Duke Energy reports first quarter 2017 financial results

PR Newswire

CHARLOTTE, N.C., May 9, 2017

CHARLOTTE, N.C., May 9, 2017 /PRNewswire/ --

- First quarter 2017 GAAP reported diluted earnings per share (EPS) was $1.02 compared to $1.01 in 2016; adjusted diluted EPS was $1.04 for the first quarter of 2017 compared to $1.13 for the first quarter of 2016

- Fundamentals of the business are strong despite warm winter weather in the first quarter

- Company remains on track to achieve its 2017 adjusted diluted earnings guidance range of $4.50 to $4.70 per share

Duke Energy today announced first quarter 2017 reported diluted EPS, prepared in accordance with Generally Accepted Accounting Principles (GAAP) of $1.02, compared to $1.01 for the first quarter of 2016. Duke Energy's first quarter 2017 adjusted diluted EPS was $1.04, compared to $1.13 for the first quarter 2016.

Adjusted diluted EPS excludes the impact of certain items included in GAAP reported diluted EPS. Amounts excluded from adjusted diluted EPS are primarily costs to achieve the Piedmont Natural Gas merger.

Adjusted diluted EPS for the first quarter of 2017 was lower than the prior year, primarily due to the absence of International Energy, which was sold in December 2016, and warm winter weather. Partially offsetting these drivers were the contributions of Piedmont Natural Gas and favorable operations and maintenance (O&M) expense at Electric Utilities and Infrastructure.

Based upon the results through the first quarter, the company remains on track to achieve its 2017 adjusted diluted earnings guidance range of $4.50 to $4.70 per share.

"We have a compelling strategy to deliver value to our stakeholders, and we are making good progress against our plan," said Lynn Good, Duke Energy chairman, president and CEO, "We recently announced Power/Forward Carolinas, our 10-year grid modernization plan in North Carolina. This program and others like it will not only strengthen the energy grid, but will also stimulate economic development and job growth in our communities and provide additional benefits for our customers."

ARIVA.DE Börsen-Geflüster

Weiter abwärts?

| Kurzfristig positionieren in Duke Energy | ||

|

MD8SVN

| Ask: 0,66 | Hebel: 6,35 |

| mit moderatem Hebel |

Zum Produkt

| |

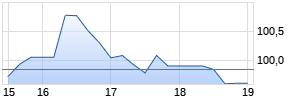

Kurse

|

"Our ongoing investments drove solid growth in our electric and gas utilities in the quarter, and we are responding to warm winter weather through disciplined cost management and operational efficiency. We remain on-track for 2017 and have affirmed our full-year guidance range."

Business segment results

In addition to the following summary of first quarter 2017 business segment performance, a comprehensive table with detailed earnings per share drivers for the first quarter 2017, compared to prior year, is provided on page 17.

The discussion below of the first quarter results includes both GAAP segment income and adjusted segment income, which is a non-GAAP financial measure. The tables on pages 8 and 9 present a reconciliation of GAAP reported results to adjusted results.

Due to the Piedmont acquisition and the sale of International Energy in the fourth quarter of 2016, Duke Energy's segment structure has been realigned to include the following segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure and Commercial Renewables. The remainder of Duke Energy's operations is presented as Other. Other now includes the results of National Methanol Company (NMC), previously included in the International Energy segment. Prior periods have been recast to conform to the current segment structure.

Electric Utilities and Infrastructure

On a reported and adjusted basis, Electric Utilities and Infrastructure recognized first quarter 2017 segment income of $635 million, compared to $664 million in the first quarter of 2016, a decrease of $0.03 per share, excluding share dilution of $0.02 cents per share.

Lower quarterly results at Electric Utilities and Infrastructure were primarily driven by warm winter weather compared to the prior year (-$0.14 per share), across all jurisdictions.

This unfavorable driver was partially offset by:

- Lower O&M expenses (+$0.08 per share), due to reduced storm restoration costs compared to prior year and ongoing cost savings initiatives

- Higher retail revenues from increased pricing, riders and volumes (+$0.04 per share) driven by new rates in Duke Energy Progress South Carolina, base rate adjustments in Florida, and energy efficiency rider revenues at Duke Energy Carolinas

Gas Utilities and Infrastructure

Gas Utilities and Infrastructure recognized first quarter 2017 reported and adjusted segment income of $133 million, compared to $32 million in the first quarter of 2016, an increase of $0.14 per share.

