEST The issuer is solely responsible for the content of this announcement.

Preliminary financials for FY2023 Fielmann Group grows sales +12%, EBITDA +21%, EBITDA margin +1 percentage point - Vision 2025 investments see Fielmann Group exceed sales goal, margin increase on track

- External e-commerce sales increase +17% to more than €100 million

- International markets’ share increases to 35% of total Group sales in Q4/2023

Over the course of 2023, persistently high inflation levels coupled with rising interest rates saw consumers reduce their spending and opt for providers that offer guaranteed quality and excellent service at the best price. In the optical and acoustic industry, this is the Fielmann Group. The German family business significantly extended its market shares across major markets, outperformed its Vision 2025 sales goal, and expanded its EBITDA margin.

Preliminary financials for FY2023 In 2023 the Fielmann Group generated external sales of around €2.27 billion (incl. VAT and inventory changes), a 12% increase over previous year (€2.03 billion). Consolidated sales rose to €1.97 billion (+12%, previous year: €1.76 billion). These figures are in line with the guidance we communicated in September and confirmed in November. The main drivers of our positive development were strong organic growth in existing markets amounting to +8% compared to previous year and acquisitions contributing an additional growth of +4%. Vision 2025 investments in the digitalisation and internationalisation of our family business drove the outperformance of our digital channels (+17% over last year), reaching external sales of more than €100 million for the first time (5% of total Group sales). Our international business continued to grow strongly, making up 35% of the Group’s total sales in Q4/2023 which is an increase by 14 percentage points since the inception of Vision 2025 in 2018. Central European markets delivered solid organic growth. Our unit market share in Germany grew by +2 percentage points to 55% – the highest value ever – thanks to the dedication of our great teams. Italy and Poland continued to record double-digit sales growth – again gaining market shares. In Spain, the Fielmann Group generated +42% sales growth over last year and is therefore progressing swiftly on its course to reach market leadership. Further growth drivers were our continued expansion in the Czech Republic and a recovery in business in Ukraine. The acquisition of SVS Vision in the United States contributed a total of around €30 million sales from September 2023 onwards. At year end, the Fielmann Group operated 1,086 stores worldwide (previous year: 968). 385 of them include hearing aid studios (previous year: 352) that fitted more than 119,000 hearing aids in 2023. Globally, 23,412 people including our new members in Spain and the US contributed to the growth of our family business as of 31 December 2023 (previous year: 22,631). FY2023 marked the turnaround in profitability with an EBITDA margin expansion of more than 1 percentage point: According to preliminary figures, EBITDA is expected to amount to approximately €410 million (+21%, previous year: €340 million), while EBT will reach around €193 million (+20%, previous year: €161 million). This positive development goes back to an increase in progressive glasses sold, the impact of our Cost Leadership Program and marketing spendings below last year.

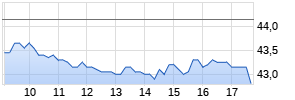

Dividend increase Considering the successful development of the Group in 2023, the Management Board and Supervisory Board are going to recommend an increased dividend of €1.00 per share (previous year: €0.75) to the Annual General Meeting on 11 July 2024. Based on our year-end share price, the dividend yield amounts to 2.0%. The total dividend payout equates to €84 million (previous year: €63 million).

Outlook In Q4/2023 and early 2024 most of our markets exhibited low consumer sentiment – in Germany a bleak economic outlook led to an even further decline. Whilst we felt these headwinds in our home market, our market share gains in 2023 make us optimistic that we can grow our market position in 2024 even further. Our focus remains on retaining new and known customers by delivering guaranteed quality and an excellent service at the best prices. Promising growth opportunities in Eastern Europe, Spain and the US coupled with a diligent execution of our Cost Leadership Program make us confident that we will continue to extend our profitability. Our guidance for FY2024 will be reviewed by our Supervisory Board in April and published subsequently, as part of our Annual Report. Hamburg, Germany – 29 February 2024 Fielmann Group AG The Management Board

About the Fielmann Group The Fielmann Group is a German family business that serves 28 million customers with eyewear, contact lenses, hearing aids and primary eyecare services. It operates an omnichannel platform consisting of digital sales channels and more than 1,000 retail stores worldwide. Founded in 1972, the company is led by Marc Fielmann, representing the second generation of the Fielmann Family who still owns most of the company’s stock. By staying true to its customer-centric values, the Fielmann Group helps everyone hear and see the beauty in the world. Thanks to the dedication of its 23,000 people worldwide, the company is consistently reaching customer satisfaction and retention rates of more than 90% and has to-date fitted more than 170 million pairs of individual prescription glasses.

Further information Katrin Carstens · Director Communications & PR · presse@fielmann.com · Phone +49 40 270 76-5907 Ulrich Brockmann · Director IR · investorrelations@fielmann.com · Phone +49 40 270 76-442

29.02.2024 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group AG. The issuer is solely responsible for the content of this announcement. The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.eqs-news.com