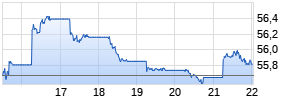

CVS HEALTH CORPORATION REPORTS FIRST QUARTER 2024 RESULTS AND REVISES FULL-YEAR 2024 GUIDANCE

PR Newswire

WOONSOCKET, R.I., May 1, 2024

First Quarter Highlights

- Total revenues increased to $88.4 billion, up 3.7% compared to prior year

- GAAP diluted EPS of $0.88 and Adjusted EPS of $1.31

- Generated cash flow from operations of $4.9 billion

2024 Full-Year Guidance

- Revised GAAP diluted EPS guidance to at least $5.64 from at least $7.06

- Revised Adjusted EPS guidance to at least $7.00 from at least $8.30

- Revised cash flow from operations guidance to at least $10.5 billion from at least $12.0 billion

CEO Commentary

"The current environment does not diminish our opportunities, enthusiasm, or the long-term earnings power of our company. We are confident we have a pathway to address our near-term Medicare Advantage challenges. We remain committed to our strategy and believe that we have the right assets in place to deliver value to our customers, members, patients, and shareholders." -Karen S. Lynch, CVS Health President and CEO

WOONSOCKET, R.I., May 1, 2024 /PRNewswire/ -- CVS Health Corporation (NYSE: CVS) today announced operating results for the three months ended March 31, 2024.

| Financial Results Summary | |||||||||||||||

| | Three Months Ended March 31, ARIVA.DE Börsen-GeflüsterWerbung Weiter abwärts?

Vontobel

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: VU975G,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.

Kurse

| ||||||||||||||

| In millions, except per share amounts | 2024 | | 2023 | | Change | ||||||||||

| Total revenues | $ 88,437 | | $ 85,278 | | $ 3,159 | ||||||||||

| Operating income | 2,271 | | 3,446 | | (1,175) | ||||||||||

| Adjusted operating income (1) | 2,957 | | 4,370 | | (1,413) | ||||||||||

| Diluted earnings per share | $ 0.88 | | $ 1.65 | | $ (0.77) | ||||||||||

| Adjusted EPS (2) | $ 1.31 | | $ 2.20 | | $ (0.89) | ||||||||||

First quarter revenues of $88.4 billion increased by 3.7% compared to the prior year, reflecting strong growth in the Health Care Benefits and Pharmacy & Consumer Wellness segments, partially offset by a decline in our Health Services segment.

First quarter GAAP diluted EPS of $0.88 decreased from $1.65 in the prior year and Adjusted EPS of $1.31 decreased from $2.20 in the prior year, primarily due to a decline in the Health Care Benefits segment's operating results, reflecting utilization pressure in the Company's Medicare business.

Recognizing the potential for continued elevated medical cost trends in the remainder of 2024, the Company revised its full-year 2024 GAAP diluted EPS, Adjusted EPS and cash flow from operations guidance to reflect the assumption that the majority of this pressure will persist throughout 2024.

The Company presents both GAAP and non-GAAP financial measures in this press release to assist in the comparison of the Company's past financial performance with its current financial performance. See "Non-GAAP Financial Information" beginning on page 11 and endnotes beginning on page 22 for explanations of non-GAAP financial measures presented in this press release. See pages 13 through 14 and page 21 for reconciliations of each non-GAAP financial measure used in this release to the most directly comparable GAAP financial measure.

| Consolidated first quarter results | ||||||

| | | Three Months Ended March 31, | ||||

| In millions, except per share amounts | | 2024 | | 2023 | | Change |

| Total revenues | | $ 88,437 | | $ 85,278 | | $ 3,159 |

| Operating income | | 2,271 | | 3,446 | | (1,175) |

| Adjusted operating income (1) | | 2,957 | | 4,370 | | (1,413) |

| Net income | | 1,124 | | 2,142 | | (1,018) |

| Diluted earnings per share | | $ 0.88 | | $ 1.65 | | $ (0.77) |

| Adjusted EPS (2) | | $ 1.31 | | $ 2.20 | | $ (0.89) |

For the three months ended March 31, 2024 compared to the prior year:

- Total revenues increased 3.7% primarily driven by growth in the Health Care Benefits and Pharmacy & Consumer Wellness segments, partially offset by a decline in the Health Services segment.

