Comerica Bank's New Michigan Index Falls

PR Newswire

DALLAS, Oct. 31, 2017

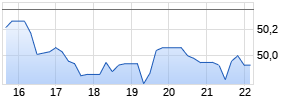

DALLAS, Oct. 31, 2017 /PRNewswire/ -- Comerica Bank's Michigan Economic Activity Index decreased by 0.7 percent in August to a level of 117.0. August's reading is 19 points, or 20 percent, above the index cyclical low of 97.9. The index averaged 117.1 points for all of 2016, one and four-fifths points above the index average for 2015. July's index reading was 117.8.

Comerica Bank's Michigan Economic Activity Index decreased again in August, after falling through June and July as well. The stall in the Michigan Index is indicative of a state economy in transition. Michigan enjoyed the benefits of a restructured and rebounding auto industry as auto production accelerated after the Great Recession. Now, facing easing demand, auto-related manufacturing is no longer a growth leader for the state. However, it can be an economic stabilizer if auto sales can maintain the 16 to 17 million unit range as the U.S. economic expansion moves into extra innings. An important reprieve for the auto industry came in September as auto sales spiked due to the emergency replacement of hundreds of thousands of vehicles damaged from Hurricanes Harvey and Irma. This helped to absorb a growing inventory of unsold cars and trucks. We expect this sales spike to be short-lived and to effectively pull demand forward, which may result in softer sales later on. In August three out of nine Michigan sub-indexes were positive. They were nonfarm payrolls, house prices and industrial electricity demand. The six negative sub-indexes were unemployment insurance claims (inverted), housing starts, vehicle production, total state trade, hotel occupancy and state sales tax revenue. We look for only modest growth in the Michigan economy through the remainder of this year.

The Michigan Economic Activity Index consists of nine variables, as follows: nonfarm payroll employment, continuing claims for unemployment insurance, housing starts, house price index, industrial electricity sales, auto assemblies, total trade, hotel occupancy and sales tax revenue. All data are seasonally adjusted. Nominal values have been converted to constant dollar values. Index levels are expressed in terms of three-month moving averages.

Comerica Bank, with more than 200 banking centers in Michigan, is a subsidiary of Comerica Incorporated (NYSE: CMA), a financial services company headquartered in Dallas, Texas, and strategically aligned by three business segments: The Business Bank, The Retail Bank, and Wealth Management. Comerica focuses on relationships, and helping people and businesses be successful. In addition to Michigan and Texas, Comerica Bank locations can be found in Arizona, California, and Florida, with select businesses operating in several other states, as well as in Canada and Mexico.

To subscribe to our publications or for questions, contact us at ComericaEcon@comerica.com. Archives are available at http://www.comerica.com/economics. Follow us on Twitter: @Comerica_Econ.

SOURCE Comerica Bank

Mehr Nachrichten zur Comerica Inc. Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.