Early Settlement Date for IRSA CP's Outstanding 7.875% Notes due 2017 and extension of early tender conditions for IRSA's Outstanding 8.500% Notes due 2017

PR Newswire

BUENOS AIRES, Argentina, March 28, 2016

BUENOS AIRES, Argentina, March 28, 2016 /PRNewswire/ -- IRSA CP today announced that in connection with its previously announced tender offer to purchase for cash (the "IRSA CP Tender Offer") any and all of its outstanding 7.875% Notes due 2017, Series No. 1 (the "IRSA CP Notes"), IRSA CP expects that the IRSA CP Notes that were validly tendered, and not validly withdrawn, in the IRSA CP Tender Offer prior to 5:00 p.m. (New York City time) on March 16, 2016 (the "Early Tender Time") will be purchased by IRSA CP on March 28, 2016 (the "Early Settlement Date"). The IRSA CP Tender Offer was subject to certain terms and conditions, which have been satisfied or waived by IRSA CP as of the date hereof.

As previously announced, Holders of IRSA CP Notes who validly tendered and did not validly withdraw their IRSA CP Notes prior to the Early Tender Time will receive US$1,004.50 per US$1,000 principal amount of such IRSA CP Notes accepted for purchase, which includes an Early Tender Payment of US$30.00 per US$1,000 principal amount of the IRSA CP Notes, on the Early Settlement Date.

The IRSA CP Tender Offer will expire at 11:59 p.m. (New York City time) on March 31, 2016, unless extended (the "Expiration Time"). Holders of IRSA CP Notes who validly tender and do not validly withdraw their IRSA CP Notes after the Early Tender Time and prior to the Expiration Time will be eligible to receive US$974.50 per US$1,000 principal amount of such IRSA CP Notes that are accepted for purchase. IRSA CP expects to make such payment on the Final Settlement Date, which is currently expected to be on or about April 8, 2016.

Holders whose IRSA CP Notes are purchased on the Early Settlement Date or the Final Settlement Date will receive accrued and unpaid interest in respect of their purchased IRSA CP Notes from the last interest payment date to, but not including, the applicable Settlement Date.

The previously announced concurrent tender offers to purchase for cash (together with the IRSA CP Tender Offer, the "Tender Offers") and the related Consent Solicitations by IRSA Inversiones y Representaciones Sociedad Anónima ("IRSA") for (i) IRSA's outstanding 11.500% Notes due 2020, Series No. 2 (the "2020 Notes") and (ii) any and all of IRSA's outstanding 8.500% Notes due 2017, Series No. 1 (the "2017 Notes" and, together with the 2020 Notes, the "IRSA Notes") will also expire at the Expiration Time specified above.

As previously announced, the Early Tender Time for the 2017 Notes of IRSA has been extended until 11:59 p.m. (New York City time) on March 31, 2016. Accordingly, Holders of the 2017 Notes who validly tender and do not validly withdraw their 2017 Notes prior to the Expiration Time will be eligible to receive US$1,005.00 per US$1,000 principal amount of their 2017 Notes that are accepted for purchase, which includes an Early Tender Payment of US$30.00 per US$1,000 principal amount of the 2017 Notes, subject to the satisfaction or waiver of the conditions to the Tender Offers and the Consent Solicitation described in the Offer Documents.

Holders of IRSA Notes who validly tender and do not validly withdraw their IRSA Notes prior to the Expiration Time will be eligible to receive the consideration described in the Offer Documents (as defined below) on the Final Settlement Date, subject to the satisfaction or waiver of the conditions to the Tender Offers and the Consent Solicitations.

The Withdrawal Deadline for the Tender Offers occurred at 5:00 p.m. (New York City time) on March 16, 2016. As a result, validly tendered IRSA CP Notes and IRSA Notes may no longer be withdrawn.