Higher quarterly results at Gas Utilities and Infrastructure were primarily driven by:

- Contribution from Piedmont Natural Gas (+$0.14 per share), which was acquired in October 2016, before debt financing costs that are included in Other, and share dilution

- Higher earnings from mid-stream pipeline investments (+$0.01 per share)

Commercial Renewables

On a reported and adjusted basis, Commercial Renewables recognized first quarter 2017 segment income of $25 million, compared to $26 million in the first quarter of 2016. Higher earnings from new wind projects brought on-line in late 2016 (+$0.01 per share) were offset by lower solar ITCs in the current year (-$0.01 per share).

Other

Other primarily includes corporate interest expense not allocated to the business units, results from Duke Energy's captive insurance company, and other investments including NMC, an equity method investment.

On a reported basis, Other recognized first quarter 2017 net expense of $77 million, compared to net expense of $148 million in the first quarter of 2016. In addition to the drivers outlined below, quarterly results were impacted by lower costs to achieve mergers and charges related to cost savings initiatives in the prior year. These charges were treated as special items and therefore excluded from adjusted earnings.

On an adjusted basis, Other recognized first quarter 2017 adjusted net expense of $67 million, compared to adjusted net expense of $62 million in the first quarter of 2016, a decrease of $0.01 per share. Lower quarterly results at Other were driven by higher interest expense at the holding company, primarily resulting from the Piedmont Natural Gas acquisition financing (‑$0.02 per share), partially offset by higher earnings from NMC (+$0.01 per share).

Duke Energy's consolidated reported effective tax rate for first quarter 2017 was 32.4 percent, compared to 30.4 percent in the first quarter of 2016. The consolidated adjusted effective tax rate for first quarter 2017 was 32.5 percent, compared to 25.6 percent in 2016. Adjusted effective tax rate is a non-GAAP financial measure. The tables on pages 10 and 11 present a reconciliation of the GAAP reported effective tax rate to the adjusted effective tax rate.

Discontinued Operations

Duke Energy's first quarter 2016 Income from Discontinued Operations includes the operating results of the International Disposal Group of $117 million, which were included in adjusted earnings.

Earnings conference call for analysts

An earnings conference call for analysts is scheduled from 10 to 11 a.m. ET today to discuss the first quarter 2017 financial results and other business and financial updates.

The conference call will be hosted by Lynn Good, chairman, president and chief executive officer, and Steve Young, executive vice president and chief financial officer.

The call can be accessed via the investors' section (http://www.duke-energy.com/investors/) of Duke Energy's website or by dialing 877-675-4757 in the United States or 719-325-4760 outside the United States. The confirmation code is 9134940. Please call in 10 to 15 minutes prior to the scheduled start time.

A replay of the conference call will be available until 1 p.m. ET, May 19, 2017, by calling 888-203-1112 in the United States or 719-457-0820 outside the United States and using the code 9134940. An audio replay and transcript will also be available by accessing the investors' section of the company's website.

Special Items and Non-GAAP Reconciliation

The following table presents a reconciliation of GAAP reported to adjusted diluted EPS for first quarter 2017 and 2016 financial results:

| (In millions, except per-share amounts) | After-Tax | 1Q 2017 | 1Q 2016 | | ||||||

| Diluted EPS, as reported | | $ | 1.02 | | $ | 1.01 | ||||

| Adjustments to reported EPS: | | | | | ||||||

| First Quarter 2017 | | | | | ||||||

| Costs to achieve Piedmont merger | $ | 10 | | 0.02 | | | | |||

| First Quarter 2016 | | | | | ||||||

| Costs to achieve mergers | 74 | | | 0.11 | ||||||

| Cost savings initiatives | 12 | | | 0.02 | ||||||

| Discontinued operations(a) | (3) | | | (0.01) | ||||||

| Total adjustments | | $ | 0.02 | | $ | 0.12 | ||||

| Diluted EPS, adjusted | | $ | 1.04 | | $ | 1.13 | ||||

| | | | ||||||||

| (a) Represents GAAP reported Income from Discontinued Operations less the International Disposal Group operating results, which are included in adjusted earnings. | | |||||||||

Non-GAAP financial measures

Management evaluates financial performance in part based on non-GAAP financial measures, including adjusted earnings and adjusted diluted EPS.