- Operating income decreased 34.1% primarily due to the decrease in adjusted operating income described below, partially offset by the absence of a $349 million loss on assets held for sale related to the write-down of the Company's Omnicare® long-term care business ("LTC business") recorded in the prior year.

- Adjusted operating income decreased 32.3% primarily driven by declines in the Health Care Benefits and Health Services segments, partially offset by an increase in the Pharmacy & Consumer Wellness segment. See pages 3 through 5 for additional discussion of the adjusted operating income performance of the Company's segments.

- Interest expense increased $127 million, or 21.6%, due to higher debt in the three months ended March 31, 2024, primarily driven by long-term debt issued in February and June of 2023 to fund the Company's acquisitions of Signify Health, Inc. ("Signify Health") and Oak Street Health, Inc. ("Oak Street Health").

- The effective income tax rate increased to 28.9% compared to 25.6% primarily due to the impact of certain discrete tax items and their proportion to lower pre-tax income recorded during the three months ended March 31, 2024.

Health Care Benefits segment

The Health Care Benefits segment offers a full range of insured and self-insured ("ASC") medical, pharmacy, dental and behavioral health products and services. The segment results for the three months ended March 31, 2024 and 2023 were as follows:

| | | Three Months Ended March 31, | ||||

| In millions, except percentages | | 2024 | | 2023 | | Change |

| Total revenues | | $ 32,236 | | $ 25,877 | | $ 6,359 |

| Adjusted operating income (1) | | 732 | | 1,824 | | (1,092) |

| Medical benefit ratio ("MBR") (3) | | 90.4 % | | 84.6 % | | 5.8 % |

| Medical membership (4) | | 26.8 | | 25.5 | | 1.3 |

- Total revenues increased 24.6% for the three months ended March 31, 2024 compared to the prior year driven by growth in the Medicare and Commercial product lines.

- Adjusted operating income decreased 59.9% for the three months ended March 31, 2024 compared to the prior year primarily driven by increased Medicare utilization, the unfavorable impact of the previously disclosed decline in the Company's 2024 Medicare Advantage star ratings, as well as an unfavorable year-over-year impact of prior-year development. These decreases were partially offset by increased volume due to growth in the Medicare and Commercial product lines, an increase in net investment income and improved fixed cost leverage across the business due to membership growth.

- The MBR increased to 90.4% in the three months ended March 31, 2024 compared to 84.6% in the prior year driven by increased Medicare utilization, the unfavorable impact of the Company's 2024 Medicare Advantage star ratings, the unfavorable year-over-year impact of prior-year development, as well as the impact of an additional day in 2024 due to the leap year.

- Medical membership as of March 31, 2024 of 26.8 million increased 1.1 million members compared with December 31, 2023, reflecting increases in the Medicare and Commercial product lines, including an increase of 493,000 members related to the individual exchange business within the Commercial product line. These increases were partially offset by a decline in the Medicaid product line.

- Prior years' health care costs payable estimates developed favorably by $473 million during the three months ended March 31, 2024. This development is reported on a basis consistent with the prior years' development reported in the health care costs payable table in the Company's annual audited financial statements and does not directly correspond to an increase in 2024 operating results.

- Days claims payable were 44.5 days as of March 31, 2024, a decrease of 1.4 days compared to December 31, 2023. The decrease was primarily driven by the impact of membership growth, higher pharmacy trends, as well as the number of days in each quarter.

See the supplemental information on page 16 for additional information regarding the performance of the Health Care Benefits segment.

Health Services segment

The Health Services segment provides a full range of pharmacy benefit management ("PBM") solutions, delivers health care services in its medical clinics, virtually, and in the home, and offers provider enablement solutions. The segment results for the three months ended March 31, 2024 and 2023 were as follows:

| | | Three Months Ended March 31, | ||||

| In millions Werbung Mehr Nachrichten zur CVS Health Corp. Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||||||