DiamondRock Hospitality Company Reports Fourth Quarter And Full Year 2016 Results

PR Newswire

BETHESDA, Md., Feb. 22, 2017

BETHESDA, Md., Feb. 22, 2017 /PRNewswire/ -- DiamondRock Hospitality Company (the "Company") (NYSE: DRH), a lodging-focused real estate investment trust that owns a portfolio of 26 premium hotels in the United States, today announced results of operations for the quarter and year ended December 31, 2016.

2016 Operating Highlights

- Net Income: Net income was $114.8 million and earnings per diluted share was $0.57.

- Comparable RevPAR: RevPAR was $179.69, a 0.2% decrease from 2015.

- Comparable Hotel Adjusted EBITDA Margin: Hotel Adjusted EBITDA margin was 31.81%, an increase of 15 basis points from 2015.

- Adjusted EBITDA: Adjusted EBITDA was $258.9 million, a decrease of $7.0 million or 2.6% from 2015. The decrease in Adjusted EBITDA is primarily attributable to the disposition of three non-core hotels during 2016.

- Adjusted FFO: Adjusted FFO was $206.3 million and Adjusted FFO per diluted share was $1.02.

- Dividends: The Company declared four quarterly dividends totaling $0.50 per share during 2016, returning over $100 million to shareholders.

- Cash: The Company ended the year with $243.1 million of unrestricted corporate cash.

Fourth Quarter 2016 Highlights

- Net Income: Net income was $23.9 million and earnings per diluted share was $0.12.

- Comparable RevPAR: RevPAR was $174.91, a 0.3% decrease from the comparable period of 2015.

- Comparable Hotel Adjusted EBITDA Margin: Hotel Adjusted EBITDA margin was 31.28%, a decrease of 16 basis points from the comparable period of 2015.

- Adjusted EBITDA: Adjusted EBITDA was $58.7 million, a decrease of $8.3 million or 12.4% from 2015. Adjusted EBITDA for the comparable period of 2015 included $7.4 million of Adjusted EBITDA from the three non-core hotels that were sold in 2016.

- Adjusted FFO: Adjusted FFO was $48.4 million and Adjusted FFO per diluted share was $0.24.

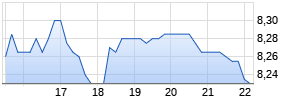

- Share Repurchases: The Company repurchased 635,637 shares at an average price of $8.92 per share during the fourth quarter.

- Dividends: The Company declared a dividend of $0.125 per share during the fourth quarter, which was paid on January 12, 2017.

Recent Developments

- Thomas G. Healy joined the Company on January 16, 2017 as Chief Operating Office and Executive Vice President, Asset Management.

Mark W. Brugger, President and Chief Executive Officer of DiamondRock Hospitality Company stated, "In 2016 DiamondRock implemented rigorous cost controls, resulting in zero growth in total hotel expenses, a record for the Company. This strong asset management led the company to achieve its original EBITDA guidance despite a softer demand environment. With the recent addition of Tom Healy, a proven industry leader, as Chief Operating Officer we look to build upon this success." Mr. Brugger added, "The company also executed on its strategic priority to create $450 million investment capacity through asset sales and financings in 2016, which positions DiamondRock to be opportunistic headed into 2017."

Operating Results

Please see "Non-GAAP Financial Measures" attached to this press release for an explanation of the terms "EBITDA," "Adjusted EBITDA," "Hotel Adjusted EBITDA Margin," "FFO" and "Adjusted FFO"and a reconciliation of these measures to net income. Comparable operating results include our 2015 acquisitions for all periods presented and exclude our 2016 dispositions for all periods presented. See "Reconciliation of Comparable Operating Results" attached to this press release for a reconciliation to historical amounts.

For the quarter ended December 31, 2016, the Company reported the following:

| | Fourth Quarter | | |||||

| | 2016 | | 2015 | Change | |||

| Comparable Operating Results (1) | | | | | |||

| ADR | $230.01 | | | $227.67 | | 1.0 | % |

| Occupancy | 76.0 | % | | 77.1 | % | -1.1 percentage points | |

| RevPAR | $174.91 | | | $175.45 | | -0.3 | % |

| Revenues | $206.6 million | | $208.7 million | -1.0 | % | ||

| Hotel Adjusted EBITDA Margin | 31.28 | % | | 31.44 | % | -16 basis points | |

| | | | | | |||

| Actual Operating Results | | | | | |||

| Revenues | $206.6 million | | $233.8 million | -11.6 | % | ||

| Net income | $23.9 million | | $25.7 million | -$1.8 million | |||

| Earnings per diluted share | $0.12 | | | $0.14 | | -$0.02 | |

| Adjusted EBITDA | $58.7 million | | $67.0 million | -$8.3 million | |||

| Adjusted FFO | $48.4 million | | $51.9 million | -$3.5 million | |||

| Adjusted FFO per diluted share | $0.24 | | | $0.26 | | -$0.02 | |

| | |

| (1) | The amounts for all periods presented exclude the three hotels sold during 2016: Orlando Airport Marriott, Hilton Minneapolis and Hilton Garden Inn Chelsea. |

For the year ended December 31, 2016, the Company reported the following:

| | Year Ended | | |||||

| | 2016 | | 2015 | Change | |||

| Comparable Operating Results (1)(2) | | | | | |||

| ADR | $225.43 | | | $224.17 | | 0.6 | % |

| Occupancy | 79.7 | % | | 80.3 | % | -0.6 percentage points | |

| RevPAR | $179.69 | | | $180.09 | | -0.2 | % |

| Revenues | $851.2 million | | $847.7 million | 0.4 | % | ||

| Hotel Adjusted EBITDA Margin | 31.81 Werbung Mehr Nachrichten zur DiamondRock Hospitality Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||