Adjusted earnings and adjusted diluted EPS represent income from continuing operations attributable to Duke Energy, adjusted for the dollar and per share impact of special items. As discussed below, special items represent certain charges and credits which management believes are not indicative of Duke Energy's ongoing performance. Management believes the presentation of adjusted earnings and adjusted diluted EPS provides useful information to investors, as it provides them with an additional relevant comparison of Duke Energy's performance across periods. Management uses these non-GAAP financial measures for planning and forecasting and for reporting financial results to the Duke Energy Board of Directors, employees, stockholders, analysts and investors. Adjusted diluted EPS is also used as a basis for employee incentive bonuses. The most directly comparable GAAP measures for adjusted earnings and adjusted diluted EPS are Net Income Attributable to Duke Energy Corporation (GAAP Reported Earnings) and Diluted EPS Attributable to Duke Energy Corporation common stockholders (GAAP Reported EPS), respectively.

Special items included in the periods presented include the following items which management believes do not reflect ongoing costs:

- Costs to achieve mergers represent charges resulting from potential or completed strategic acquisitions.

- Cost savings initiatives represents severance charges related to company-wide initiatives, excluding merger integration, to standardize processes and systems, leverage technology and workforce optimization.

Adjusted earnings also include operating results of the International Disposal Group, which have been classified as discontinued operations. Management believes inclusion of the operating results of the Disposal Group within adjusted earnings and adjusted diluted EPS results in a better reflection of Duke Energy's financial performance during the period.

Due to the forward-looking nature of any forecasted adjusted earnings guidance, information to reconcile this non-GAAP financial measure to the most directly comparable GAAP financial measure is not available at this time, as management is unable to project all special items for future periods (such as legal settlements, the impact of regulatory orders, or asset impairments).

Management evaluates segment performance based on segment income and other net expense. Segment income is defined as income from continuing operations attributable to Duke Energy. Segment income includes intercompany revenues and expenses that are eliminated in the Consolidated Financial Statements. Management also uses adjusted segment income as a measure of historical and anticipated future segment performance. Adjusted segment income is a non-GAAP financial measure, as it is based upon segment income adjusted for special items, which are discussed above. Management believes the presentation of adjusted segment income provides useful information to investors, as it provides them with an additional relevant comparison of a segment's performance across periods. The most directly comparable GAAP measure for adjusted segment income or adjusted other net expense is segment income and other net expense.

Due to the forward-looking nature of any forecasted adjusted segment income or adjusted other net expense and any related growth rates for future periods, information to reconcile these non-GAAP financial measures to the most directly comparable GAAP financial measures is not available at this time, as the company is unable to forecast all special items, as discussed above.

Duke Energy's adjusted earnings, adjusted diluted EPS, and adjusted segment income may not be comparable to similarly titled measures of another company because other companies may not calculate the measures in the same manner.

Headquartered in Charlotte, N.C., Duke Energy is one of the largest energy holding companies in the United States. Its Electric Utilities and Infrastructure business unit serves approximately 7.5 million customers located in six states in the Southeast and Midwest. The company's Gas Utilities and Infrastructure business unit distributes natural gas to approximately 1.6 million customers in the Carolinas, Ohio, Kentucky and Tennessee. Its Commercial Renewables business unit operates a growing renewable energy portfolio across the United States.

Duke Energy is a Fortune 125 company traded on the New York Stock Exchange under the symbol DUK. More information about the company is available at duke-energy.com.

The Duke Energy News Center serves as a multimedia resource for journalists and features news releases, helpful links, photos and videos. Hosted by Duke Energy, illumination is an online destination for stories about people, innovations, and community and environmental topics. It also offers glimpses into the past and insights into the future of energy.

Follow Duke Energy on Twitter, LinkedIn, Instagram and Facebook.