The terms and conditions of the Tender Offers and the related Consent Solicitations are described in the Offer to Purchase and Consent Solicitation Statement, dated March 3, 2016 (the "Offer to Purchase"), as amended by the press release dated March 17, 2016, and the related Consent and Letter of Transmittal (together with the Offer to Purchase, the "Offer Documents").

Citigroup Global Markets Inc. and J.P. Morgan Securities LLC are acting as the Dealer Managers and Solicitation Agents with respect to the Tender Offers and the Consent Solicitations. Investors with questions may contact Citigroup Global Markets Inc. at +1 (212) 723-6106 or +1 (800) 558-3745 (U.S. toll-free) or J.P. Morgan Securities LLC at +1 (212) 834-7279 or +1 (866) 846-2874 (U.S. toll-free).

Bondholder Communications Group, LLC has been appointed as Tender Agent and Information Agent. All deliveries and correspondence sent to the Tender Agent should be directed to 30 Broad Street, 46th Floor New York, New York 10004 Attn: Isabella Salvador.

Copies of the Offer Documents are available at the following web address: www.bondcom.com/IRSA. Copies of the Offer Documents may also be requested from, and questions regarding the procedures for tendering Existing Notes may be directed to, Bondholder Communications Group, LLC by telephone at +1 (212) 809-2663 or +1 (888) 385-2663 (U.S. toll-free) or by email to Isabella Salvador, at ISalvador@bondcom.com.

This press release is not an offer to purchase, a solicitation of an offer to purchase, or a solicitation of consents with respect to the IRSA CP Notes nor is it an offer to sell nor a solicitation of offers to buy any securities. The IRSA CP Tender Offer is being made only pursuant to the Offer Documents.

The IRSA CP Tender Offer is not being made to Holders of IRSA CP Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. None of IRSA CP, its board of directors, the Tender Agent, the Information Agent, the Dealer Managers, the trustee of the IRSA CP Notes or any affiliate of any of them makes any recommendation as to whether or not Holders of IRSA CP Notes should tender IRSA CP Notes.

About IRSA CP

IRSA CP is one of the largest owners and managers of shopping centers and office and other commercial properties in Argentina in terms of gross leasable area and number of rental properties. IRSA CP owns and operates 15 shopping centers in Argentina, seven of which are located in the City of Buenos Aires. In addition, IRSA CP owns and manages six premium office buildings in the City of Buenos Aires and owns certain properties for future development in Buenos Aires and several provincial cities.

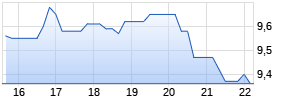

IRSA CP's shares are listed on the Buenos Aires Stock Market (Mercado de Valores de Buenos Aires S.A.) through the Buenos Aires Stock Exchange (Bolsa de Comercio de Buenos Aires) and its American Depositary Shares are listed on NASDAQ under the ticker "IRSACP".

Forward-Looking Statements

This press release contains certain "forward-looking" statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual outcomes to differ materially from current expectations. These statements are likely to relate to, among other things, the Purchasers' current beliefs, expectations and projections about future events and financial trends affecting the Purchasers' businesses. Any of such forward-looking statements are not guarantees of future performance and may involve risks and uncertainties, and that actual results may differ from those set forth in the forward-looking statements as a result of various factors (including, without limitations, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates, and operating and financial risks related to managing growth and integrating acquired businesses), many of which are beyond the control of the Purchasers. The occurrence of any such factors not currently expected by the Purchasers would significantly alter the results set forth in these statements.

| Contact: IRSA Propiedades Comerciales S.A. Moreno 877, Floor 22, (C1091AAQ), Ciudad Autónoma de Buenos Aires T: (5411) 4344 4600 F: (5411) 4814 7875 | |

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/early-settlement-date-for-irsa-cps-outstanding-7875-notes-due-2017-and-extension-of-early-tender-conditions-for-irsas-outstanding-8500-notes-due-2017-300241861.html

SOURCE IRSA Propiedades Comerciales S.A.

Mehr Nachrichten zur IRSA Inversiones Y Representaciones S.A. ADR Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.