Forward-Looking Information

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on management's beliefs and assumptions and can often be identified by terms and phrases that include "anticipate," "believe," "intend," "estimate," "expect," "continue," "should," "could," "may," "plan," "project," "predict," "will," "potential," "forecast," "target," "guidance," "outlook" or other similar terminology. Various factors may cause actual results to be materially different than the suggested outcomes within forward-looking statements; accordingly, there is no assurance that such results will be realized. These factors include, but are not limited to: state, federal and foreign legislative and regulatory initiatives, including costs of compliance with existing and future environmental requirements or climate change, as well as rulings that affect cost and investment recovery or have an impact on rate structures or market prices; the extent and timing of costs and liabilities to comply with federal and state laws, regulations and legal requirements related to coal ash remediation, including amounts for required closure of certain ash impoundments, are uncertain and difficult to estimate; the ability to recover eligible costs, including amounts associated with coal ash impoundment retirement obligations and costs related to significant weather events, and to earn an adequate return on investment through the regulatory process; the costs of decommissioning Crystal River Unit 3 and other nuclear facilities could prove to be more extensive than amounts estimated and all costs may not be fully recoverable through the regulatory process; costs and effects of legal and administrative proceedings, settlements, investigations and claims; industrial, commercial and residential growth or decline in service territories or customer bases resulting from variations in customer usage patterns, including energy efficiency efforts and use of alternative energy sources, including self-generation and distributed generation technologies; federal and state regulations, laws and other efforts designed to promote and expand the use of energy efficiency measures and distributed generation technologies, such as private solar and battery storage, in Duke Energy's service territories could result in customers leaving the electric distribution system, excess generation resources as well as stranded costs; advancements in technology; additional competition in electric and gas markets and continued industry consolidation; the influence of weather and other natural phenomena on operations, including the economic, operational and other effects of severe storms, hurricanes, droughts, earthquakes and tornadoes, including extreme weather associated with climate change; the ability to successfully operate electric generating facilities and deliver electricity to customers including direct or indirect effects to the company resulting from an incident that affects the U.S. electric grid or generating resources; the ability to complete necessary or desirable pipeline expansion or infrastructure projects in our natural gas business; operational interruptions to our gas distribution and transmission activities; the availability of adequate interstate pipeline transportation capacity and natural gas supply; the impact on facilities and business from a terrorist attack, cybersecurity threats, data security breaches, and other catastrophic events such as fires, explosions, pandemic health events or other similar occurrences; the inherent risks associated with the operation and potential construction of nuclear facilities, including environmental, health, safety, regulatory and financial risks, including the financial stability of third party service providers; the timing and extent of changes in commodity prices and interest rates and the ability to recover such costs through the regulatory process, where appropriate, and their impact on liquidity positions and the value of underlying assets; the results of financing efforts, including the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings, interest rate fluctuations and general economic conditions; the credit ratings may be different from what the company and its subsidiaries expect; declines in the market prices of equity and fixed income securities and resultant cash funding requirements for defined benefit pension plans, other post-retirement benefit plans, and nuclear decommissioning trust funds; construction and development risks associated with the completion of Duke Energy and its subsidiaries' capital investment projects, including risks related to financing, obtaining and complying with terms of permits, meeting construction budgets and schedules, and satisfying operating and environmental performance standards, as well as the ability to recover costs from customers in a timely manner or at all; changes in rules for regional transmission organizations, including changes in rate designs and new and evolving capacity markets, and risks related to obligations created by the default of other participants; the ability to control operation and maintenance costs; the level of creditworthiness of counterparties to transactions; employee workforce factors, including the potential inability to attract and retain key personnel; the ability of subsidiaries to pay dividends or distributions to Duke Energy Corporation holding company (the Parent); the performance of projects undertaken by our nonregulated businesses and the success of efforts to invest in and develop new opportunities; the effect of accounting pronouncements issued periodically by accounting standard-setting bodies; substantial revision to the U.S. tax code, such as changes to the corporate tax rate or a material change in the deductibility of interest; the impact of potential goodwill impairments; the ability to successfully complete future merger, acquisition or divestiture plans; and the ability to successfully integrate the natural gas businesses following the acquisition of Piedmont Natural Gas Company, Inc. and realize anticipated benefits.

Additional risks and uncertainties are identified and discussed in Duke Energy's and its subsidiaries' reports filed with the SEC and available at the SEC's website at www.sec.gov. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than described. Forward-looking statements speak only as of the date they are made; Duke Energy expressly disclaims an obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Media Contact: Catherine Butler

24-Hour: 800.559.3853

Analysts: Mike Callahan

Office: 704.382.0459

| DUKE ENERGY CORPORATION | ||||||||||||

| REPORTED TO ADJUSTED EARNINGS RECONCILIATION | ||||||||||||

| Three Months Ended March 31, 2017 | ||||||||||||

| (Dollars in millions, except per-share amounts) | ||||||||||||

| | | | | | | | ||||||

| | | | | Special Item | | | ||||||

| | | Reported Werbung Mehr Nachrichten zur Duke Energy Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||||||